Nike just made it crystal clear it aims to be a player in the premium women’s activewear space. And its new effort probably won’t be cheap.

The Oregon sportswear giant announced a partnership Tuesday with Kim Kardashian’s shapewear line Skims, with a new line launching in the U.S. this spring, and a global rollout next year.

Aimed squarely at women, the joint label is called NikeSKIMS and comes with an air of high-end branding that Nike has been grasping for. The move also comes as part of a broader turnaround effort, led by new CEO Elliott Hill, after struggling with too many discounts and too little innovation in the last couple of years.

The market for global women’s activewear is projected to grow from $193 billion in 2024 to $304.4 billion by 2032. And Nike is trying to tap into that market with help from one of the most famous celebrity entrepreneurs in the world with a colossal social media following.

Nike has a large women’s business already, “but it’s not really seen as a premium women’s athleisure brand. I think it’s an attempt to separate Nike Skims merchandise as higher quality and higher price than normal Nike women’s gear,” says David Swartz, retail analyst at Morningstar.

Not to mention Kardashian’s involvement will bring some heat—and relevance—to a brand that needs it.

With brands like Alo Yoga, Vuori, and Lululemon surging in popularity, the move shows Nike is “back on offense,” says retail analyst Matt Powell. “This collaboration won’t be a huge game-changer, but definitely a step in the right direction.”

Making Deeper Inroads With Women

New sneaker brands like Hoka and On—as well as older names like Asics—pushed Nike off its perch in the sneaker world over the last few years as the sportswear and footwear markets have grown ever more fragmented.

It’s a similar situation with women’s activewear as female-oriented upstart brands win over younger customers—whether they run marathons or do an occasional Pilates class. Lululemon had 13.7% of market shares for women’s sportswear in the U.S. in 2024, compared with just 5.3% for Nike, according to market research firm GlobalData. Athleta is at 3.6%.

Yes, Nike has a sizable women’s business, coming in at $8.5 billion in sales for fiscal full-year 2024. But the portion of Nike’s overall sales in the women’s category fell to 21% in 2024 from 23% in 2020 because of the fast growth of the Jordan brand, which is primarily men’s, Cristina Fernández, retail analyst at Telsey Advisory Group, wrote in a note Tuesday. During this period, Nike has lost share to women’s focused apparel brands like Lululemon, Athleta, and Alo Yoga.

Lululemon, which began with apparel focused on yoga, has been notable: From 2020 to 2024 annual revenue exploded by 118%, increasing from $4.4 billion to $9.6 billion. Nike also likely sees Lululemon’s strong growth in China as a threat it needs to respond to. The brand’s net revenue from China surged 34% in the fiscal second quarter, compared with a 1% gain for the Americas region. Alo Yoga is a private company, so it doesn’t have to make financial results public, but reports have put its valuation at around $10 billion.

The joint brand approach “feminizes” Nike, says Kristen Classi-Zummo, apparel industry advisor at Circana. While many women feel great about wearing Lululemon, this new brand “has the opportunity to speak more authentically to women,” she says.

Nike is ramping up its investment in women’s products: It ran a 90-second Super Bowl commercial featuring a slew of women athletes, and is releasing A’ja Wilson’s A’One signature shoe in May.

The Kim K. Boost

Hooking up with Kardashian is a no-brainer for Nike. She has 358 million Instagram followers and 9.8 million TikTok followers; Nike has 302 million Instagram followers and 7.2 million on TikTok.

Skims, which she launched in 2019 with serial entrepreneur Jens Grede, reportedly has a $4 billion valuation. Kardashian was the top social media influencer for fashion in the U.S. in 2024, according to marketing platform Traackr.

The Nike partnership is logical given Skims’s previous alliances. Skims collaborated with The North Face in December on a skiwear line (including jackets, leggings, and balaclavas) that sold out online within minutes and had thousands on a wait list. Skims has also done collaborations with the likes of Fendi, Swarovski, and Dolce & Gabbana.

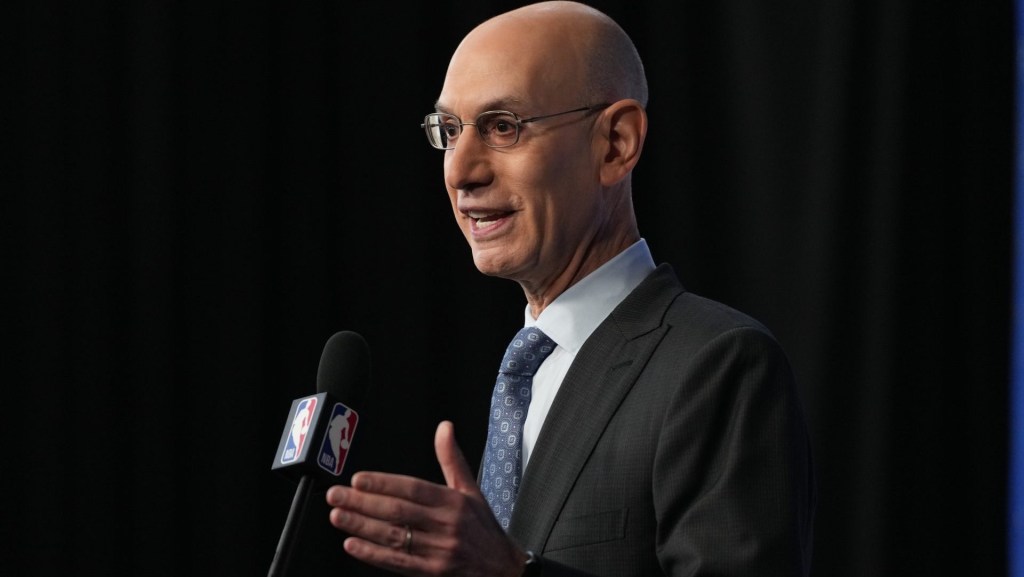

Skims, which sells a $158 “push-up butt enhancing padded mid thigh bodysuit” and underwear in the $20 range, also has a men’s line. In 2023, it became the official underwear partner of the WNBA, NBA, and USA Basketball. The Nike partnership appears to be much greater in scope, BMO Capital Markets analysts wrote in a note Tuesday, “aiming to create a new brand”—and lend Nike some of the cultural relevance and validation it’s been missing.