The media landscape is changing, and the premier media tabulator intends on keeping pace.

Nielsen has created Nielsen One, which provides a holistic measure of viewership across broadcast and streaming platforms.

The analytics company has cash to work with after selling off retail shopping analytics company NielsenIQ, formerly Global Connect, for $2.4 billion to private equity firm Advent International.

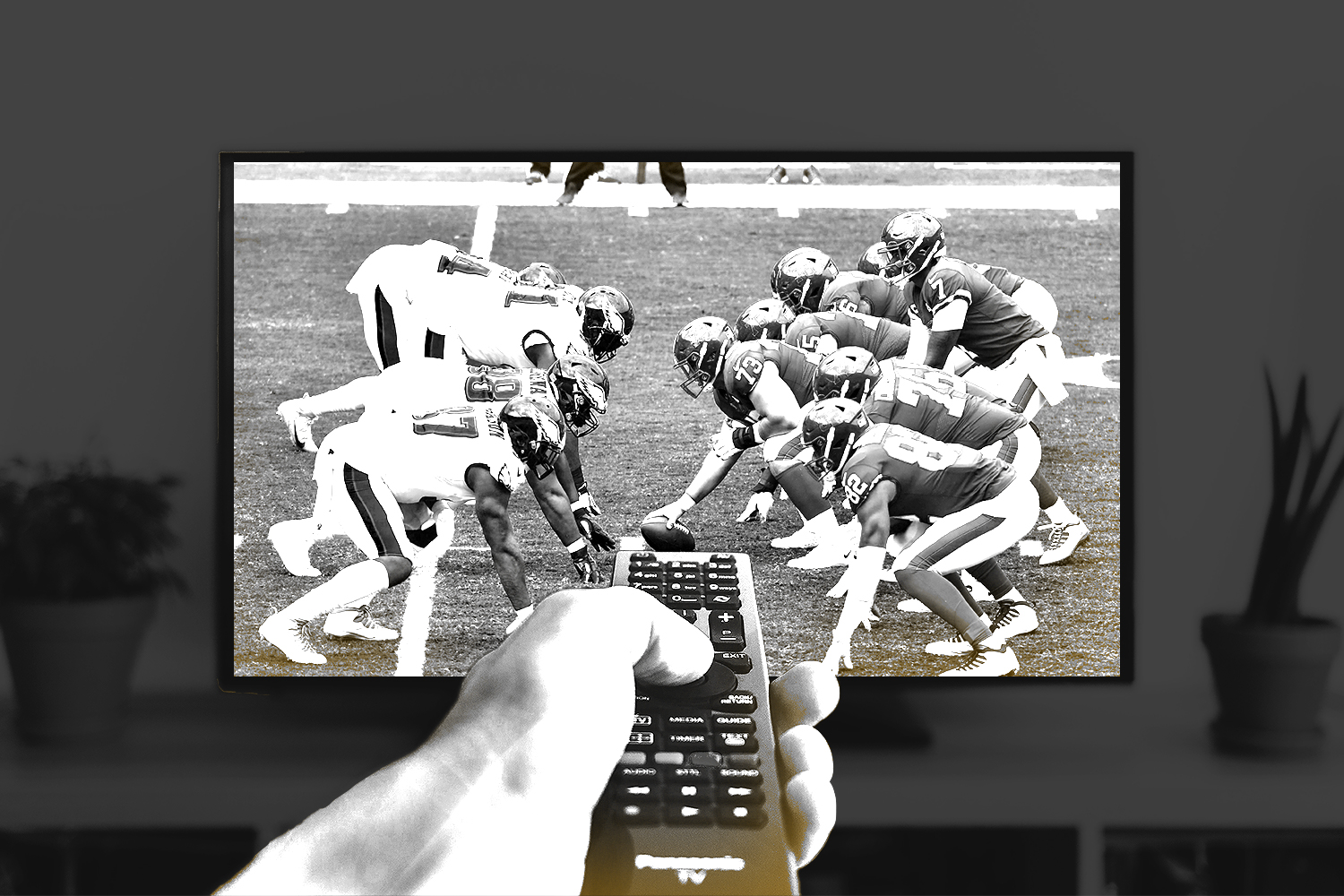

Nielsen One was necessitated by the tremendous growth in streaming uptake over the last year.

- U.S. streaming subscriptions nearly doubled from the start of 2019 to the end of 2020, passing 250 million.

- The average U.S. household subscribed to 3.1 streaming services in 2020, up from 2.7 in 2019 and 2.2 in 2018.

- Traditional pay-TV providers, namely AT&T and Comcast, lost 6.2 million subscribers in 2020 —a shift partly attributed to the lack of live sports.

Legacy broadcasters ABC/ESPN, CBS, Fox, and NBC ponied up over $100 billion to hang onto NFL coverage, but streaming services such as ESPN+ (14 million subscribers) and DAZN (400 million monthly users across all channels) have eaten into the live sports market.

Amazon will pay $1 billion a year through 2033 for exclusive “Thursday Night Football” rights.

Nielsen One provides an opportunity for a fresh start for the nearly century-old company. Earlier this month, the Media Rights Council said that Nielsen undercounted TV watching among 18-to-49-year-olds by 2-6% in February.