Overview

From smartphones to streaming, there are several recent examples of how a single technological innovation or trend has indelibly changed the entire direction of an industry.

Now, the spotlight turns to microtransactions, which have forever altered the eSports and gaming industries.

One of the most relevant tech trends of the past two decades has been in the fintech space — specifically innovations in digital money exchange. Banks, governments, and many other financial institutions began integrating diverse forms of technological solutions to update some of their archaic models of operations.

These integrations allowed companies to create new business models in different industries, including sports and gaming. In particular, the gaming industry has undergone an intriguing monetization evolution via fintech developments.

Here’s how it happened.

The Monetization of Video Games

When video games started in the ‘70s, they had two core business models: coin-operated arcade games and home consoles.

The introduction of information and communication technologies (“ICTs”) in the ‘80s allowed game developers to make and sell video games made for PCs.

After seeing solid demand growth in the following years, new developers brought new platforms and consoles to the market, creating a key demand-generation asset for the gaming industry.

Back then, the formula for scalability was very straightforward: More consoles increased the probability of more games being sold, and thus more growth in sales YoY.

The pay-to-play business model quickly became the standard for developers.

Nevertheless, pay-to-play wasn’t enough. Fierce competition in the gaming market forced console and game makers to either innovate and keep up with the competition or burn the rest of their capital — then merge or die.

At the beginning of the 2000s, many household names in the gaming industry were struggling — forcing some to restructure and others to close down.

- THQ — the Nordic game developer with a solid reputation in the 90s suffered losses of $136.1 million in 2011 and $239.9m in 2012 — declared bankruptcy in 2012.

- Atari, best known for creating “Pong” and “Asteroids,” filed for Chapter 11 in 2013.

Game publishers had to take a different approach in a saturated market with rapidly changing consumer preferences.

The rise of smartphones, mobile gaming, and internet-connected devices created an opportunity for the gaming industry to adopt other forms of monetization such as subscriptions, in-game advertising, and the ‘freemium’ model, which gave players partial access to games in the hopes of hooking them into paying for upgrades later.

The purchases made by players through freemium video games were made possible by microtransactions.

Microtransactions

The concept of microtransactions, payments for purchasing additional features within a system (i.e., in-app purchases for video games) is relatively recent and has only been adopted by a few industries, primarily within gaming and eSports.

With the exception of criticisms of BMW for announcing that its cars’ operating systems would allow for microtransactions on features like automatic high beams, adaptive cruise control, and seat heating, microtransactions haven’t been widely discussed in mainstream media.

They exist in many shapes and forms, although they can be separated mostly into the following categories:

- Performance-enhancing upgrades — acquired items influence the gameplay, and their value is known upfront (aka “pay-to-win”)

- Cosmetic enhancing upgrades — where players don’t get a competitive advantage for buying them (i.e., skins or characters in “Fortnite”)

- Randomized rewards— acquired through secret loot boxes or packs (i.e., player packs on FIFA Ultimate Team)

Why do microtransactions work?

Human psychology is predisposed to support microtransactions.

The freemium model gets the user accustomed to dopamine hits from what is known as a state of hyperarousal — essentially gifting feelings of pleasure to the players without expense.

The human brain will not only crave more of that feeling but will feel indebted to the game, allowing users to spend money on the game without deeply questioning the monetary value of their purchases

Cosmetic enhancing upgrades are considered major status symbols, and kids playing games in social settings will even claim to feel “poor” if they stick with the free, default skins.

Randomized rewards will also create an effect in the player’s mind similar to the sports bettor or gambler, who will continuously try to get lucky by keeping the microtransactions going.

Perhaps most importantly, microtransactions work because users don’t feel like they’re spending a huge lump sum of capital in one shot — though average expenses will probably end up being higher.

The eSports Effect

Credit: EA

According to Electronic Arts’ annual report for 2021, Ultimate Team — the part of EA’s games (Madden NFL, NHL, and FIFA) that uses microtransactions — represented 29% of the total net revenue during the fiscal year of 2021. A substantial portion of it came from FIFA Ultimate Team.

Both “League of Legends” and “Fortnite” are free games played by millions of people that generate most of their revenues via microtransactions.

All the hype and increase in usage and popularity for all these games also build their reputation, which leads to tournaments watched by millions, prize pools, and even an in-game economy with real-world economic consequences.

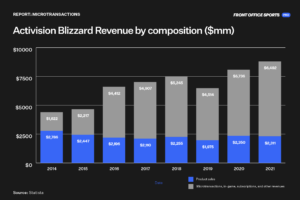

Activision Blizzard, one of the top players in sports gaming — and which Microsoft is acquiring for almost $68.7 billion — generated $6.49 billion in revenues through microtransactions, downloadable content, subscriptions, licensing royalties, and others. That segment now accounts for 73% of ATVI’s revenues, compared to only 36% in 2014.

The Market

The microtransaction market is growing in step with the expansion of the gaming industry.

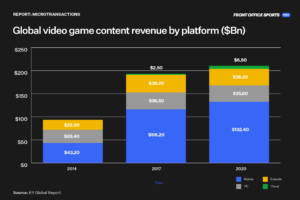

According to Ernst & Young’s Global Report, over a third of the planet’s population played a video game in 2021. By 2025, it expects the gaming industry to generate $211 billion in revenue, with mobile gaming contributing $132 billion.

Data from the Microtransaction Global Market Report 2022 expects market size to grow from $59.49 billion in 2021 to $67.60 billion in 2022 at a compound annual growth rate (CAGR) of 13.6%.

The report also expects the market to reach $106.02 billion in 2026, which would mean a CAGR of 11.9%.

For context, a CAGR higher than 5-7% is considered good. The microtransaction market is expected to keep up a rate higher than 10% – which is great, particularly under the current macroeconomic conditions.

Some of the other major players in the online microtransaction market and companies with a high impact on eSports are Riot Games, Tencent, Ubisoft, and Take-Two Interactive.

The Bear Case Against Microtransactions

Microtransactions opened a new business model for game developers and have been lucrative for the video game industry, but they weren’t always appreciated.

- The Netherlands Gaming Authority declared some types of loot boxes (powered by microtransactions) illegal in 2018 and asked developers to modify them, as they were considered a pure gambling product.

- NBA 2K producer Take-Two Interactive faced backlash in 2017 and a $5 million lawsuit in 2022 for not providing what the in-app purchases promised.

- FIFA Ultimate Team also faced an investigation regarding loot boxes, and the feature was banned in various countries.

Electronic Arts even considered negative perceptions of these products as a business risk in its annual statements:

“Negative perceptions about our products may damage our business (…) For example, we have included in certain games the ability for players to purchase digital items (…) virtual “packs,” “boxes,” or “crates” that contain variable digital items (…) if the future implementation of these features creates a negative perception of gameplay fairness or other negative perceptions, our reputation and brand could be harmed, and revenue could be negatively impacted.”

The reputation and public perception of these digital items is certainly something to monitor going forward.

The Future of Microtransactions in eSports and Gaming

Opportunities exist for game and console developers through efficiently mixing different business models and layering diverse technologies to create experiences, expand the addressable market, and tap into new users.

The gaming and eSports industries are in a prime position to leverage new up-and-coming trends such as NFTs, the Metaverse, and augmented and virtual realities.

New concepts powered by the blockchain such as play-to-earn and move-to-earn will be able to integrate microtransactions in their tokenomics.

Furthermore, there’s a massive opportunity to increase microtransactions’ pie size — according to Investopedia, only 5-20% of users in gamer communities participate in microtransactions.

Final Thoughts

The transformation of the business model of the gaming industry from the classic pay-to-play to in-app purchases and microtransactions proves what a mix of new technological solutions, fierce competition, and several psychological factors can do for the market.

The novelty of the concept has prevented wide adoption, limited the collection of “product-market fits,” and resulted in R&D scarcity — making it an attractive tool to understand for investors and innovators.

The next moves for successful adoption of microtransactions within gaming and eSports are to make the business model more dynamic, keep a player-first mindset, focus on the gaming community, and ensure through best practices that the bad reputation of mishandled microtransactions can be avoided.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)