When the SEC announced its decision to lift the stadium-wide ban on alcohol sales at collegiate events late last spring, individual institutions were faced with a literal million-dollar question: Should we sell alcohol at our stadiums and sporting events?

After a full football season following the conference’s ruling – where alcohol sales were implemented safely, and highly profitably, at a number of SEC schools – the revenue boost and enhanced fan experience appear to have calmed fears about the potential downsides.

When the conference made the decision to lift the ban last summer, several member schools immediately worked to add alcohol sales to football concessions. Arkansas, LSU, Missouri, Tennessee, Texas A&M, and Vanderbilt all sold beer and wine within three months of getting the green light.

A number of others, however, clung to tradition, some continuing to hold out even today – particularly those that didn’t have as much of a need for a revenue boost.

Alabama’s stadium, like Georgia’s, Kentucky’s, and Auburn’s, continued to sell alcohol in a limited capacity during game days, as was previously allowed by the conference. Yet none of the aforementioned institutions extended that availability to the general public after the SEC’s 2019 decision.

Other schools, like Florida, who’s policies had similarly remained unchanged during the football season, began pilot programs a few months after their more eager peers to test the waters before deciding whether or not they’ll dive in next season. The Gators’ program, which began in November, includes alcohol sales in select concession areas of men’s basketball games.

Other institutions, like Florida, also held off until they could feel confident that the upsides outweighed any potential risks, including Ole Miss.

The Rebels did not implement alcohol sales until their last three home games of the 2019 season. Athletic director Keith Carter said the decision to wait allowed the school to talk to their peers who had already started selling alcohol to the general public about what they were experiencing. It also gave them an opportunity to seek answers about some of the risks and concerns voiced by groups within their university and fanbase.

“We were anticipating that we might hear things like incidents or arrests had gone up,” Carter said. “But really what we heard was that they had at least been the same level or even gone down. What we heard mostly, though, was that schools didn’t anticipate the procedural pieces. Arkansas, for example, got beat up a little bit about really long lines in their first game with their fanbase.”

READ MORE: Miami Football Leverages More Than Ed Reed’s Legacy With Hire

Watching and learning paid off for Ole Miss. They sold more than 15,000 beers against both Texas A&M and LSU, a number Carter is confident will reach the 20,000 range next season when they can start sales earlier in the season. Even given the delayed date, with beer and alcoholic seltzer priced at $8 or $9 each, per local reports, the school did more than $125,000 in sales at each of their final three home games.

That data helped Ole Miss set more strategic goals for 2020 and get a better understanding of what they could offer and how much they could sell “to be in a good place to make revenue but still be in a safe environment,” Carter said, come this August. Alcohol is now also available to fans in Oxford at basketball games, as is it at South Carolina – the most recent Bible Belt institution to imbibe – this winter season.

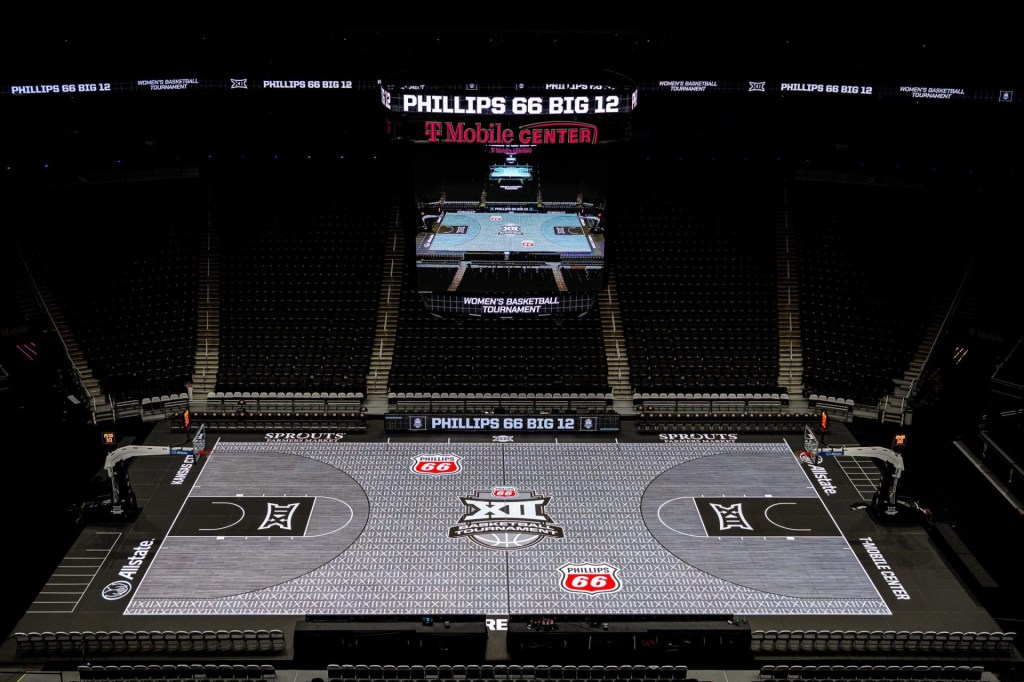

The Gamecocks’ dipped their toes in the world of wine and beer after their Board of Trustees unanimously voted to approve alcohol sales at all football, basketball, and baseball games in December. Sales began in January at basketball events, with Colonial Life Arena serving as their first testing ground in part because alcohol has been sold at the venue before at non-college sporting events like concerts.

Waiting until 2020 gave South Carolina more time to make sure they were adding alcohol to their concessions in a way that would work well for their institution, but it also gave them time to learn from the schools who started last semester as they prepared plans of their own, as Ole Miss had done a few months prior.

“We wanted to make sure we had everyone on the same page across campus before we just jumped in with both feet,” Chris Rogers, South Carolina’s senior associate athletics director, said. “But the other benefit of that is other people in the league had already rolled out their alcohol sales in the fall which gave us the ability to talk to some of our peer institutions and learn what worked well, what didn’t work and what were some things to take into consideration for our institution.”

One of the institutions Gamecocks’ administrators reached out to was Texas A&M, the first SEC school to announce it would sell alcohol to the general public during the 2019 season. Ole Miss, with a few weeks of experience under its own red and blue belt, was also able to pass the same sort of information they had sought just months prior along to other schools curious about their process and success. “Full circle,” said Carter.

The Aggies, like many of their conference counterparts, had previously sold alcohol in premium areas of their stadium. Preliminary numbers following the expansion of sales to the general public show an increase of over a million dollars for a gross total alcohol revenue of approximately $2.4 million, according to information obtained from the school. The net commission increase to Texas A&M was roughly $500,000.

For LSU, the number broke the million-dollar barrier.

Administrators in College Station supplied South Carolina with information regarding the types of alcohol made available at Kyle Field as well as specifics surrounding their top draft items and their top-selling craft beers. They, along with other SEC schools, also provided insights into other areas of concern Gamecocks’ administrators wanted to address before the implementation of alcohol sales at their events.

“Talking to our peer groups helped to give us information on what those institutions were experiencing once they flipped the switch [and started selling alcohol],” Rogers said. “For example, we were able to go to other institutions and say, ‘Okay, did you have more incidents at your stadiums once you turned on beer sales?’ As we talked to everybody, there was not a single institution we spoke to who said, ‘Yes, we had a higher number of alcohol-related incidents at our stadiums once we sold beer.’ That was a common concern we heard about those risks from different groups, so those were the types of things it was helpful to talk to those campuses about and be able to bring back to our constituent groups.”

Texas A&M saw no increases in either, as athletic director Ross Bjork has publicly stated. Neither did Ole Miss.

“We didn’t see a lot of issues,” Carter said of Oxford. “As far as arrests or incidents, those were not an issue for us in terms of an increase. Every home game on a Saturday, you’re going to have a few alcohol-related issues, but we did not see any of that spike or anything out of the ordinary after we started serving in our venues. Like our peers, our main goal was maintaining and even elevating the fan experience, and I think we were able to do that without any other additional incidents.”

That information helped South Carolina not only ease the fears of fans but also of other campus constituent groups who participated in the planning process and were worried about any aspect that could take away from the overall gameday experience as opposed to elevating it, Charles Bloom, South Carolina executive assistant athletic director, said.

“That kind of data, having actual incident rate numbers from our peers, helped push back on those concerns, and it still will,” Bloom continued. “A sizable majority of fans we have heard from wanted alcohol sales at our venues. The fans who are nervous about it, the challenge is making sure they know that when they come to an athletics event, they [will still] have a safe and positive experience from the minute they arrive until the minute they depart.”

The school says it’s currently working through the logistical plans for Williams-Brice Stadium and Founders Park–the home field for Gamecock baseball–so they can begin implementing alcohol sales at baseball games as soon as this spring and football for this coming fall.

READ MORE: Topgolf Swing Suite Takes Aim at Sports Stadiums And Arenas

“The other tricky thing that people often forget about is that it’s not as simple as ‘the league says you can sell alcohol – okay go,'” Rogers said. “Each state has different liquor laws in terms of licensing, timeline, all the standards you have to meet. While that wouldn’t have necessarily precluded us in the fall, there were some things we wanted to figure out before we jumped in to make sure it worked the way we wanted it to work.”

Both Mississippi State and Ole Miss had to consider similar state legislation. State law prohibits alcohol sales on college campuses, which, presumably, would’ve excluded both schools from the conversation. The Rebels’ Vaught Hemingway Stadium ultimately acquired “resort” status, an exemption that allowed the university to add alcohol to concessions late last fall. The Bulldogs’ Davis Wade Stadium does not yet have such status.

Aside from the individual state obstacles, culture and tradition also had to be taken into consideration. As Carter mentioned more than once, “many SEC schools, like us, are pretty deep in the South and the Bible Belt here.” Florida athletic director Scott Stricklin echoed a similar sentiment last summer, saying, “There are a lot of societal pressures in the south.”

Those societal pressures – as well as not having a need to overturn every stone for revenue – could be why some schools continue to abstain from offering alcohol to every attendee at sporting events.

Alabama, for example, made a profit of $48.2 million from football in 2018 on revenue of $111.1 million, landing them among the country’s most profitable programs annually. In comparison, South Carolina – while still generating substantial revenue as most SEC institutions do – historically operates with a significantly smaller profit margin.

And as many schools deal with declining ticket sales and attendance, the potential revenue is not something many can overlook as readily as Alabama.

“Yes, we looked at what other institutions had drawn on their revenue from adding alcohol sales to concessions, for football, in particular, this past season,” Rogers said. “We wanted to look at what different sales looked like at different game times, with other schools they were working with, at professional venues, and what the service looks like. All of that.”

Aramark, the Gamecocks concessionaire, said that the schools they worked with attained both financial and fan benefits from adding alcohol sales into their gameday experience.

“The schools, I would say, have benefitted in a variety of ways by allowing alcohol sales at sporting events,” Brent Hardin, vice president, east region, of Aramark’s sports & entertainment division said. “Financially, in terms of revenue, as well as from a fan experience perspective. When you look at the fans attending a collegiate sport [event] today, a lot of them are looking for a ‘pro sports experience.’ By introducing alcohol, that’s something that has improved the fan experience in that sense as well.”

Hardin said they have heard a host of reasons as to why schools have chosen to implement or abstain. While the drivers or deterrents vary, common themes have emerged – from a desire to improve fan experience to an effort to increase attendance at games to an interest in additional revenue sources – that have led these institutions to seriously consider the new opportunity afforded to them by the SEC.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)