Peloton announced plans to sell $1.1 billion of its Class A common stock in an effort to come up with more cash as demand for its products slows.

The reported public offering of 23.9 million shares at $46 each contradicts the connected fitness company’s statements earlier this month that it didn’t need additional funds, despite a temporary hiring freeze and cutting its full-year revenue outlook by as much as $1 billion.

Peloton missed Wall Street revenue estimates of $810.7 million in fiscal Q1 2022, bringing in only $805.52 million — but new products and services continue to roll out.

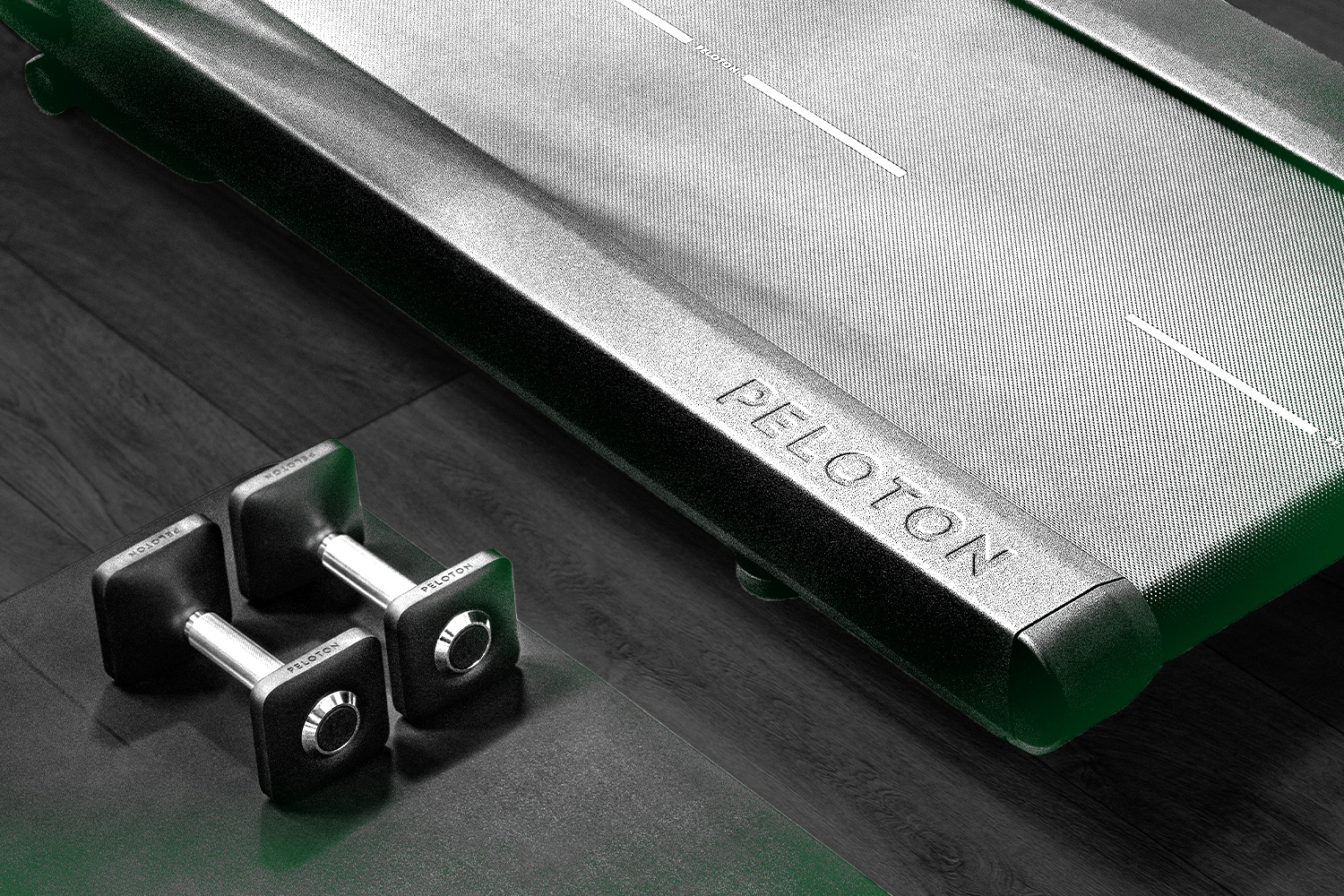

- The company recently unveiled the Peloton Guide, a connected strength product sold in a bundle for $495 with the company’s new heart rate armband.

- Peloton also began offering five classes on Delta Air Lines flights at the beginning of the month.

As part of the sale, Peloton expects to grant the underwriters a 30-day option to purchase additional shares of up to $150 million at the public offering price.

The company said accounts advised by T. Rowe Price Associates and affiliates of Durable Capital Partners and TCV are already interested in purchasing shares.

As of Tuesday’s market open, Peloton shares have fallen almost 70% year-to-date.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)