Streaming started in many ways as an attempted liberation from the confines of traditional cable TV, a move to provide greater choice and control to consumers. But now, the business of streaming looks more and more like that much-derided cable with each passing week.

The resemblance is arguably no more prevalent than when looking at the dizzying array of streaming bundles on the market. Major media companies that otherwise are heated rivals for exclusive programming and viewers are now racing to align with one another in the pursuit of the next great streaming bundle. Among the major tie-ups now on the market:

- A sports-oriented bundle involving ESPN, Warner Bros. Discovery, and Fox, recently named Venu Sports, that is scheduled to debut this fall

- StreamSaver, a new offering from Comcast that combines its own Peacock with Netflix and Apple TV+

- A package that will arrive this summer bundling WBD’s Max with Disney’s Hulu and Disney+

- A Disney-specific bundle, dating to late 2019, combining ESPN+, Disney+, and Hulu

- A discounted package of Max and Netflix for Verizon subscribers

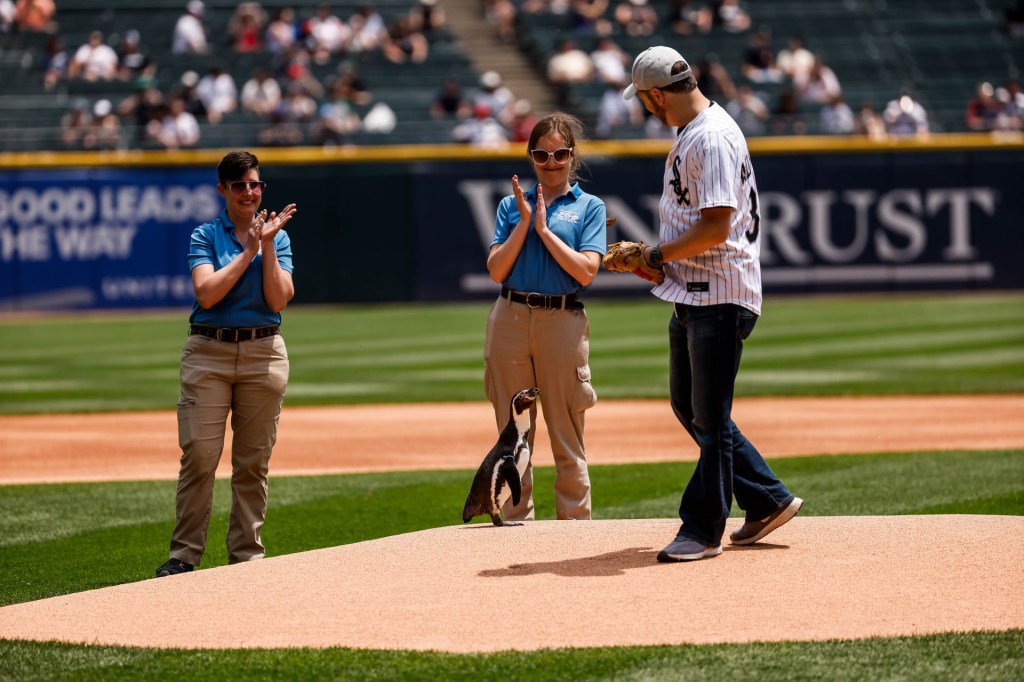

- Hulu, Apple TV+, Netflix, and MLB.TV included in certain T-Mobile subscriptions

By nearly all accounts, the array of often-overlapping offers has resulted in a muddled mess for consumers, and even for executives leading these companies. So if you’re confused, join the crowd. The ongoing search for answers helps explain why there will be three different types of a streaming version of ESPN next year.

Here is everything you need to know about the complex landscape of streaming bundles.

What’s driving the run to create these bundles?

Two major factors are primarily at play here, both relating to aggregating audiences in a media business in the midst of historic levels of disruption. Cord-cutting continues to batter the industry, with fewer than half of U.S. households now subscribing to traditional cable TV.

Subscription fatigue, churn, and heightened consumer sensitivity to price hikes, meanwhile, are combining to increasingly afflict streaming. Several leading services such as ESPN+ have seen their subscriber totals plateau in recent months, in turn leading to a heightened push to embrace new tie-ups and altered business models.

“We’ve been bundling video successfully and creatively for 60 years,” Comcast chairman and CEO Brian Roberts said recently at the MoffettNathanson Media, Internet & Communications Conference. “And so this is the latest iteration of that, and I think will be a pretty compelling package.”

What else has led to this?

The durability of that Disney-specific bundle, now nearing five years on the market, continues to draw notice. That blending within the company is also still expanding, as ESPN will be featured by the end of the year on a tile within Disney+, with it providing access to select live games and studio programming to U.S. subscribers.

“It’s a start of essentially conditioning the audience on Disney+ and Hulu that sports are going to be there,” said Disney CEO Bob Iger in a recent earnings call with analysts.

How much of the rise of streaming bundles is additionally a hedge against consumer behavior?

A lot. Research rather consistently shows a sizable drop-off in the potential number of subscribers for any streaming product once a consumer already has four services. Offering a bundle at a discounted rate essentially represents a back door toward getting somebody to take on an additional service they otherwise would not.

Does any particular media company actually have any of this figured out?

No, and anybody who claims they have is lying. Rather, many networks are acting almost prematurely given the rising turbulence in the market.

“With the accelerating decline of traditional TV, these companies can’t just put off decisions about the next phase of their business. They have to make some choices,” Tom Richardson, Mercury Intermedia senior vice president and a longtime influential voice in digital sports media, tells Front Office Sports. “Decisions simply have to be made proactively, and everybody in the sports business seems to have gotten that memo. … But that also means a lot of the attempts to bundle are still experimental in nature.”

Is there a truly comprehensive bundle out there to serve a sports fan?

No, and that’s one of the greatest pitfalls of the current landscape. In particular, Venu Sports will have no involvement from Peacock or Paramount+, in turn leaving out large chunks of NFL, college sports, golf, horse racing, and tennis coverage, as well as the Olympics and Premier League, that are carried on those platforms. Every other streaming bundle has similarly gaping holes in its sports offerings.

Regional sports networks, which are still a cornerstone of many fans’ consumption patterns despite pressing issues in that business, have furthermore been largely absent thus far in the streaming bundling push. The same can be said of broadcast operators such as Scripps Sports and CW Sports, or Amazon and its rising sports portfolio.

Rounding up everything out there in a single bundle is also growing more difficult as many leagues continue to break off small slices of rights to additional streaming players in search of new and expanded audiences, such as the NFL’s recent deal with Netflix and MLB’s with Roku.

What is the role of ESPN in the future development of streaming bundles?

It will be significant. ESPN+ previously experienced major growth as a result of the broader Disney bundle, more than doubling its subscribers to more than 10 million within the first year of being marketed along with Disney+ and Hulu. That ESPN+ subscriber number has now leveled off at nearly 25 million. But come next year, there will essentially be three different iterations of ESPN in the digital marketplace: the existing ESPN+; a full, direct-to-consumer version of ESPN that has been the subject of widespread industry anticipation; and ESPN’s participation in Venu Sports.

Disney executives have already begun to discuss the planned segmentation of the products. And communicating that distinction—both in terms of product features and which live games will be available on each offering—will be critical in what is already a deeply confusing situation for many consumers.

Speaking earlier this year with analysts, Iger described the flagship ESPN streaming product coming in the fall of 2025 as a “very, very immersive, very obviously sports-centric app, which will have features that this combination with Fox and Warner Bros. Discovery will not have, such as integrated betting, integrated fantasy. [It will] likely have some sales arm or merchandise capabilities, a deep dive into stats, and [a] high degree of customization and personalization.”

What is the best advice for any fan deciding what to do?

Stay nimble. Various combinations and offers are changing almost by the week. Some streaming bundles that currently exist may not be around a year from now, and other combinations that could be compelling have yet to be created. The situation may further morph as a result of mega-mergers in the media industry, such as what’s now being discussed around CBS Sports parent Paramount.

“Nobody knows what nirvana is yet,” Richardson says. “That hasn’t revealed itself.”