Streaming has arguably never looked more like the traditional cable bundle, thanks to a landmark deal between three media titans.

Disney-owned ESPN, Warner Bros. Discovery, and Fox Corp.—normally fierce competitors across the media landscape—are teaming up on a shared, multisport streaming service that will bring together content from 14 linear networks owned by the three companies, as well as ESPN+, and feature live sports involving nearly every major North American pro and college sports property, and international competitions such as the World Cup, golf and tennis majors, and Formula One.

The move represents one of the most dramatic steps to date in response to cord cutting that continues to batter the industry, with fewer than half of U.S. households now subscribing to traditional cable TV, and subscription fatigue increasingly afflicting streaming. It’s also a further recognition of how important live sports are to the entire media business. Just as live sports dominate linear television, other streaming networks such as Netflix are increasingly leaning into sports to attract and retain consumers, and a Netflix-ESPN+ bundle was recently suggested by an activist Disney investor.

Disney CEO Bob Iger called the effort with WBD and Fox no less than “a major win for sports fans, and an important step forward for the media business.”

But the step still leaves many more questions than answers, most notably: Why now, particularly given both Disney and WBD are potentially nearing major equity transactions that would fundamentally reshape their sports operations?

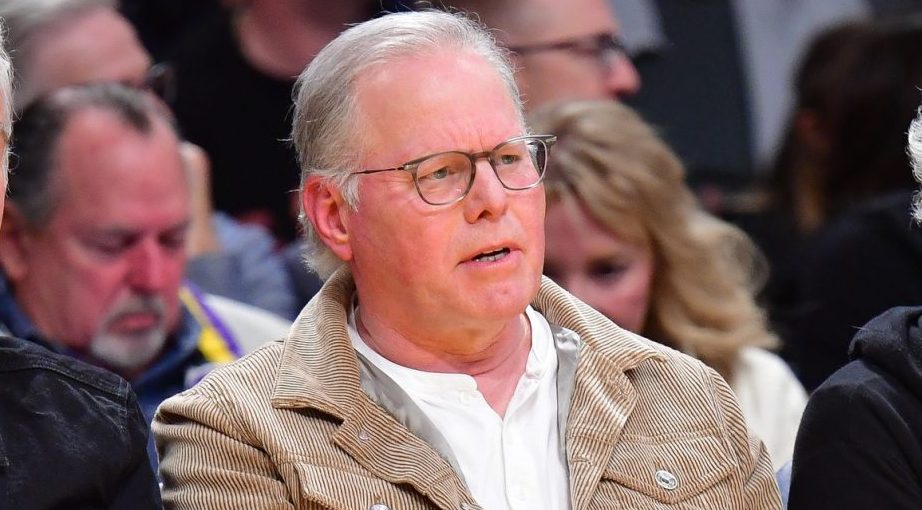

“There is no product serving sports fans that are not within the cable TV bundle,” said Fox CEO Lachlan Murdoch early Wednesday during a company earnings call, referencing “cord-nevers” that are a fundamental target of the new venture. “There’s tens of millions of them. This is a very large market and a large opportunity that we can address without undermining the traditional bundle.”

The Great Unknowns

The as-yet-unnamed service is scheduled to debut this fall with its own dedicated management team, and each of the companies will own one-third of the joint venture, though revenues will be divided disproportionately, in part because ESPN and Fox have NFL rights, and WBD does not. The service will essentially act as a new distribution partner, paying the trio of corporate parents for licensing rights to their sports content, and carriage fees paid to the networks are likely to be similar to what they are elsewhere.

But among the other questions surrounding the new service:

- How much will it cost? No price point was initially revealed, but numerous reports have suggested a likely range of $35 to $50 per month, something that would vault it to among the most expensive streaming services on the market. That range, however, is less than YouTube TV, which offers most of the channels included in the new streaming service (and many others) beginning at $72.99 per month, after a promotional period. A key part of the pricing strategy will likely be to slot in between a stand-alone streaming network and a full, multichannel service like YouTube TV.

- Why weren’t NBC Sports parent Comcast and CBS Sports parent Paramount involved? Multiple reports suggested there was a lack of perceived incremental benefit to including them relative to the additional cost and complexity that expanding the group would have created. Disney, WBD, and Fox collectively control the vast majority of the total U.S. sports rights market, and it’s also unclear how receptive Paramount and particularly Comcast would have been to the concept of unbundling its sports content from its entertainment properties such as Peacock.

- Does this really provide one-stop shopping for sports fans? No. In addition to the lack of NBC Sports and CBS Sports content, the service will not have programming such as MLS matches shown on Apple TV+, pro wrestling on Netflix, several league-owned networks, broadcast operators such as Scripps Sports and CW Sports, or Amazon’s rising sports portfolio. Content from any regional sports network is also not included.

- Does this elevate Fox in the streaming space? Without a doubt, as the company’s ad-supported Tubi was something of an afterthought in the streaming world, particularly because Fox has steadfastly resisted using significant amounts of live sports to elevate that service.

- Does this project negate ESPN’s plans to offer a full, direct-to-consumer version of the network? No, and Disney now plans to make that standalone streaming version of the network available by fall 2025.

- Will this service change the way the linear networks pursue future sports rights? It’s likely too soon to say, but the upcoming NBA rights negotiations will provide a key window into that dynamic, with the newer streaming players such as Netflix and Amazon eagerly eyeing a chance for that top-tier content.

“We’ve done lots of sensitivity analysis and we would not be launching this product if we thought it was going to significantly affect our pay TV affiliate partners, and that’s very important to us,” Murdoch said.