The former CNBC founder is now trying his hand at a gaming app for live sports.

Before TiVo, there was CNBC. Behind both was Tom Rogers. Now growing a new company, WinView, where he sits as Executive Chairman, he is on a path to continue innovating within the media landscape.

Act 1: CNBC

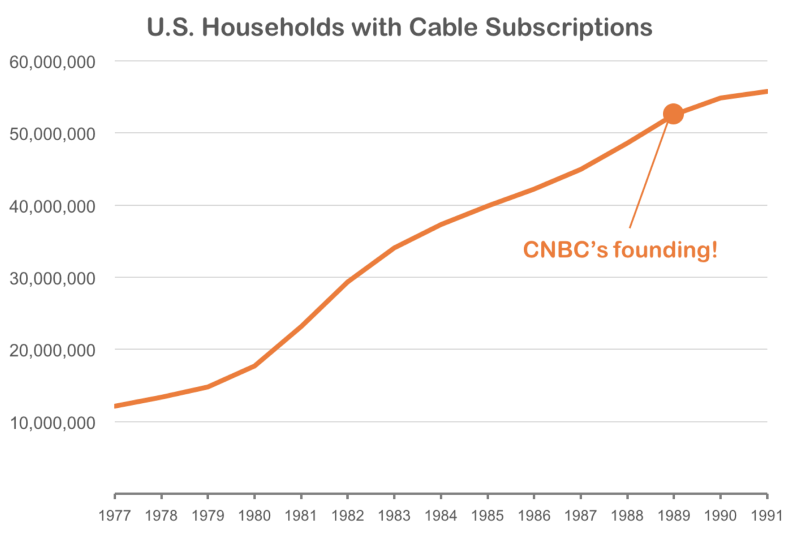

People don’t think of CNBC as innovative anymore, but when cable TV was starting to emerge following the 1984 Cable Act (which Rogers was involved in), it was still an industry in its growth phase.

While Rogers’s innovations were developed far too late in the industry life cycle to warrant industry-defining designs, Rogers did introduce an on-screen ticker — which would eventually became a standard in more than just in television news, including sports.

The ticker was brilliant because it was uniquely suited for television: unlike radio or newspapers, the animated television screen offered an opportunity to provide seemingly infinite additional content. What also helped was that for viewers, television news qualifies as passive consumption — the marginal utility experienced by the viewer of consuming the news is not substantially impacted (if at all) by a minor “distraction”. And to top it all off, the ticker added substantial value — meaning that the combined utility of the ticker and the broadcast far surpassed that of the broadcast alone.

CNBC began when Rogers was hired by Jack Welch (the CEO of GE) and Bob Wright (CEO of NBC) to lead NBC’s push into the cable industry. His epiphany came upon the realization that business news — an underserved market at the time, was where NBC had an advantage over other competitors.

Rogers: “It occurred to me that NBC had massive news resources. News was a money loser for the broadcast networks at that point… The cable industry didn’t want us to compete against CNN and Turner. They liked that network, and many of the big companies owned a piece of it. So we decided business news was where we could make a contribution and truly make available upgraded programming service, relative to anything available in finance news that cable would have.”

This would begin a series of competitions against CNN, who launched their own business news channel in 1995 — competing for exclusive interviews and scoops. Much like the Twitter landscape today, where reporters compete to be first to market with new deals, the ’90s had two major outlets battling to report news first.

Act 2: TiVo

Tom Rogers’s next major success was TiVo, where he was CEO for 11 years. And ironically, TiVo has indirectly aided in the success of WinView:

“People are starting to watch ten minutes in and fast forwarding [sic] through the ads.”

At its peak, TiVo acted as a media hub: aggregating media consumption into a singular, easy-to-consume location. By reducing this friction, and introducing a simple UI to make capture and viewing easy, TiVo succeeded early in a nascent industry.

Rogers: “… this had a huge impact on how people watch entertainment on television today… When I started at TiVo in 2005, of the top 100 shows watched live on television, I think 9 of them were sports events. Last year, of the top 100 shows watched live on television, I believe 89 or 90 were live sports events.”

While I would hazard to place all the credit on TiVo, it did, for the first time, introduce an ability for consumer to access linear media in a non-linear fashion. If you wanted to watch 2 shows that were on at the same time, you could watch one of them, and record the other the save for later viewing!

And as mentioned, TiVo acted as a media hub as well — through early partnerships with Netflix¹ and Amazon Prime Video, TiVo provided access to more types of programming, without the necessary cable subscription.

Through Rogers’s tenure, one of the most difficult areas to navigate were upon the realization that TiVo did not protect their intellectual property.

As cable and satellite boxes would provide the ability to record and play back content, the relative value of TiVo began to diminish. As a consumer, it became more difficult to rationalize purchasing a third-party DVR when your cable provider could provide the same functionality at little-to-no cost. As Rogers says, “We needed to aggressively enforce our intellectual property. We won a couple billion dollars of patent suits from the likes of AT&T and Verizon and Dish and others… With that money, we became the largest provider of advanced television at TiVo to the satellite industry worldwide.”

Act 3: WinView

WinView acts as a play-along gaming app for live sports — where users compete with predictions on given outcomes.

While in a certain light, it does resemble gambling apps such as the much-maligned daily fantasy sports apps, Rogers made clear the distinction:

“If you do this as a game for a quarter of basketball, a quarter of football, an inning of baseball. Enough time so you get 20 or 25 propositions coming at you. Skill will invariably win out over guessing. A game of skill allows you to be legal in over 50 states.”

In addition to this, there are two interesting elements with regards to WinView that I’d like to highlight:

1. Targeting Risk-Averse Users

An ad-supported model is extremely interesting. Where most North American betting apps have relied on pari-mutuel betting, WinView hosts both sponsored prize rooms and prize rooms with low entry fees. In comparing his company to the DFS sites, Rogers says, about DraftKings and Fanduel: “… the money goes to people who are putting in 20–30 hours a week of very sophisticated statistical inputs and very fancy algorithms which are basically taking money off the table for a tiny, tiny percentage of those who are playing.”

The big difference here is not about creating a betting app per se, but a companion app for live broadcasts (which happens to incorporate betting).

The target here ends up being risk-averse users — who also happen to comprise of the vast majority of fans. WinView is unlikely to win over the niche market of serious betters, but is more likely to appeal to the “mainstream” population of people who watch sports.

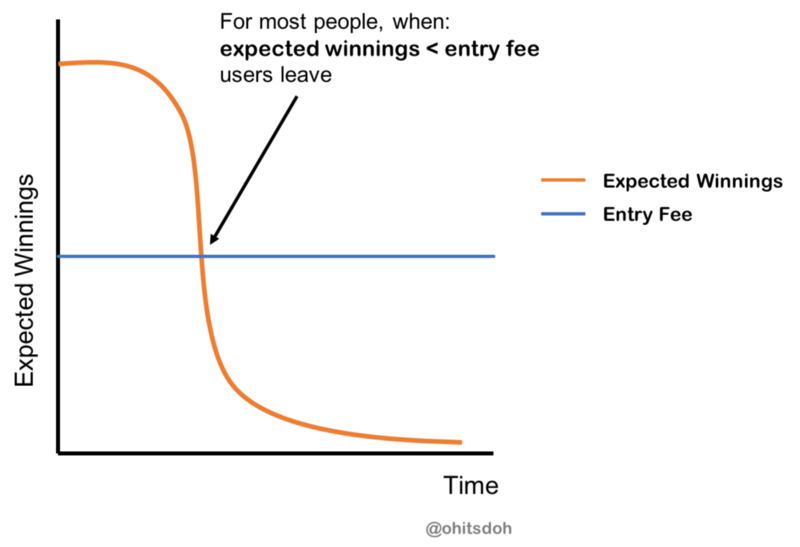

And here, Rogers is completely correct. For most sports fans, who are unwilling to invest the time and effort necessary to win in existing North American betting apps, it can become irrational to compete. The expected value of competing is negative for these users.

This leads to Rogers’s next point:

“The bigger pitfall that fantasy has had is that they’ve blown through tons of marketing money. Estimates that I’ve read are half a billion dollars, DraftKings and Fanduel. On marketing. Where the issue of attracting, and holding a subscriber has been their major problem.”

The pre-conceived expectation of winning quickly dissipates as you compete and continue to lose money. When a large part of the value proposition for DFS is the prospect of winning millions, users will quickly leave the platform — meaning that DraftKings and Fanduel will be required to acquire new customers to replace the lost revenue.

Not to be forgotten in all this is the option to participate in rooms with low entry fees — which allow for risk-seeking individuals to self-select into more competitive rooms.

2. Integrating Television Consumption

One of WinView’s distinctive elements is its integration with television content. While other apps have implicitly created an integration with existing networks, their aim is to bring true integration into the app — via sponsored content that would concurrently be displayed on both the app and the television screen.

While on one hand, this strategy helps WinView with securing network and league partners, it also acts as an effective business strategy. The acknowledgement that its role is as a complement to live sports is effective in advising its tactics going forward.

For commissioners, for whom two major sources of revenue may be at risk in the future (distribution and sponsorships), WinView is an attractive proposition. As Rogers says, “One of the things that all sports commissioners that I’ve talked to when we were talking about launching this last year… we know we have a ratings issue with millennial audiences not watching television the same way.”

In driving engagement from users, WinView adds to the holistic live sports consumption bundle at no additional cost to users, while also providing incentives to view events in real-time.

Though its role in the context of television is clear, WinView’s relationship with social media is less so.

WinView was created with a social concept in mind: “(Founder, David Lockton) said, ‘when buddies watch with each other, or when fathers and sons watch with each other, there’s one commonality in the viewing experience. And that is, they’re cross talking with each other…’”

Where users can communicate within prize rooms — whether that be with friends, family, or strangers.

My contention is that other social platforms have already taken this job. Twitter, through user-curated timelines, has become an effective platform for users with similar niche interests to communicate. Facebook is the default option for all communication amongst social circles.

What WinView is betting on is that the reduced friction of communicating directly on their app will trump the value of using other social platforms.

Tom Rogers’s Driving Motivators

Rogers’s career has been fascinating — mostly because of his ability to spot trends, and switch gears when new ones emerge.

But in his view, it’s always been about managing growing companies through transitions: “When you see the transformation that looks like you can turn it into a mass opportunity, and can identify at the right time to drive it forward, that’s the most fascinating thing about being involved in the media industry.”

Finally, on WinView:

“I personally think that this one is going to have as much or more impact that CNBC did… or TiVo did… I think being able to live, breathe, and enjoy the action of live sports in a way that has never been presented before is going to be equally or more transformative to the sports world compared to the other spheres.”

¹ Netflix also tried developing their own digital media player with Roku. ^

This piece has been presented to you by SMU’s Master of Science in Sport Management.

Front Office Sports is a leading multi-platform publication and industry resource that covers the intersection of business and sports.

Want to learn more, or have a story featured about you or your organization? Contact us today.