What if I told you that you could get access to thousands of soccer matches, in dozens of languages, every month, for free. Does that interest you?

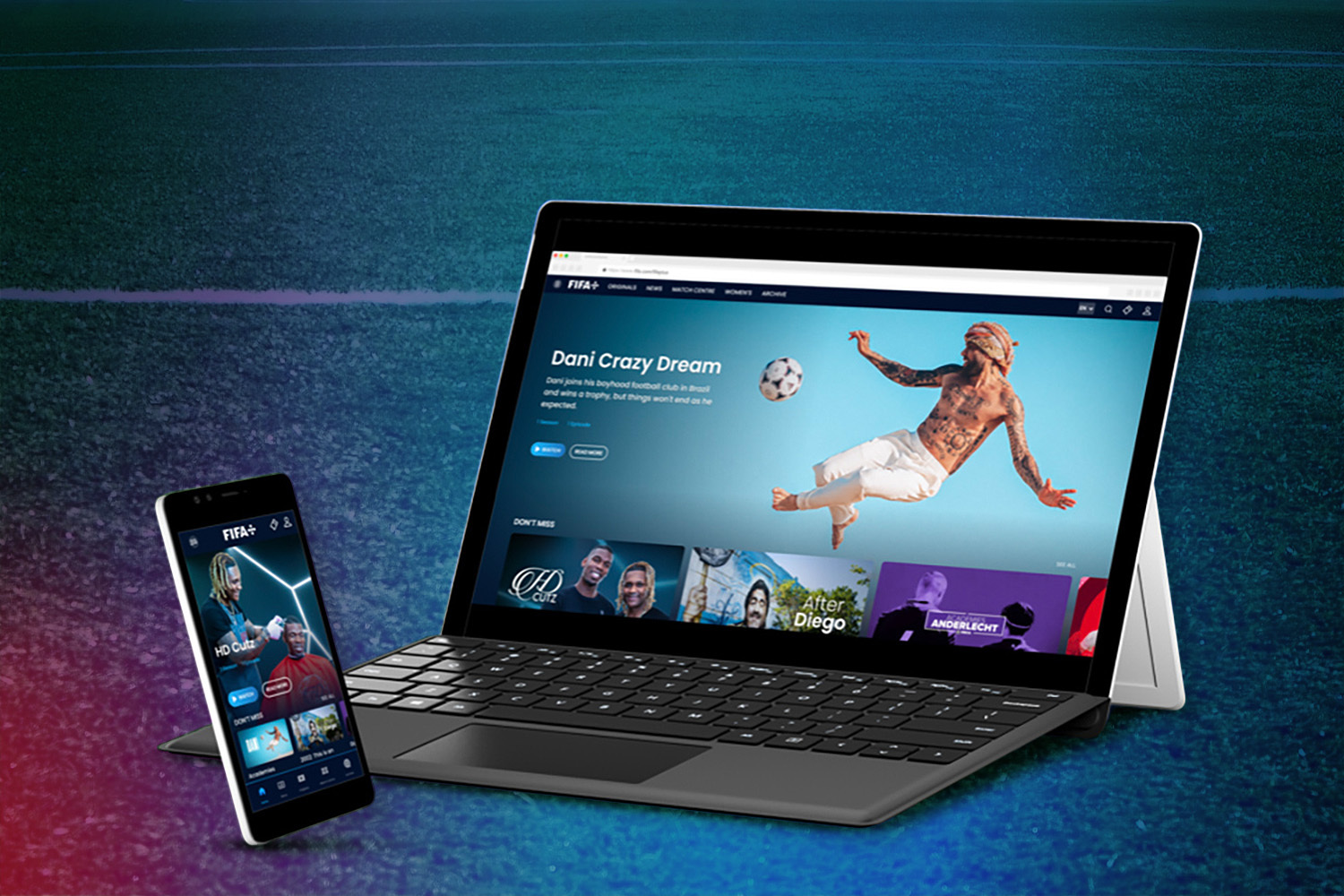

FIFA is betting on it. On April 12, the federation announced its new FIFA+ streaming service, which will broadcast a staggering 40,000 games in 2022.

The service will use an ad-supported model, which will keep it free to users for now, but that might not always be the case.

Director of strategy for FIFA, Charlotte Burr, did not mince words when discussing future plans for the platform.

“We will be strategically extending — so we will be potentially going into gaming, social community, and potentially subscription depending on where this goes and where the industry disruption heads,” Burr said during a presentation about the service.

As it stands, the product will be a mix of live streaming from FIFA’s bank of club-level matches in five different languages, archive clips and games, and original documentaries — think “Drive to Survive.”

Its introduction into the market, however, could not come at a more turbulent time for streaming companies. In just the past few days, Netflix and CNN+ were each put through the wringer.

- On last week’s earnings call, Netflix made clear it’s still holding off on streaming live sports and saw its stock tank after announcing that it lost a stunning 200,000 subscribers in Q1.

- Meanwhile, WarnerMedia shut down CNN+ after less than a month of operations.

At this stage of the streaming wars, big questions come to mind. One FIFA+ will have to answer immediately: Does the world really need more streaming services?

Business Model Decisions

The original plan for FIFA+ is an ad-supported model with the potential for paid subscriptions in the future. Let’s take a look at how those business models stack up against each other:

Subscription

Up until the recent sell-off in its share price, Netflix was trading somewhere between two and six times higher (EV/EBITDA) than peers such as Paramount and Comcast. Why? Its business model.

Paid subscription models produce:

- Steady and predictable revenues for increased clarity and financial planning

- Better expense management due to visibility of revenues and ability to reinvest capital in the business

So, with the prospect of garnering higher valuations than they otherwise could, legacy media companies went all-in on streaming. Now we see that paid subscription models have their drawbacks.

When a company’s valuation is predicated on the growth of its subscribers, there will ultimately be a point where growth dries up — particularly when the market becomes saturated with a plethora of new offerings. Netflix hit that inflection point.

In the first quarter, Netflix saw subscriber numbers go negative (200,000) for the first time in over a decade — a reminder to FIFA+ that you can’t over-rely on this model forever.

Ad-Based

Ultimately, everybody comes back to ads.

While executives at Netflix have long held the belief that an ad-supported model wasn’t for them, they’re now considering flipping that stance. While the revelation feels significant, it’s really par for the course.

Ad-supported offerings are included at the launch of most streaming services. Disney-owned Hulu, HBO Max, Peacock, and even YouTube all have ad-based tiers for consumers that are either free or lower-priced. Opening up lower-tier subscriptions unlocks instant value through a larger user base.

- According to analyst Eric Seufert, Netflix (which currently generates $30 billion in annual revenue) could instantly scale its ad business to $2-$3 billion per year.

- But Seufert believes that a Netflix app-publishing platform could be the real value unlock.

Apple’s recently updated privacy policy better protects consumer information and gives users the option to block the transmission of their data to iPhone apps. As a result, mobile ads no longer wield the power they once did.

How does this benefit Netflix? The service’s first-party data on what you watch is valuable to app developers who want to more accurately target customers.

If Netflix built out an app-development platform, it would lead to increased top-of-funnel and create an opportunity to take a cut of in-app revenues — like Apple’s 30% commission rate on in-app purchases.

All of these scenarios are realities FIFA+ should be aware of under the new ad landscape.

FIFA’s Path Forward

Perhaps FIFA’s ad-supported streaming model signals that it already knows that subscription-based models aren’t the end-all be-all — especially with the market as saturated as it is right now.

Down the line, if FIFA can generate enough first-party user data from the billions of soccer fans who may be interested in FIFA+, there could be ways outside of paid subscriptions to generate significant value.

The world doesn’t seem to need or want another paid streaming service. The $300 million failure of CNN+ and Netflix’s woes speak directly to that assertion. That said, HBO and HBO Max just announced that they added 13 million subscribers last year, showing that the right content will always be a draw.

Either way, when looking ahead, sports organizations considering building their own streaming services (looking at you, NFL) must heed the examples in today’s market before they make a move.