What do professional athletes do when their playing careers come to an end? How do they spend their time — and keep earning money?

Over the years, there have been a few evergreen, go-to outlets for ex-players: coaching or management, media, and general business.

Many athletes also become investors, and few go as far as building up personal investment firms. Magic Johnson was one of the first professional athletes to create his investment fund when he partnered with Canyon Capital in 1998 to fund Canyon-Johnson.

More recently, there has been a noticeable rise in the number of athletes making headlines and getting involved in the world of private equity and venture capital.

From Lionel Messi’s Play Time Sports-Tech fund and Serena Williams’ Serena Ventures firm to the full portfolios of superstars like Kevin Durant, Lewis Hamilton, LeBron James, Shaquille O’Neal, and Alex Rodriguez, there’s no shortage of sports figures involved in PE and VC investments.

But why do athletes become investors? What challenges do they face, and how do they approach them? Do they all need an investment fund? Should athletes pursue any kind of investment opportunity?

Let’s dive in.

The Financial Need

An Earnings Bias

Salary distribution in professional leagues is skewed — the top superstar players in each sport earn much more than the median, and the bottom of the pack makes much less.

L.A. Rams superstar Aaron Donald earns $31.66 million per year, but the average NFL player earns $2.7 million annually, with an annual median salary of $860,000.

Back-to-back NBA MVP Nikola Jokic earns $46.55 million per year with the Denver Nuggets, but the average NBA player makes $7.1 million on average, with a median of $2.1 million.

Although these numbers may seem high, it’s important to remember that half of all players in these leagues earn less than these median figures. When you consider taxes and other expenses like agent fees, many professional athletes keep considerably less disposable income.

And, of course, all playing careers — and even the most exorbitant salaries that accompany them — have to end sometime.

Career Length

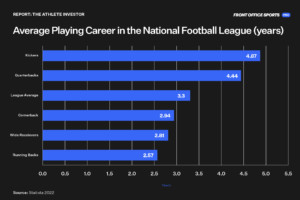

Playing careers don’t last as long as you might think. Due to physical and mental wear and tear, a long-lasting run is an exception more than the rule.

According to Statista, the average career length of an NFL player is about 3.3 years. For the NBA and the NHL, the number jumps to 4.5 years. The average MLB career lasts 2.7 years.

For reference, Tom Brady’s NFL career (23 years) is over five times greater than the average quarterback (yet another reason to call him the GOAT.)

Most professional athletes relatively quickly find themselves forced to find other sources of income, but many invest their capital because of its potential.

Tapping The Potential

Athletes’ broadened horizons and access to information have led them to quickly realize the disparity between potential on- and off-field earnings.

Michael Jordan earned $90 million in salary, but his net worth today is $1.8 billion — in total, MJ earned only 5% of his value dominating basketball.

“The rising popularity of PE and VC firms, mixed with the astounding results from what other role-model athletes such as Magic Johnson or Kobe Bryant have achieved through some of their investments, intrigued many athletes who have since been pulled into the investing world,” explained Fernando Prieto, CEO of Pau Gasol Enterprises and Managing Partner of Everest Talent Management.

“Additionally, increased access to information through technology has created a form of ‘athlete sophistication’ where athletes started seeing the investing world more professionally.”

Similarly, athletes have a more in-depth grasp of their brand, status, and image, as well as more resources to network and build relationships with C-level execs, investors, and private equity partners on projects that interest them.

“Athletes get access to opportunities that are not truly available to the general public. To maximize earning power off the field through alternative investments, players want to build brand equity as early as possible and optimize that access to companies and investments down the line,” said Daniel Magliocco, Partner at Patricof Co.

But since athletes aren’t necessarily experts in financial terminology, tech products, or returns, how can they tap into the potential of investment opportunities?

The Role of Investment Funds

Due to sports’ commercial nature and popularity, during their playing career, athletes usually interact with hundreds of people from the media, legal, public relations, sponsors, marketing, etc. However, their financials and investments usually have to be managed independently.

Depending on their earning level, athletes may choose to establish funds, partner, or hire personal wealth management teams to manage and deploy their capital.

But not many athletes have the resources, time, or financial literacy to actively jump into the investing world so aggressively.

As a result, firms within the VC and PE space have made efforts to involve athletes in their group of investors and partners to help them become better investors, teach them how to evaluate deals, meet the right people, and let them find the funds, franchises, and other investments that suit their needs, interests, and budget.

For instance, SeventySix Capital — the venture capital firm investing in tech startups in sports, esports, and sports betting — created the Athlete Venture Group that allows players to invest, learn, and work directly with top sports tech startups and entrepreneurs.

“We believe that having an athlete as an investor or advisor in a sports deal is important. An elite athlete can help an entrepreneur build a successful business because the same traits that made them successful in their respective sport are what you need to be successful in business: passion, desire, drive, and persistence,” said Wayne Kimmel, Managing Partner at SeventySix Capital.

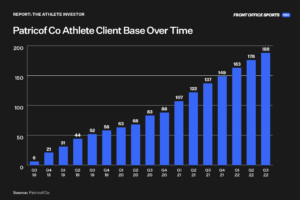

Through its advisory practice, the vision of Patricof Co. is to provide athletes with the tools and knowledge to get involved and invest in companies. The goal is to educate and untangle their hesitation by providing the right information and teaching them things like pattern recognition and business and financial fundamentals, explained Magliocco.

“Education and network are vital for athletes — for example, we organize executive speakers series, where we aim to have athletes engage with a network of key investors and stakeholders in the industry.”

The expanding client base of PE investment firm Patricof Co. — whose clientele is made up of world-class professional athletes — points to the burgeoning value these firms can provide to athletes.

The development and expansion of these funds have allowed athletes from all ends of the earnings spectrum to get more involved — not only the ones owning investment firms.

Today, thousands of athletes invest in diverse asset classes — from consumer-focused products to sports technologies, teams, and emerging technologies like NFTs, Crypto, and others.

With the right tools, platforms, and advisors — should athletes pursue any kind of investment opportunity?

Thinking Long-Term

Jumping into the hottest trends just because of a fear of missing out could be detrimental to any investor’s wallet and reputation — even for athletes.

For instance, Tom Brady will likely see extended losses from his early investment in FTX — the cryptocurrency exchange that filed for bankruptcy on Friday.

Given that athletes have a public image, they must leverage their investments to generate a compelling story around their brand — not only do it for the money.

As Prieto explained, creating a narrative and finding investments aligned with their values can build credibility around their name and unlock further access beyond financial returns. Athletes should ask themselves, “Does this investment fit my narrative and brand? Does it help me tell my story and show who I am?”

“Athletes can learn from Leonardo DiCaprio’s approach to investing — besides being a famous Hollywood actor, he’s always been a proponent of climate change and sustainability. His investments in vegan food, recycled apparel, and sustainable farms for climate change support his identity, which will unlock more opportunities for future investments.”

It’s not like Brady’s wallet or reputation will suffer greatly from his investment in FTX — but athletes, in particular, should be wary of the types of investments they seek out.

Looking Forward

With the rise of new firms and platforms, more successful examples from other athletes, and increased access and exposure, there’s much room for an accelerated influx of athlete capital in private equity and venture capital in the coming years.

However, both athletes and companies must be intentional about the long-term implications of their marriage.

As long as the partnership is authentic, athletes can add value to companies beyond the capital they can provide. If companies partner with athletes strategically focused in the verticals where they operate, they can provide awareness and legitimacy beyond what a traditional investor could.

“Athletes are not ‘dumb money’ — they are getting more sophisticated, and they are thinking strategically about where they put their money,” said Prieto.

If strategic and authentic, the right company-athlete partnership has the potential to generate tremendous value for both sides.