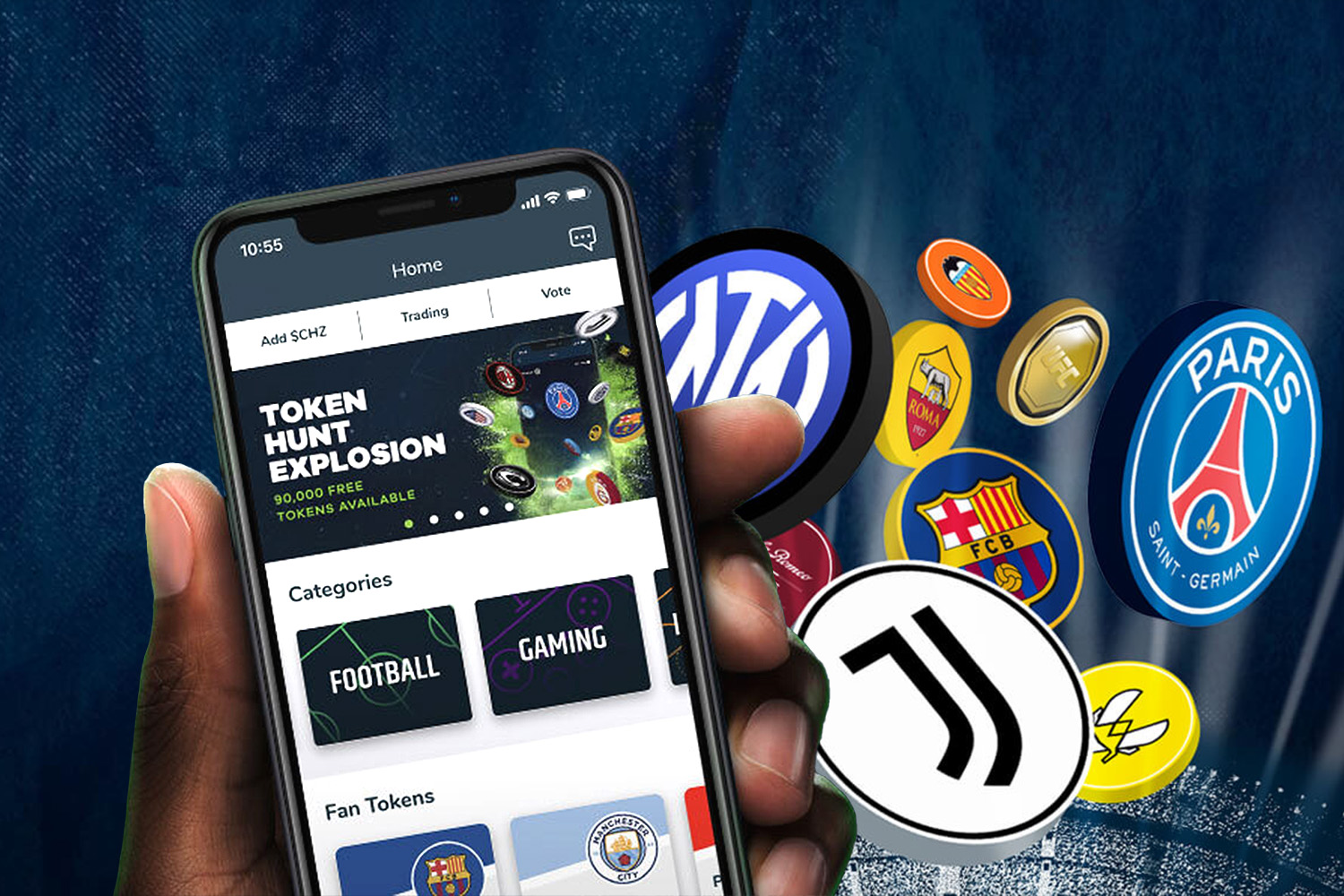

This week’s Scouting Report covers applications of blockchain technology in sports through a case study of Socios.com. The company has built a blockchain based fan engagement platform with wide ranging applications for teams and leagues.

The Socios.com platform provides fans the opportunity to own a governance token in their favorite teams. In the past six months, the company has almost tripled the number of teams on their platform while generating $200 million in 2021 (as of August).

The company has been able to provide instant value to partners. When F.C. Barcelona launched their initial fan token offering in June of 2020, the tokens sold out in less than two hours, generating US $1.3 million for the debt-burdened club.

Check out the full Scouting Report now.

ICYMI: Two weeks ago, we published a Heat Check on trends in IoT technology space and applications related to sports and stadiums. You can access that report — along with our entire catalog of research since launch — at Insights HQ.

One Big Thing

It was announced earlier this week that former Disney CEO Bob Iger could be interested in buying the Phoenix Suns. While there have not been any direct reports of bids, the franchise will likely be the target of various bidders due to supply and demand.

The franchise could be up for grabs given the recent allegations against current owner Robert Sarver. Sarver is under investigation by the NBA following allegations of racism and misogynistic behavior from the 60-year old owner. If the team were ultimately to become available, it would be at a hefty price tag.

The Suns were most recently valued at $1.8 billion by Forbes but could reportedly sell for more than $2 billion. Sarver bought the team for $410 million in 2004; a $1.8 billion price represents a 388% increase in value over the period.

A new ownership structure in Phoenix could be interesting – but the NBA has been no stranger to shake-ups in the recent past. In 2019, league commissioner Adam Silver proposed a new investment vehicle to owners that would allow private equity investors to purchase minority stakes in franchises. In January of this year, the structure was put in place and a new class of franchise investor was introduced.

According to the ratified agreement from January, institutional investors are able to invest with two restrictions:

- Equity providers may own up to (but not exceed) 20% of a single NBA franchise.

- No team can collectively have greater than 30% of its ownership coming from institutional investors.

The NBA isn’t the only league to allow for private equity to enter the ownership ranks. In early November, the MLS finalized a new set of rules which allow private equity firms to own up to 20% in a single franchise. Additional rules regarding qualified buyers and the qualifications around ownership are included below:

- Each fund must have raised at least $500 million, and no more than 10% of a fund can be invested in one team.

- Funds are limited to four teams each.

- Each investment in a single club must be more than $20 million, but it can’t surpass 20% of the club’s equity.

Other sports such as F1, Rugby, and Tennis all have had ownership participation in some capacity as well.

What do we think?

Owning sports franchises is the ultimate status symbol. As an investment, team ownership does not only provide access to the world’s greatest athletes and most coveted celebrities, but has also proven to generate hefty returns. The total return that NBA franchises returned from 2002 to 2020 was 852% compared to the S&P’s 334% over the same period. Minority owners, however, were unable to realize these gains due to one fundamental issue. A lack of buyer liquidity.

Prior to the introduction of the private equity rules, it was difficult for minority owners to sell their stakes in franchises. With immense valuation appreciation across the board for teams and leagues, owners’ investments had generated crazy returns…on paper.

The lack of liquidity necessitated a change as higher valuations priced out new buyers. What the introduction of private equity, writ large, could mean is a further financialization of franchises. While some see this as a negative, it shouldn’t be viewed that way. Strong capital providers like CVC, Blue Owl, Sixth Street Partners, and other financial firms can help franchises better utilize and monetize their IP and media assets. In order for those firms to achieve the financial gains they are looking for, they need to make the underlying assets – the franchises – more valuable. Be prepared to see significantly more activity from financial sponsors in the sports ownership space.