Two Suns minority owners are suing the team’s holding company and majority owner Mat Ishbia, alleging mismanagement, conflicts of interest, and a lack of required transparency from Ishbia.

The team says the suit is simply part of a pressure campaign to get Ishbia to buy out his minority partners at a premium.

Kisco WC Sports II and Kent Circle Investments filed the “books and records suit” against Suns Legacy Holdings LLC on Wednesday in the Delaware Court of Chancery, where many business disputes are handled due to Delaware’s long-standing role as the preferred state for U.S. companies to incorporate.

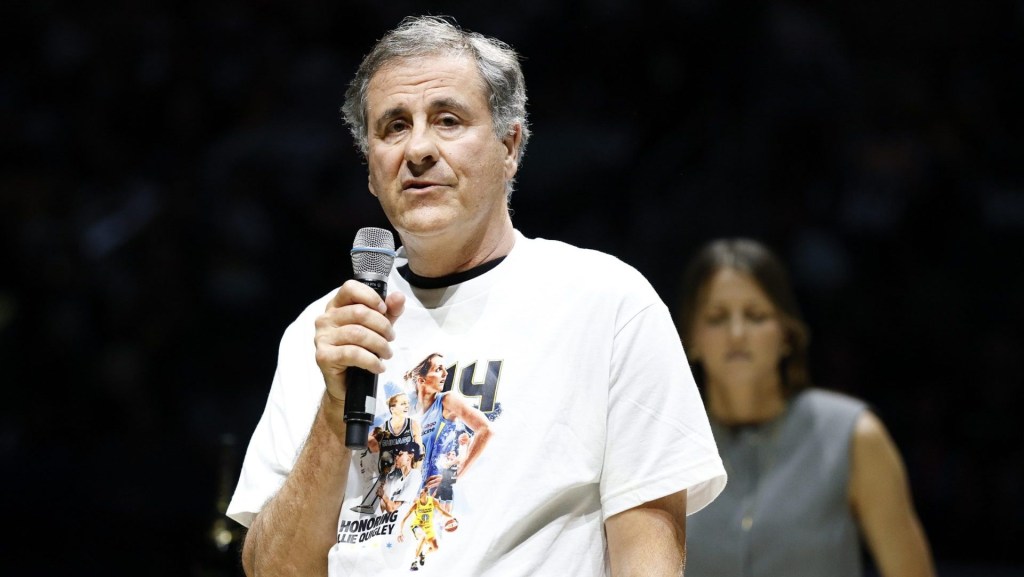

Kisco is led by Andrew Kohlberg, a former professional tennis player who now runs a senior living business and has been a limited partner in the Suns since 2004, while Kent Circle is led by Scott Seldin, who has an Arizona-based real estate business. They, along with all the other previous minority partners, were given the choice of staying on under Ishbia or selling their stakes when he bought the team from Robert Sarver two years ago. Kisco and Kent Circle chose not to sell their stakes, while the rest of the minority owners did.

The suit is heavily redacted in some areas and seeks internal documents in order to determine whether Ishbia breached contractual agreements with the partners.

Ishbia bought a reported 57% stake in the NBA’s Suns and WNBA’s Mercury at a $4 billion valuation in 2023. The suit is highly critical of how he has run the team since then.

According to the suit, the drama began last September, when Kisco—“dissatisfied” with Ishbia’s management of the team—started negotiations to sell its stake to Ishbia. The suit cites a lack of details about how a Mercury practice facility was funded as one example of his mismanagement.

The Suns declined to comment. But the team’s version of the story is very different from that of the suit, according to an Aug. 26 letter sent to the plaintiffs’ attorneys and viewed by Front Office Sports. The letter, signed by Suns attorney David Marroso of O’Melveny & Myers LP, says Kisco and Kent Circle have demanded that Ishbia buy their interests for $825 million, implying an enterprise value of more than $6 billion for the team. That would represent a 60% increase compared to when Ishbia bought the team in 2023.

According to the letter, the increasing valuation of the Suns is “a direct result” of multiple factors, including the NBA’s new $77 billion media-rights deal, but also “massive investments” made into the Suns and Mercury by Ishbia, including in real estate, local media rights, arena upgrades, and more.

However, the team’s market value “is not the point,” the letter says. It insists that Kisco and Kent Circle “have no right” to compel Ishbia to buy their interests at all, though they are free to market their stakes and find a buyer elsewhere.

The letter, sent Tuesday, says Kisco and Kent Circle have “resorted to threatening baseless litigation and sensationalized press coverage as a means of intimidating and coercing [Ishbia] into unprincipled and unjustified buyout negotiations.”

“That will not work,” the letter says. “[Ishbia] will not be bullied by these sharp and abusive tactics.”

A representative for Kisco and Kent Circle responded to the letter, telling FOS “we’re not going to comment on baseless assertions.”

While Kent Circle didn’t yet seek a buyout along with Kisco, “it too had growing concerns” about Ishbia’s management, the suit says. The discussions continued through the middle of this year, at which point Kisco requested Ishbia “provide a final response” to its offer to sell by June 1.

Instead of responding by that date, Ishbia held a capital call requesting additional money from investors on June 2. The suit says the call was “part of a leverage strategy to exert pressure on and dilute the company’s minority owners.” According to the lawsuit, the per-unit price attached to the call was “strikingly low” compared with what they say is the Suns’ true valuation, meaning those who failed to fund their share risked not just dilution but a severe write-down of their equity.

The suit also alleges that Ishbia may have cut undisclosed side deals with other partners tied to the call—which would be in violation of a clause in the LLC agreement stating all members must be treated equally, the suit claims. The relevant portions of the agreement are cited in the suit but heavily redacted. Specifics of the alleged side deals were not clear, which is part of why the plaintiffs say they need access to books and records.

While the Suns ultimately produced some documents, “including an agreement signed by [Kisco and Kent Circle] that they already possessed,” the suit alleges the team has failed to provide the complete records needed to assess potential breaches of the LLC agreement.

The plaintiffs’ attorneys, Michael Carlinsky and Michael Barlow of Quinn Emanuel, framed the fight as a transparency issue, saying in a statement, “Our clients sued to obtain records to which they are entitled as minority owners of the Suns.”

“They are concerned by the manager’s approach towards minority owners, and want more information about certain spending and capital raises in which the manager has engaged,” they said. “Transparency with minority owners is not optional, and our clients think it is critical to the success of the Suns.”