A Federal Trade Commission action to block a merger between Nvidia and Arm could cost SoftBank $74 billion.

The deal, agreed to in September 2020, would bring one of the world’s largest providers of chip technology, SoftBank-owned Arm, under the umbrella of a global leader in chip manufacturing.

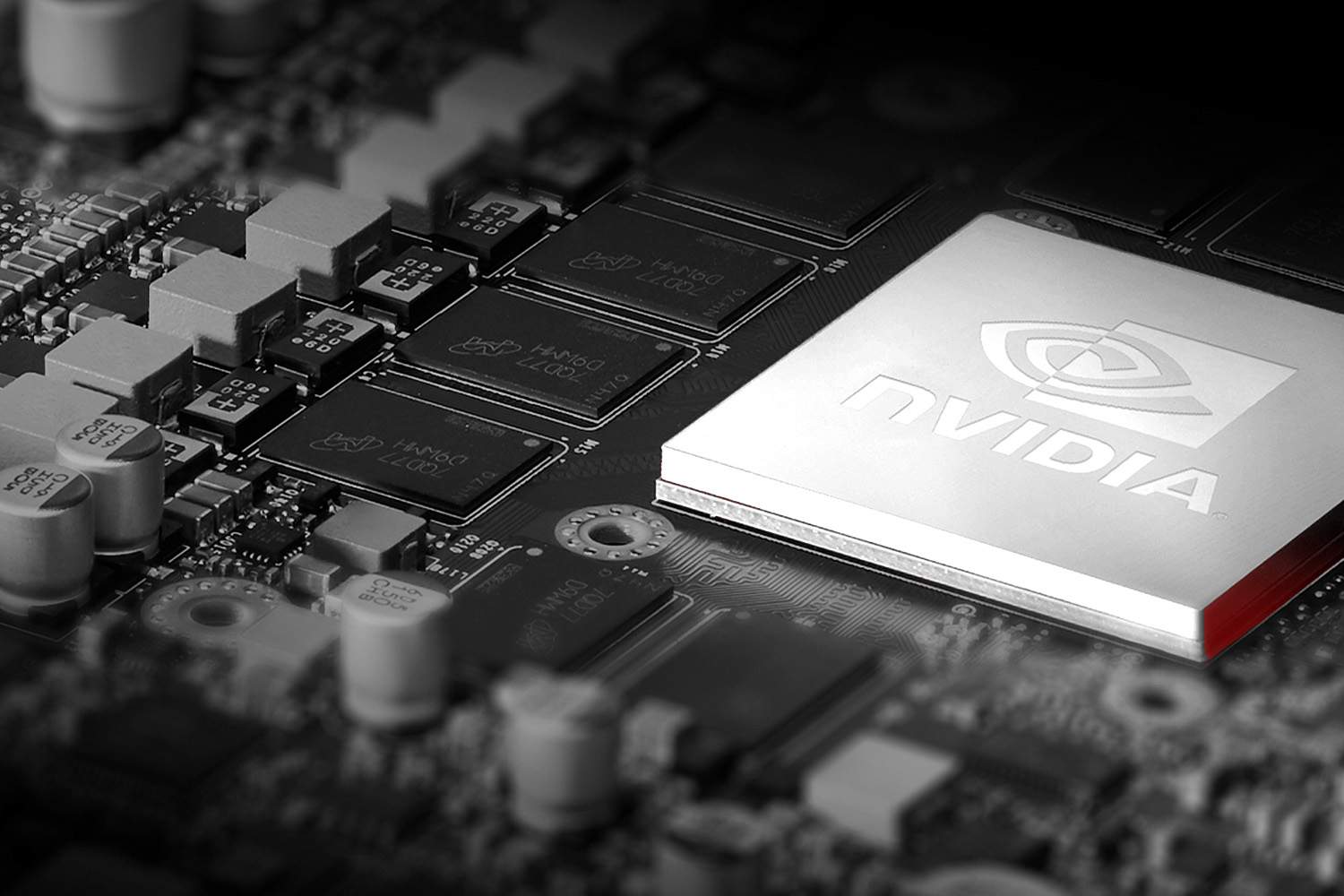

Nvidia is a major provider of gaming hardware and software, offering graphics cards, gaming laptops, and gaming cloud software. Revenue from its gaming division rose 42% year-over-year in the third quarter to $3.2 billion.

The FTC said the merger would threaten Arm’s status as a neutral partner to chip producers. Arm estimated that its software is used in 25 billion chips per year.

“The combined firm would have the means and incentive to stifle innovative next-generation technologies,” the regulator wrote.

Nvidia, however, said that the merger would promote competition in the chip industry — and that the company would challenge the FTC suit.

- SoftBank, which bought Arm in 2016 for $32 billion, agreed to sell the company to California-based Nvidia for a package of cash and stock worth $40 billion at the time.

- Nvidia’s stock price has more than doubled since then, bringing SoftBank’s potential haul from the sale to $74 billion.

SoftBank’s Vision Fund 2 has invested at least $2.6 billion in sports and entertainment this year, and its Fortress Investment Group bought Accordia Golf for $3.5 billion last month.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)