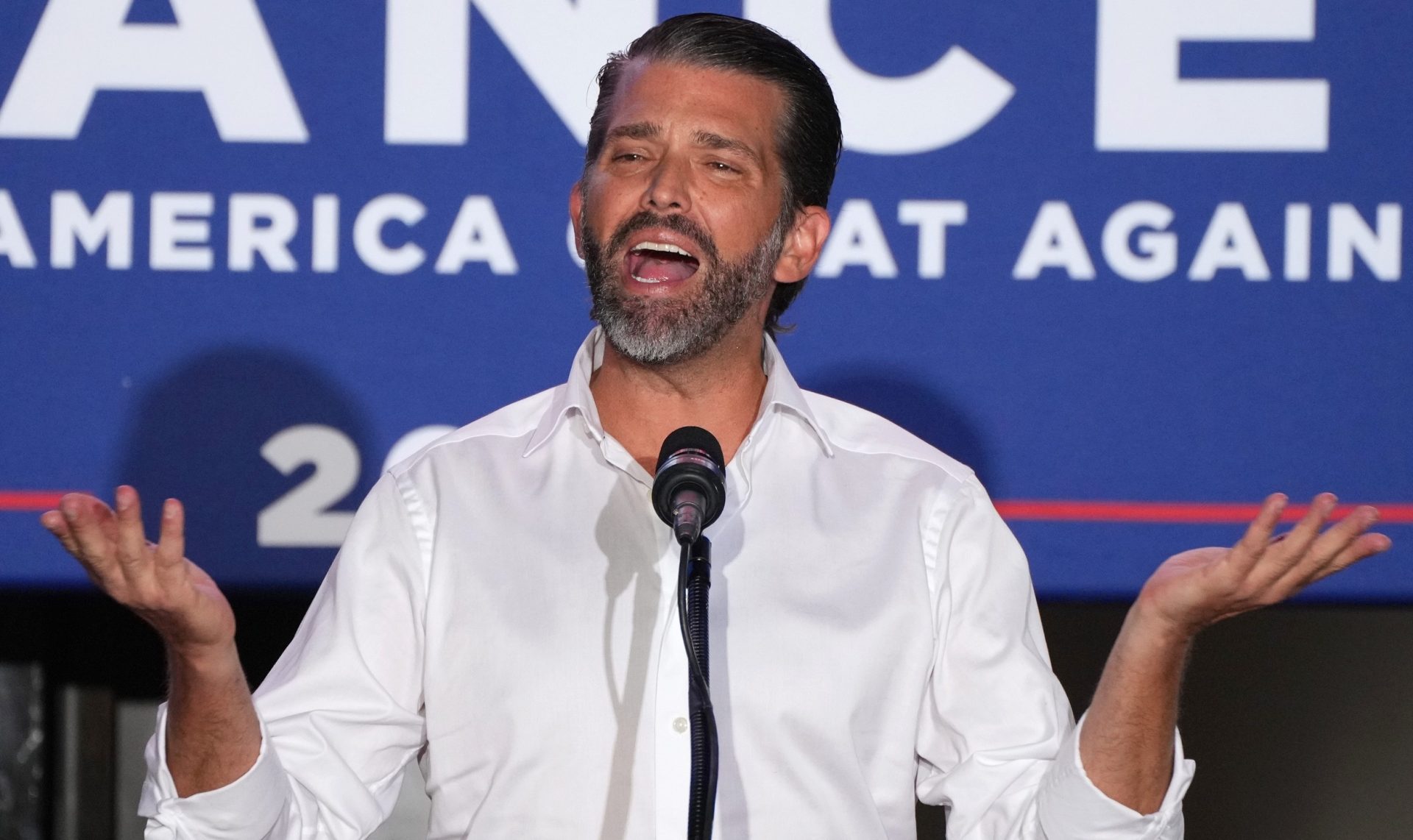

Donald Trump Jr. is investing in prediction-markets exchange Polymarket through his venture capital firm, a curious move that could create the appearance of a conflict of interest since the president’s son is separately a “strategic advisor” for rival Kalshi.

As part of the undisclosed investment from Palm Beach, Fla.–based 1789 Capital, Trump Jr. will also join Polymarket’s advisory board, according to a statement. The firm is injecting “double-digit millions of dollars” into Polymarket, Axios reported.

The news comes as Polymarket has been making a push to reenter the U.S. market. It has been banned from operating in the country as part of a 2022 settlement with the Biden Administration.

Other recent moves signaling the imminent reentry into the U.S. include the company’s June agreement to become the official prediction markets partner for X/Twitter, the announcement a few weeks later by Polymarket founder Shayne Coplan that the company had “been cleared of any wrongdoing” in a federal investigation, and its July acquisition of QCX, a small derivatives exchange that was recently licensed by the Commodity Futures Trading Commission. Coplan was the subject of an FBI raid last year, with agents taking electronics from his apartment. In his words, they were “looking for anything that could imply foul play.”

Additionally, the company has been running ads suggesting it will be available in the U.S. any day now, and reportedly its reentry could take place within the next two weeks.

Trump Jr., who has been a strategic advisor to Kalshi since January, said in Tuesday’s press release that “the U.S. needs to access this important platform.”

A spokesman for Trump Jr. tells Front Office Sports “This doesn’t change anything regarding Don’s role with Kalshi. Don is committed to supporting the prediction market industry as a whole and couldn’t be more excited about his new role with Polymarket.”

Kalshi declined to comment. When the company announced it was bringing him on, Kalshi said Trump Jr.’s “bold business mindset and deep understanding of market dynamics perfectly align with Kalshi’s mission to redefine how America engages with information.”

Trump Jr. being involved with both Polymarket and Kalshi is odd, although it’s not clear whether this rises to the level of a legal or regulatory conflict of interest. Trump Jr.’s role with Kalshi is a paid position, according to Axios.

Polymarket and Kalshi are rivals in the nascent, but growing, area of prediction markets.

Both companies have engaged in outlandish behavior, including on social media and through some of the event contracts they offer. They also both recently raised millions of dollars; in June, one day after Bloomberg reported Peter Thiel’s Founders Fund led a more than $200 million investment in Polymarket at a $1 billion valuation, Kalshi scored $185 million in a funding round led by crypto-focused venture capital firm Paradigm.

Prediction-market platforms like Kalshi and Polymarket give users the ability to trade money on outcomes of events, such as whether there will be a recession this year or whether it will rain in New York City today. As of this year, both companies offer sports event contracts, which allow users to trade on matters like which team will win a given game.

The sports offerings have drawn the ire of state regulators, which have jurisdiction over sports gambling, and the NFL has warned that their offerings are identical to traditional sports betting—but with less oversight and regulation.

Representatives for the CFTC and 1789 Capital did not immediately respond to requests for comment.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)