Soccer clubs have potentially made hundreds of millions of dollars selling fan tokens that unlock real-world benefits for fans.

According to data from FanMarketCap.com, the fan token economy has seen 50% growth since June, with the total market cap increasing from $260 million to $391 million.

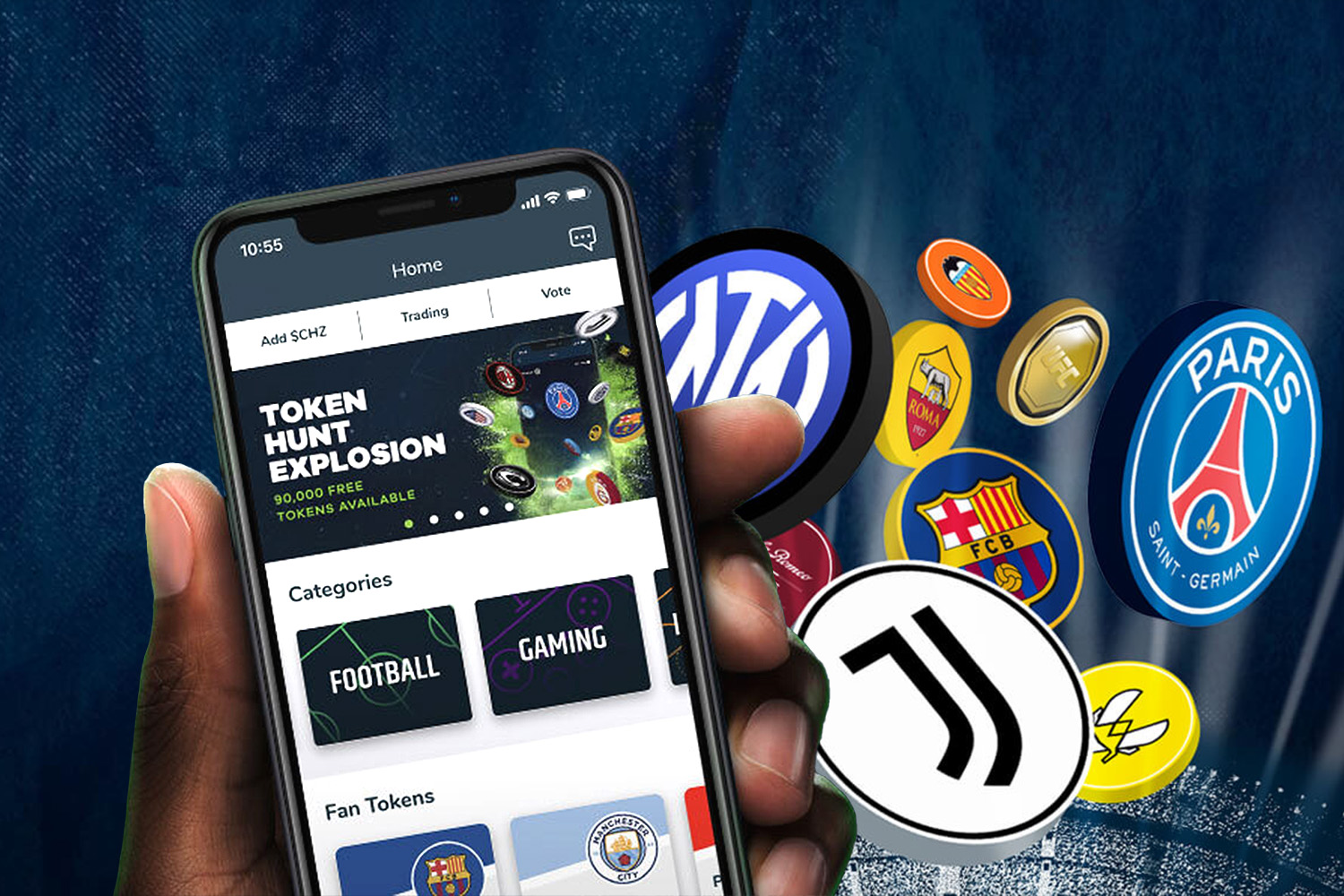

Leading the way is Socios.com, which allows fans to engage with favorite teams and clubs through digital assets. The tokens unlock access to special offers and voting rights on decisions the team puts before the fans, such as which player should take over the team’s Instagram for a day.

The company has been able to provide instant value to partners. When F.C. Barcelona launched an initial fan token offering in June of 2020, the tokens sold out in less than two hours, generating $1.3 million for the debt-burdened club.

Clubs generate revenue from the Socios.com platform in the form of direct payments. Currently, teams fan tokens are trading down relative to their Q2 highs.

- Paris Saint-Germain fan tokens are currently trading at $14.56 with a $45.3 million market cap.

- Manchester City tokens are currently trading at $9.49 with a market cap of $33.8 million.

- Barcelona tokens are currently trading at $8.8 with a $31.1 million market cap.

Socios.com has also partnered with U.S. properties in the MLS, NBA, NHL, and NFL. While those partnerships have yet to offer fan tokens, the model could soon be introduced domestically.

If you want to learn more about the use case for fan tokens and blockchain in sports, check out our Insights report.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)