Wynn Resorts intends to sell its online betting unit, Wynn Interactive, for $500 million — and that’s after it received a $3 billion valuation last year, according to the New York Post.

High marketing costs associated with acquiring new customers, despite recent growth in revenue and reach, is reportedly spurring the decision.

- The company’s WynnBET sportsbook has market access in Arizona, Colorado, Indiana, Michigan, New Jersey, Tennessee, Virginia, Louisiana, and New York.

- It’s inked multiyear partnerships with the NFL’s Indianapolis Colts, Detroit Lions, and New York Jets.

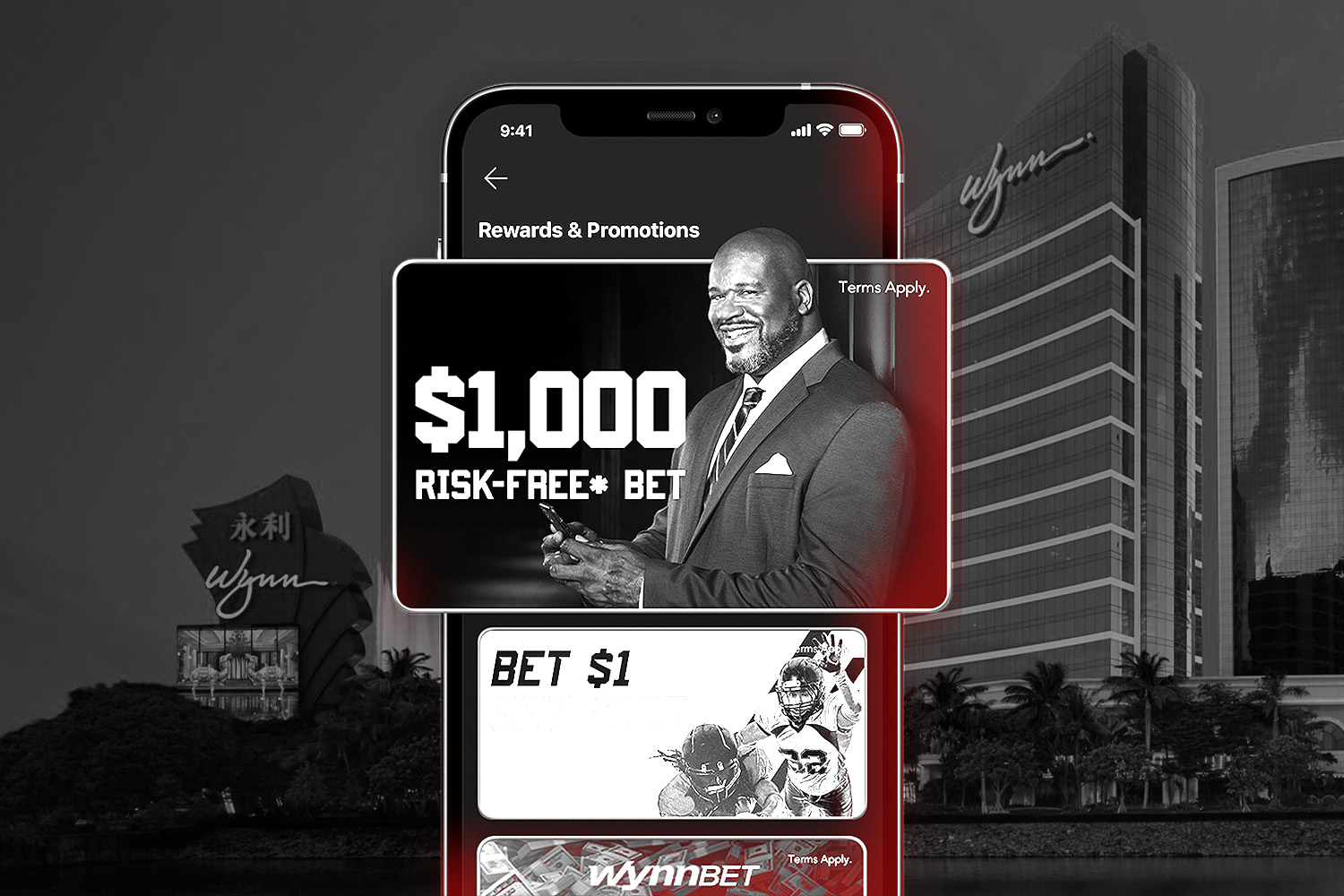

- Over the past year, it’s added NBA legend Shaquille O’Neal, former USMNT goalkeeper Tim Howard, and former NFL star Chad Johnson as ambassadors.

Wynn posted $994.6 million in revenue in Q3 2021, up from $370.5 million for the same period a year prior. The company reported a net loss of $166.2 million during the quarter, down from a net loss of $758.1 million in Q3 2020.

Change of Plans

Last September, Wynn entered an agreement with the Bank of China to obtain a $1.5 billion line of credit. Reports suggested that the company planned to use $100 million of the capital to market its sports betting app during this year’s football season.

Wynn planned to take its online sports betting division public via a SPAC merger with Austerlitz Acquisition Corporation but scrapped the deal last November.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)