Monday was a turbulent day for the stock market as the Dow Jones Industrial Average dropped more than 1,000 points, or about 2.6%.

The crash was a reaction to Japan’s Nikkei 225 index slipping by more than 12%—its steepest drop since 1987—and to an increase in the U.S. unemployment rate, which rose to 4.3%, the highest since October 2021.

The S&P 500 fell by 3% on Monday—its biggest single-day drop in two years—and around 6% when extending to Thursday. The Nikkei recovered by 11% on Tuesday—still short of its Monday drop, but enough to stop the heavy bleeding for many of the stocks in the U.S. as the S&P 500 rose by 1%.

The broader sports sector was not spared in the market crash.

Sports Stock Round-Up

Media: Companies like tech giants Amazon and Apple were hit hard. Amazon is down 14% over the last five days, but most of the dip came before Monday’s crash as the company announced on Thursday that it had missed revenue estimates in Q2.

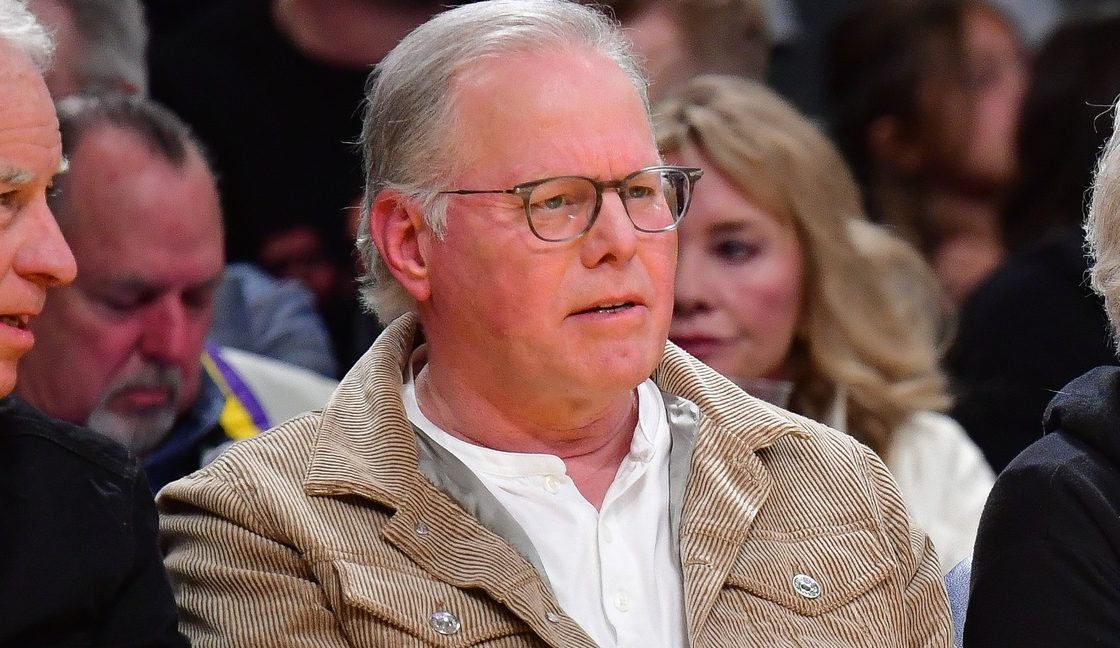

Warner Bros. Discovery, which recently lost its NBA broadcast rights, is down 10% over the last five days as of Wednesday’s market close. It dipped another 9% in the hour following market close after announcing a quarterly operating loss of more than $10 billion.

The company is looking to sell off some assets to recoup losses. It’s also suing the NBA for breach of contract, as the TNT parent company had matching rights to the league’s media-rights deal that were not honored by the league. Despite the shaky financial situation, CEO David Zaslav said Wednesday that he feels “very good about where we are.”

Disney had better news on its streaming side, with its direct-to-consumer unit reporting its first profitable quarter on Wednesday, despite its stock dipping around 9% since last week.

Apparel: Adidas, Under Armour, and Lululemon all saw their stocks begin to dip last Thursday, declining by at least 5% over the last five days. Nike did not feel the drop last week the same way its competitors did, even seeing a slight gain Friday before a 4% dip Monday. However, The Swoosh is navigating a tumultuous year when its stock is down about 32%.

Sports betting: DraftKings reported its first profitable quarter last week, but its stock is down nearly 20% since Thursday. The betting giant’s stock crash was triggered by an announcement it would impose a tax on winnings from bettors in certain states and issue a stock buyback worth $1 billion.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)