When Nike abruptly ousted its beleaguered CEO last week, former and current employees were reportedly “celebrating” with “tears in their eyes.” No doubt after a rocky few quarters many at the company—and those watching it—are welcoming the change with relief.

Wall Street analysts didn’t quite react with the same euphoria, but there is cautious optimism. There also wasn’t too much surprise given the dire state the sneaker giant has been in over the past year.

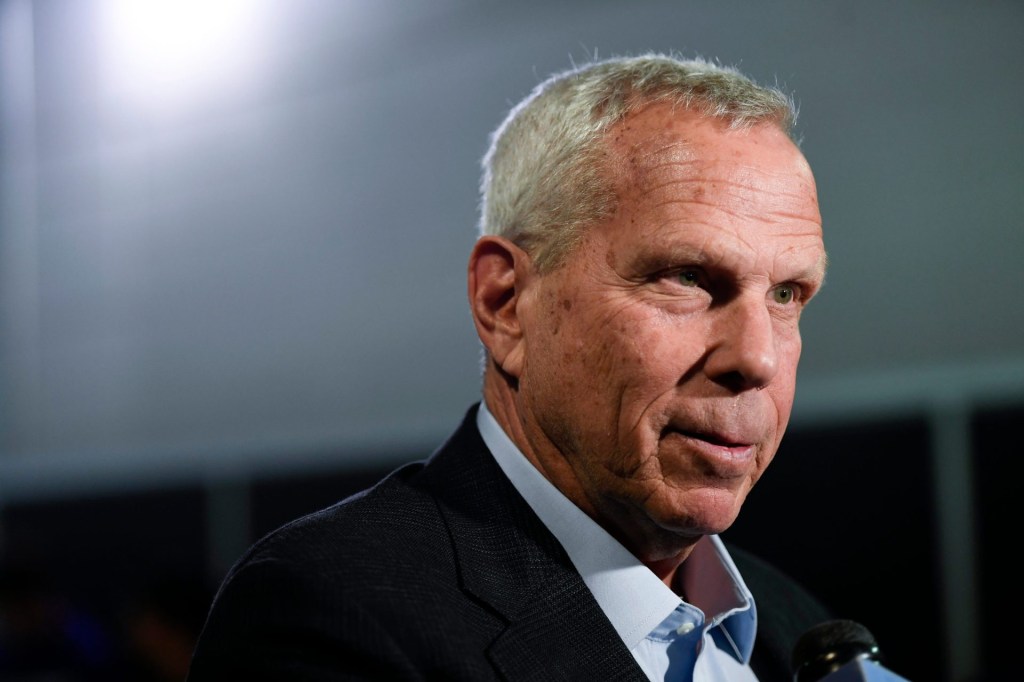

Nike announced Sept. 19 that Elliott Hill, a veteran Nike executive, would replace John Donahoe, whose recent tenure was marred by sagging sales, a lack of product innovation, heightened competition, and a retail strategy misaligned with broader consumer preferences. Donahoe had been under pressure in recent months after the firm had essentially no sales growth in fiscal 2024 and projected lower revenue in fiscal 2025, investment research firm Morningstar said.

The retailer’s stock rose about 10% following the news after market close Thursday. Shares are down 20% year-to-date and up about 6% since Thursday.

“We welcome a potentially refreshed perspective. Management change has been a common topic in our investor conversations on NKE, and has seemingly grown more urgent considering other recent high-profile management change announcements,” Morgan Stanley analysts wrote. They said the management change was “unsurprising.”

One of Nike’s more pressing problems is Donahoe’s efforts to prioritize direct-to-consumer selling over product development and retail relationships. Nike has pulled back from selling through wholesalers to do more direct selling—a move that accelerated over the past five years, says David Swartz, senior equity analyst at Morningstar. The sneaker giant “cut off thousands of stores that used to sell Nike in favor of a few selected retailers it likes more. The general consensus now is that Nike went too far in this effort,” Swartz told Front Office Sports.

“We are not making any revisions to our $124 fair value estimate and view Nike’s shares as very attractive,” Swartz, who thinks Nike stock is underpriced, wrote in a note after the Donahoe news. However, the company faces a challenging market in the short run, especially without a compelling new product to fuel sales higher. Nike was trading at $85.76 a share on Monday afternoon.

‘Trough for Sales Growth’

Morningstar expects the sportswear firm to report a large (10%) sales decline when it releases its first-quarter results Oct. 1. The longer-term outlook is decidedly more positive: “We anticipate that sales will pick up in subsequent quarters as new products are released,” wrote Swartz, who is forecasting a pickup in sales growth next year.

Similarly, Morgan Stanley noted investors may have to grapple with the fact that “fundamentals are unlikely to inflect/improve meaningfully in the [near term] and may actually worsen before they get better.”

The upcoming earnings release should mark “the trough for sales growth,” Bank of America analysts wrote in a Monday note. They also forecast flat sales growth for the second half of the year, which is in line with Nike’s expectations. In June, Nike reported disappointing fourth-quarter and full-year results, with revenue down 2% to $12.6 billion in Q4 and about flat for the year. Donahoe said on an analyst call at the time that declines in lifestyle sales as well as uncertain macroeconomic conditions were behind the cut to Nike’s guidance for fiscal year 2025. (This followed a prior reduced sales outlook for the year last December.)

“Nike warned us it will take time,” Swartz said. “It has a lot of new products coming out, but they won’t be out until calendar 2025, maybe the middle part of the year. There are long development cycles in the industry.”

In Step With Previous Executive Changes

In a note following the management announcement, BofA wrote Hill’s appointment “bodes well for the effort to rejuvenate innovation, rekindle wholesale relationships, and rebuild sales.” The bank maintained its buy rating on Nike and said the move “is the first step forward to accelerate the turnaround.”

Wells Fargo analysts echoed that sentiment, writing that the CEO change is a step toward Nike “returning to its roots and re-establishing the culture that made it successful.” They noted that executive changes had been afoot for the last several months, including the July rehire of Tom Peddie (as head of marketplace partners) and the elevation of veteran Tom Clarke (to president of innovation).

“We view these compelling shifts in leadership favorably, adding visibility to this turnaround story,” Wells Fargo wrote.

China Skeptics

While industry watchers are cheering a new management regime at Nike, some analysts also flagged a few lingering downside risks. One of the most prominent is China, where a slower-growing economy and weak consumer sentiment is negatively affecting other companies (like Apple) with heavy exposure to that market.

“We have grown even more skeptical in the last three months on China sportswear market deterioration and higher freight expenses, among other headwinds in the space,” Morgan Stanley analysts wrote last week.

In its fiscal second-quarter report in December 2023, Nike cut its full-year sales forecast, attributing the pullback to stronger macro headwinds, particularly in Greater China and EMEA (Europe, the Middle East, and Africa), among other factors.

Hill certainly has his work cut out for him. And though his past experience at the company is reassuring, there’s always the flip side of the coin. As Morgan Stanley analysts pointed out, while a 10% pop in shares after market close last Thursday was a positive initial reaction, it “appears somewhat muted compared to what we observed in other similar situations,” including Starbucks (stock jumped 24% after the new CEO announcement in August) and Victoria’s Secret (21%).

It could be because Hill might not be as sufficiently radical to make the kinds of changes needed for a turnaround. He was long immersed in the corporate philosophy and strategy that resulted in the difficult situation Nike finds itself today. The analysts wrote: “We look forward to understanding how his outlook potentially differs.”

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)