Building any sports league is already an uphill slog, but the second year of the United Football League carries even more of a burden. As the league barrels into the upcoming season, beginning March 28, it’s also fighting history—and its own urge to grow aggressively.

Born from the January 2024 merger of the revived XFL and United States Football League, the UFL will enter its 2025 season with not only its own sophomore campaign but also the fourth consecutive year overall with spring football. That’s already unprecedented—and given the more than half-century of wreckage of other failed challengers to the NFL, a particularly notable achievement.

The league is still gunning to establish itself as a fixture among sports fans, but Year 1 of the UFL was a solid success. Viewership outstripped its predecessors by a meaningful 30% compared to 2023 totals, averaging 816,000 viewers per game during the regular season, and nearly doubling that for the championship game.

The impulse for many other leagues in a similar situation would be to push the accelerator and pursue a top-tier status straight away, reaching to match powers like the NFL, NBA, and MLB. Despite the temptation, though, UFL executives say that’s not happening, and that the league will remain on a more measured development path.

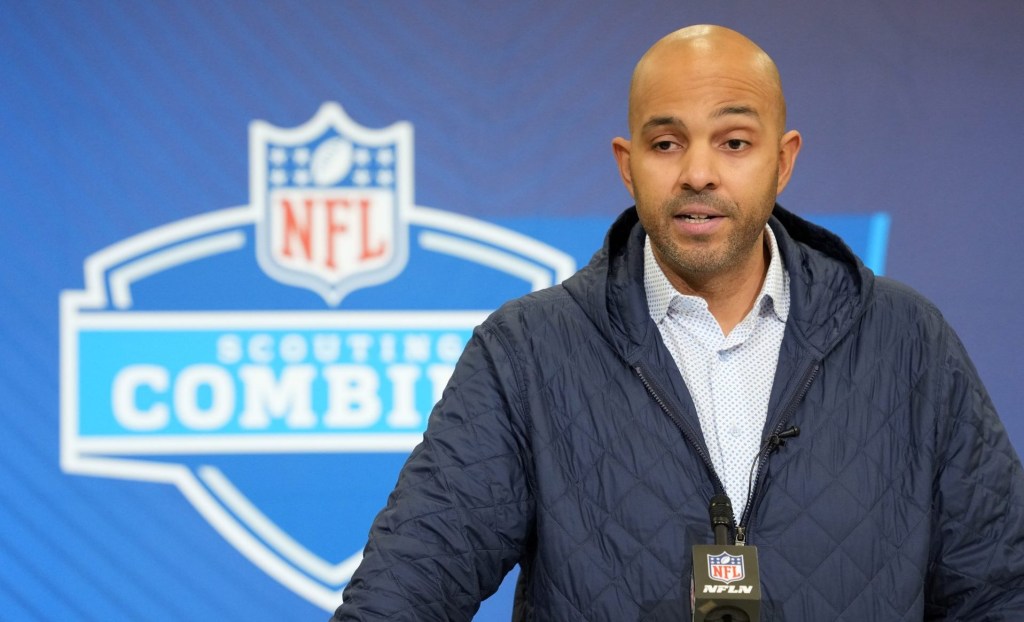

“You have to have a disciplined, patient, methodical approach when you’re building, which isn’t easy,” UFL president and CEO Russ Brandon tells Front Office Sports. “You have to think differently, but we have done that here.”

Brandon says that strategy begins with UFL’s ownership of Dwayne “The Rock” Johnson, business partner Dany Garcia, RedBird Capital Partners, and Fox Corp.—a group of entities that pushed aside prior rivalries and competition to make a better and much more unified attempt toward a truly sustainable alternate football league. “They’re in this for the long haul, and know this is a marathon, not a sprint.”

Financial figures from 2024 have not been released, and while the league reportedly was unprofitable during the initial season—not surprising given the start-up phase—he says it still paced ahead of internal projections.

Perhaps the biggest difference from Year 1 to Year 2 of the UFL is the presence of an actual offseason. Like many start-ups, the UFL formation and completion of the merger was something of a fire drill, even with the prior resources of the XFL and USFL that carried over into the new entity. A sense of normalcy, however, is now beginning to reach the league.

“One of the things that’s really been fantastic for all of us is that we’ve actually had an offseason to prepare,” Brandon says. “A year ago, we did the merger on January 12, went to training camp on February 22, and then kicked off on March 28. We were drinking from the proverbial fire hose. You never have enough time, but it’s been good to have a true offseason.”

An important portion of the offseason work involved signing a lease for new league headquarters within the Arlington, Texas, entertainment district that includes the Cowboys’ AT&T Stadium and Rangers’ Globe Life Field. While on the surface a straightforward commercial office lease, the deal also puts the league just steps away from Choctaw Stadium, the Rangers’ former ballpark and now the home field for the UFL’s Arlington Renegades.

“This is a defining moment for the United Football League as they establish their headquarters in one of the most dynamic sports and entertainment districts in the nation,” said Jamie Adams of Zang | Adams Real Estate, which represented the league. “It’s genuinely exciting to see this come together in a city that lives and breathes sports.”

Among the key issues also settled during this longer offseason were the 2025 competitive and broadcast schedules. A key fixture of that is the creation of a Friday primetime slot on Fox throughout the 10-week regular season.

That shifts in large part from 2024 coverage on Sundays, a much more competitive slot for viewers. The move stemmed in part by Fox’s start of IndyCar Series race coverage this year, but it also gives the UFL a regular broadcast position of its own.

“We’re really excited—to create a dedicated night and make it appointment-viewing for our fans and our league is another feather in our cap,” Brandon says.

Fox’s strategy for the UFL is not unlike what it started in 2024 for college football, drawing solid early results. More broadly, Fox and ESPN will again share UFL coverage across their various platforms including linear and cable networks, streaming, and Spanish-language networks—combining to air all 43 of the league’s games.

The growth path may be measured, but the UFL is still looking at expansion—though without any defined timetable or target number of additional teams.

The current eight-team UFL team lineup is primarily concentrated in Texas and the U.S. Southeast. As a result, big pockets of geographic opportunity exist. The arrival of new teams across the Northeast, West Coast, and much of the Midwest could also yield new team brands, building on the current ones that draw equally from the prior XFL and USFL.

A critical differentiator from the UFL and nearly all prior challenger football leagues is its formal working relationship with the NFL. The XFL previously struck a partnership agreement with the NFL, acting as a testing ground for a variety of on- and off-field rules and technology. That relationship has grown and developed, perhaps most notably with the NFL’s new kickoff rules that were modeled heavily from a prior XFL format.

The UFL, meanwhile, has seen dozens of its former players sign to NFL rosters, including Lions kicker Jake Bates, a development pathway that also applies to many in support, coaching, and training roles. Bates set a Lions franchise record in 2024 for points in a season.

“When you see those guys making plays on the biggest stage, it gives you such a great feeling, watching individuals thrive,” Brandon says. “We talk about our league being a league of opportunity. We are a stand-alone professional spring league, but we are well aware that 98% of our players are hoping to get an opportunity in the NFL.”

Editors’ note: RedBird IMI, of which RedBird Capital Partners is a joint venture partner, is the majority owner of Front Office Sports.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)