A U.K. judge ruled Friday that John Textor is liable to pay about $97 million to two investors who he claimed bamboozled him into signing a complicated financing deal that was meant to take his soccer empire public.

The ruling is a significant win for Iconic Sports Eagle Investment LLC, the company owned by the two investors, although the case is not yet closed. Textor said in a statement to The Guardian: “While this is a preliminary hearing, I am disappointed with the decision not to end this lawsuit at the outset. I intend to appeal.” Representatives for Textor did not immediately respond to requests for comment.

The judge rejected Textor’s attempt to stop Iconic from making him honor a provision that was tied to a special purpose acquisition company (or SPAC) merger meant to take Eagle Football public at a $1.2 billion valuation.

Iconic—run by James Dinan and Alexander Knaster—issued a statement celebrating the decision, saying they will pursue the money they’re owed, which was previously almost $94 million, but with interest is now roughly $97 million, excluding legal costs. Knaster owns investment firm Pamplona Capital Management, while Dinan is the founder of hedge fund York Capital Management and part-owner of the NBA’s Bucks.

“Today’s decision from the UK Commercial Court confirms unequivocally that John Textor knowingly violated contractual commitments and owes Iconic approximately $97 million excluding legal costs,” the statement said. “Iconic intends to recover the funds that are rightfully owed, and will pursue all options, in any jurisdiction, to do so.”

The ruling represents the second soccer-related legal setback for Textor this week. On Wednesday, a U.S. federal judge in Florida tossed a suit Textor had filed there, which alleged he had been defrauded by the investors, saying the parties’ agreement required the case to be heard in the U.K.

His now-dismissed suit in Florida was filed July 4, the day after Dinan and Knaster sued him in the U.K.

According to Textor, the deal to take Eagle Football public was destined to fail because Knaster—and another investor in Iconic—had “close financial ties with Russian individuals and assets that were the subject of international sanctions.” Through Eagle Football, Textor owns stakes in multiple soccer clubs, including Olympique Lyonnais in France and Daring Brussels in Belgium (although he stepped back from day-to-day operations with Lyon over the summer, he still owns the team).

Under the put option at the heart of the dispute—which could be triggered if the SPAC merger was not completed by a certain date—Iconic paid £1 for the right to compel Textor to buy back its $75 million stake in Eagle Football for that cost, plus 11% annual interest. As of today, the total cost when including interest is about $97 million, according to Iconic.

Textor said in his lawsuit that he only agreed to the put option under those terms because he was convinced the deal was a sure thing, but later found out that the investors knew the transaction—which officially died in September 2023—was doomed from the start due to their undisclosed ties to sanctioned Russian oligarchs.

In the U.K. lawsuit, Iconic had argued it has been trying to get Textor to pay the money he owes under the put option for years, to no avail.

As of earlier this year, Textor was still trying to take Eagle Football public; last month, the company made a confidential IPO filing with the U.S. Securities and Exchange Commission.

Textor’s headaches this year don’t end with this legal dispute. He was unsuccessful in an attempt to keep another soccer team, Crystal Palace, in the Europa League next season, after the Court of Arbitration for Sport ruled he failed to follow European UEFA rules governing multi-club ownership. Two clubs Textor held significant ownership stakes in through Eagle Football Holdings Limited—Crystal Palace in the U.K. and Lyon in France—each qualified for the Europa League, and although he offloaded the Crystal Palace stake to Jets owner Woody Johnson, the Swiss-based international arbitration court ruled he did so too late.

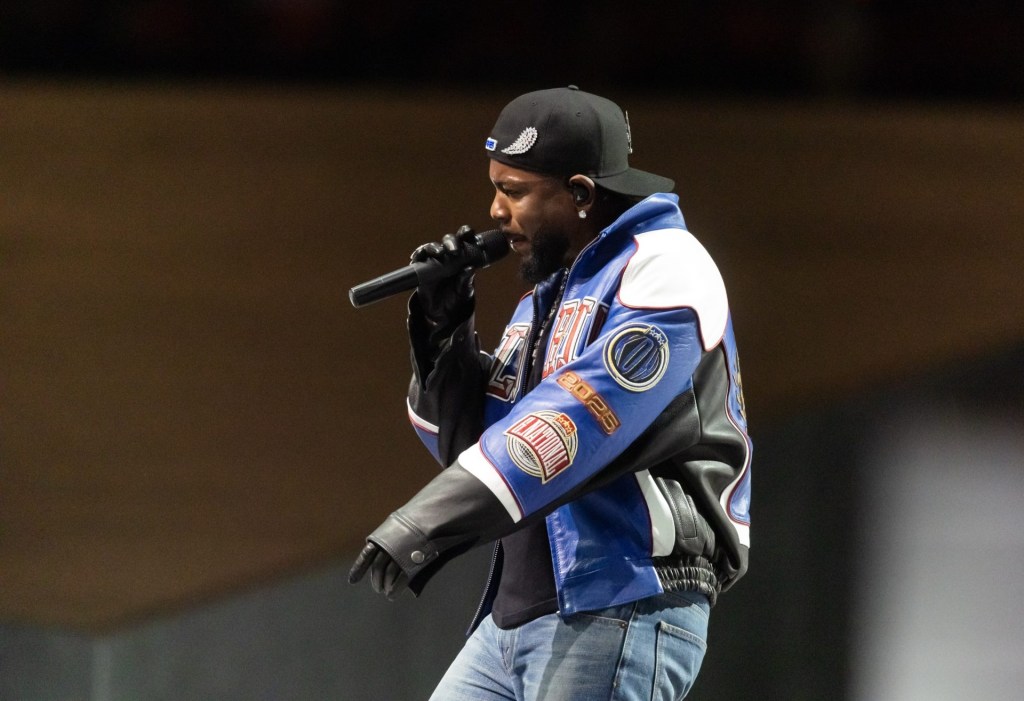

![[Subscription Customers Only] Jun 19, 2025; Pasadena, California, USA; Botafogo owner John Textor before the match during a group stage match of the 2025 FIFA Club World Cup at Rose Bowl Stadium.](https://frontofficesports.com/wp-content/uploads/2025/10/USATSI_26494677_168416386_lowres-2-scaled.jpg?quality=100)