Days before it was set to go public, Topps and a SPAC — Mudrick Capital Acquisition Corporation II — called off their merger.

Topps, which said the deal was terminated by mutual agreement, will remain a private company for the time being.

“Topps expects to be able to produce substantially all its current licensed baseball products through 2025, pursuant to its existing agreements,” the company said.

- The merger, announced in April, valued Topps at around $1.3 billion, 12.5 times its 2021 projected adjusted EBITDA at the time.

- The partnership that would have taken Topps public was set to be complete on Aug. 25. Mudrick had just released a statement to shareholders reminding them to vote in favor of the Topps merger on Tuesday.

- On Wednesday, Topps posted second-quarter earnings that showed a 77.7% year-over-year increase in net sales to $212.2 million.

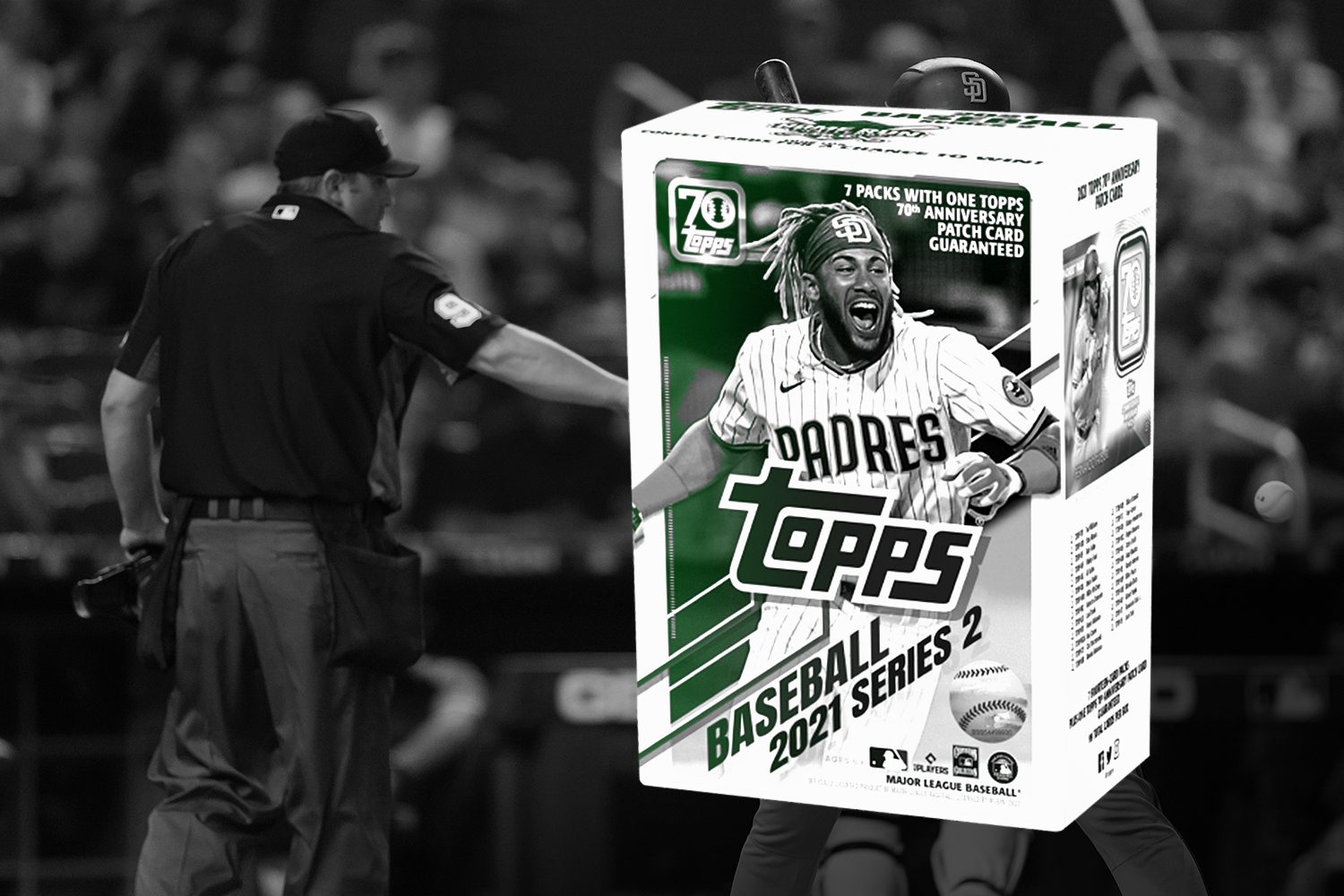

The news caps a dramatic week for the iconic trading card company. Reports surfaced Thursday that Topps had lost its 70-year partnership with MLB and MLBPA to Fanatics. Mudrick referenced the end of that relationship in its statement announcing that the Topps deal had been called off.

Fanatics also scored deals with the NBA, NBAPA, and NFLPA. The company raised $325 million at an $18 billion valuation earlier this month and plans to dive into ticketing and sports betting in the future.