Both companies have looked to the secondary market for success.

Adidas, Nike, and Under Armour recently announced their quarterly earnings: not surprisingly, Adidas was the fastest riser (+26% in North America), with Nike stagnating (+1% in North America). Under Armour, meanwhile, experienced one of its worst quarters — quarterly losses of $12M, and historically low stock prices.

However, until 2016, Nike still reigned supreme — and what they had built to that point was nothing short of incredible. The brand fervor exhibited by their fans was only matched by Apple, giving rise to a new concept: the sneakerhead.

How did Nike do this?

Two ways: sponsorships and leveraging the secondary sneaker market.

With sponsorships, Nike created their brand through what I call the “contained shotgun” approach: where they have outspent all their competitors within specific categories.

The best example is in basketball, where Nike has occupied all levels of the sport: high school, college, professional leagues, and even pro-am leagues, such as Drew League. This brand affinity has become massive enough that college teams are willing to take a discount to partner with Nike.

That goes multiple levels: players want to play for a Nike school, and merchandise sales increase with a Nike logo.

The logic is the following: take a discount to partner with Nike, and you make up that difference in the extra revenue you receive by recruiting a star player, and by selling jerseys. For Nike, the goal here was to become all-encompassing for basketball fans, while also becoming the first brand to mind when thinking of the sport.

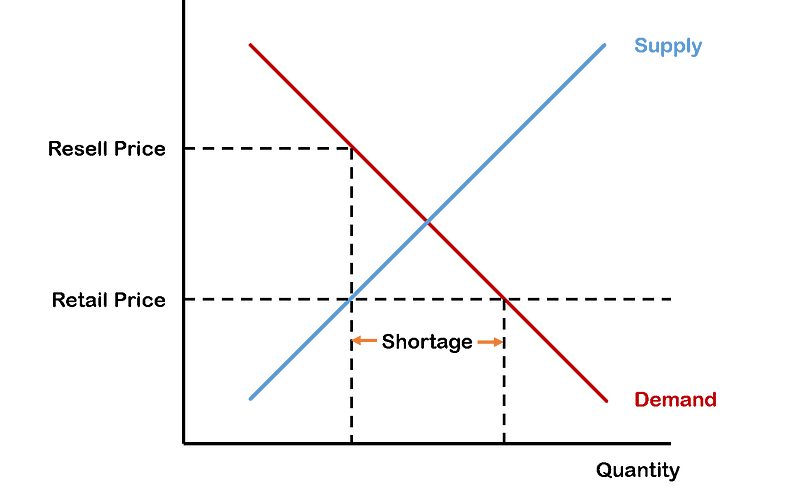

Next, to nurture a burgeoning secondary market (which resembles a black market), Nike created limited releases — strangling supply, which in turn increased prices in the resell market. Sneakerheads occupy the secondary market, and are (like drug addicts) characterized by their low price elasticity and high willingness to pay.

The secondary market created a massive overall brand premium, and while this did not necessarily translate to direct revenues to Nike, it created spillover demand for other products, improving overall net profitability. In other words, as long as:

Held true, it was rational to continue creating limited releases.

And god damn, has Nike been successful at this. In 2014, within the resell market, Nike comprised of 96% of total sales.

In creating and nurturing the sneakerhead segment, Nike maintained a firm hold on the resell market.

Adidas’ rise

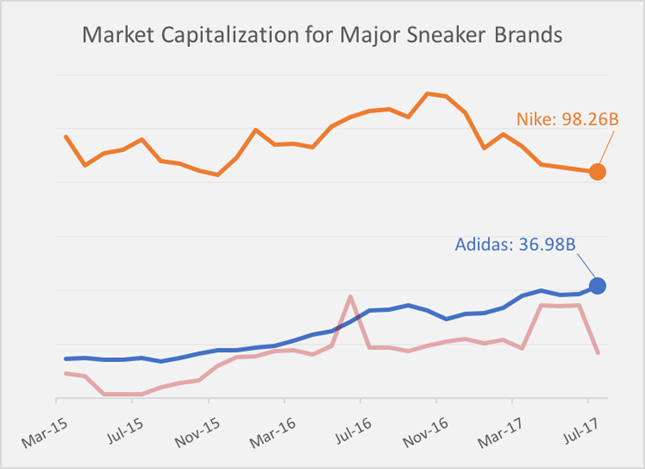

In February 2015, Under Armor’s Kevin Plank called Adidas his “dumbest competitor”. I’d argue that in the years since that statement, Adidas has made more intelligent strategic decisions than anybody else in their industry — leading to an ascendant market cap (share price times shares outstanding).

(I included Plank’s Under Armor in red, for good measure).

The reason behind this growth was a revamped strategy, centered around the same two factors that led to Nike’s success: sponsorships and distribution.

Through a completely refreshed sponsorship strategy, Adidas began to reallocate their investments into a category undervalued by traditional sporting apparel brands: the lifestyle market. At the same time, Nike doubled down on segments that were stagnating, such as basketball (through their massive NBA partnership¹) and athletics. Funnily enough, Adidas has executed a similar contained shotgun approach in soccer, with a flood of new and extended partnerships with clubs, leagues, and players. This culminated in the highest number of sponsorships of any other brand for teams contending for major titles in 2017.

Targeting Americans wearing athletic wear for casual use (75% of all customers) was the perfect example of a classic whitespace strategy: examine where your competitors are not occupying, and if profitable, invest heavily into that space. Their endorsements of public figures such as Kanye West and Pharrell Williams, was in many ways, buying low on the lifestyle stock.

From the distribution angle, Adidas borrowed Nike’s strategy: creating limited releases and catering to the secondary market, with releases such as the Yeezy Boost and NMDs. At the same time, Nike started to increase their supply in the market. During this period, Adidas saw resell margins of up to 400%, while new Nike products began to falter. As with Nike’s limited releases, Adidas created spillover demand for products such as their Superstars — the top selling sneakers of 2016.²

All that said, Adidas’ strategy was straight out of the Nike textbook: sponsor aggressively into specific categories, and cut supply for limited releases. This coincided with Nike’s missteps within both areas, leading to gains for Adidas: sneaker sales for Adidas grew 80% in 2016, as per the NPD Group, contributing to the doubling of their market share (11.3% as of May ’17). Meanwhile, as a result of declining basketball sales, Nike moved their focus from the secondary market to the retail market through signatures and player editions — attempting to leverage their unmatched athlete roster.

Looking forward

While Adidas has made headwinds into the sneakerhead segment, it is still Nike’s territory (by recent estimates, a 67% share). Resell margins still serve as one of the best measures of brand strength in sneakers, and outside of a few new entrants within the top 10, the swoosh is still prominently featured. A couple years of popularity is not enough to diminish Nike’s brand — in many peoples’ minds, Nike is still the top sneaker brand.

Therein lies the power of a brand. While Adidas has made all the right decisions over the past two years, for them to overtake Nike within consumer minds, it will take a colossal effort and years of positive reinforcement to do so.

It will not be difficult for Nike to regain some market share within the sneakerhead segment. They have already begun to make their way back into the secondary market. However, Adidas’ entrance into the lifestyle market may have led to a first mover advantage large enough to be insurmountable, at least in the short term.

This advantage should be concerning to Nike, given that their existing partnerships may be well past the point of diminishing returns. These partnerships are all a part of brand building — and a few more years of success may aid in Adidas’ goal to win the sneaker wars.

¹ To be clear, NBA player endorsements are still effective, especially in a league that is increasingly becoming more player-driven. ^

² For an exhaustive history of Adidas resell, check out Josh Luber of StockX’s outstanding analysis here. ^

Front Office Sports is a leading multi-platform publication and industry resource that covers the intersection of business and sports.

Want to learn more, or have a story featured about you or your organization? Contact us today.