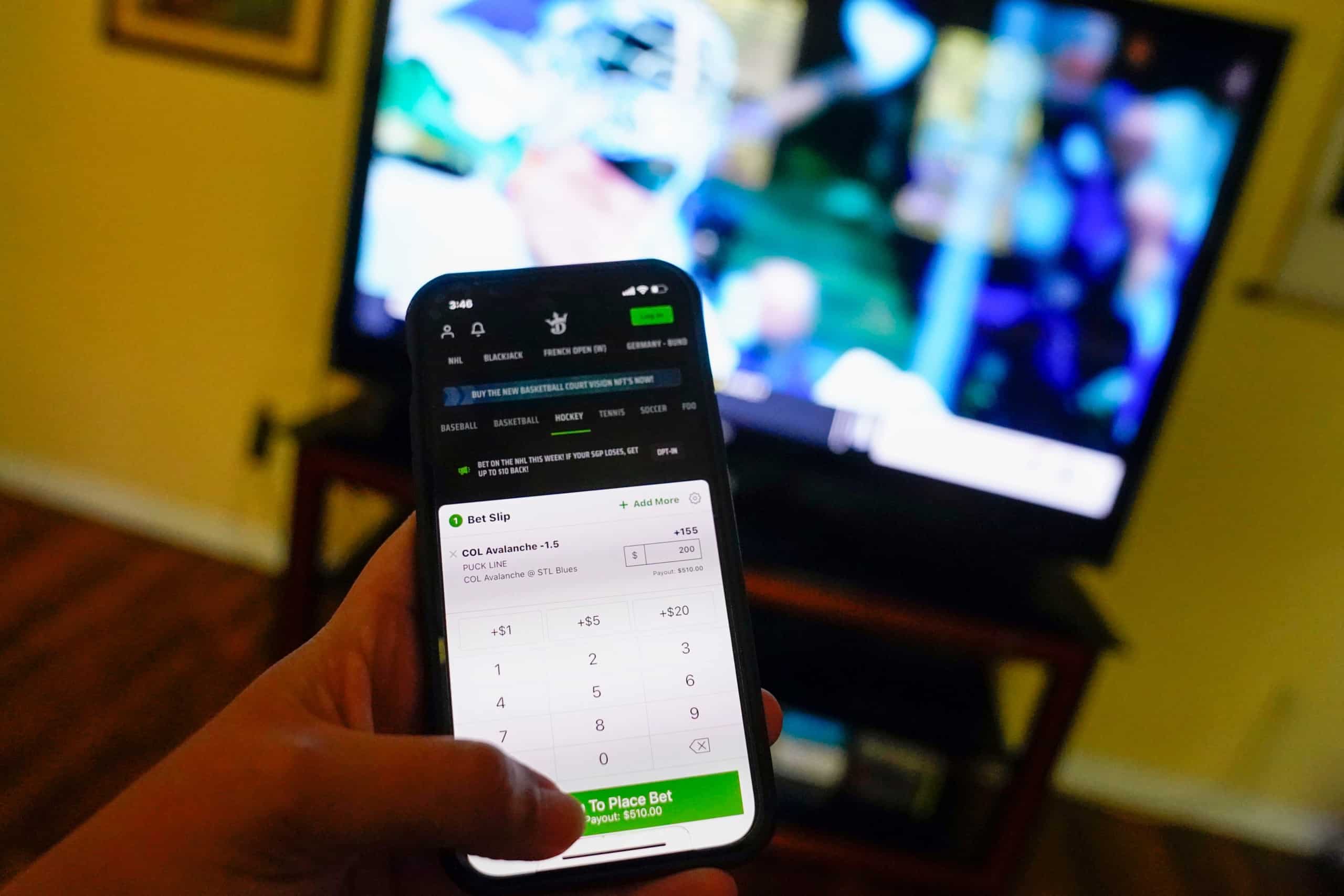

Since the United States Supreme Court struck down Professional and Amateur Sports Protection Act legislation in 2018, sportsbooks have been scrambling to figure out how to scale operations and win over mainstream bettors.

One of the best ways to accomplish this is through partnerships with media companies and personalities, or outright mergers and acquisitions.

Last week, Penn Entertainment exercised its right to buy the remaining shares of Barstool Sports that it didn’t already own for $325 million. It’s only the latest splashy pairing in recent years.

- In 2021, Sports Illustrated partnered with 888 Holdings to launch a sportsbook in Colorado.

- FanDuel owner Flutter Entertainment inked a multiyear deal with former athlete and media personality Pat McAfee.

- FanDuel also announced a brand new sports betting TV show with former NFL Network host Kay Adams.

- DraftKings partnered with Turner Sports and Bleacher Report to become their exclusive sportsbook and daily fantasy sports provider.

- ESPN integrated DraftKings and Caesars betting odds and daily fantasy information into its app.

- NBC Sports acquired equity in PointsBet, which has been providing odds and betting data for all NBC networks since 2020.

- CBS Sports partnered with William Hill to improve fan engagement through sports betting data and technology.

Why is all of this happening?

The Opportunity

Legal sports betting is an early-stage sector in the U.S. — and is likely to be one of the most prominent in the next decade.

According to Statista, sports betting revenues amounted to $2.1 billion in 2021. With a massive compounded annual growth rate of 35%, Macquarie Research expects the industry to generate $30 billion in revenue from $400 billion in total wagers by 2030.

With this forecast, everyone’s rushing to get a piece of the pie before it’s too late.

Market Adoption

Under the market adoption bell curve for sports betting, the industry is only beginning to cross the chasm (i.e. the void between early and mainstream adoption). The early, diehard sports bettors are already customers. But true success will come from winning over the late majorities — in essence, skeptical and casual bettors.

Sports betting companies want to understand what triggers these casual fans, how they interact and engage, and where they gather.

Media companies and content providers have this knowledge from years of delivering sports content and analyzing data to enhance the consumer experience — sportsbooks need it.

The Benefit

A company can measure its marketing performance based on customer acquisition cost (CAC) and lifetime value (LTV). If the cost to bring in the customer is higher than the average monetary value they will eventually bring to the company, it’s a bad investment.

For example, in a 2020 report, DraftKings’ average CAC was $371 and its LTV was $2,500. For context, a 3x LTV-to-CAC ratio is considered good for software companies — DraftKings’ ratio more than doubled that.

The right LTV justifies the seemingly exorbitant CAC that some sportsbooks face due to extensive marketing costs and a habit of shelling out cash for prime real estate within top sports media content.

The Bottom Line

Besides the straightforward appeal of gaining a foothold in a rapidly growing business, tapping into the multi-billion dollar sports betting market especially helps media companies by:

- Increasing fan engagement through different integrations in their programming (e.g. live betting odds, new content, data, statistics)

- Opening new revenue sources through direct advertising and affiliate marketing

For sportsbooks, it’s more about customer acquisition.

With the 2022 NFL season set for kickoff, more states legalizing sports betting, and Disney exploring betting offerings through ESPN — you can bet on more media–sports gambling weddings happening soon.