It’s more than just swipe right or left.

There’s much to like about Tinder’s reported negotiations to become Manchester United’s official sleeve sponsor. While it has raised curiosity and clever comments, there is absolutely a case to be made that it may be one of their most important marketing moves ever.

But before we get to that, let’s start with an overview of the company.

The Tinder strategy

Tinder follows a simple concept: users create profiles, which become cards that other users “like” (swipe right) or “nope” (swipe left).

What makes it valuable for users, and the reason why it is a superior dating platform, is that it artificially creates a thick market — which it does better than any other dating app on the planet, due to its sheer coverage¹ and minimal required effort for users.

Drawing it out, a user’s pre-Tinder world looks like this:

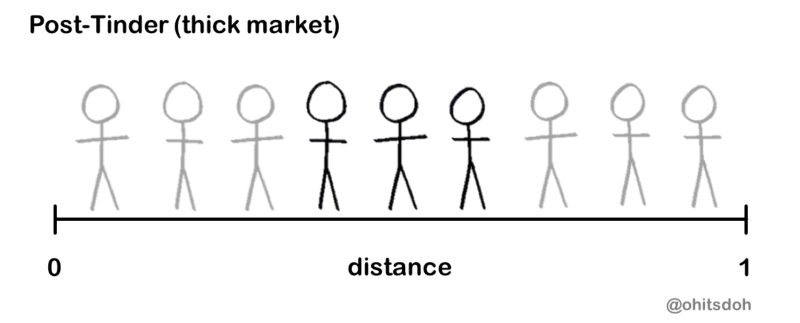

While a user’s post-Tinder world looks like this:

Clearly, the Internet creates more possibilities!

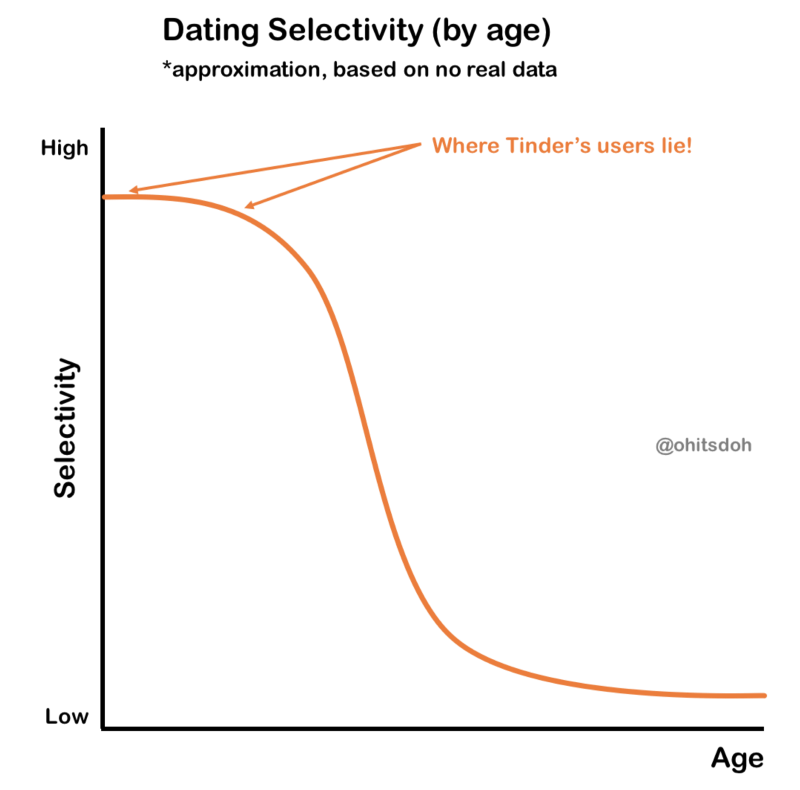

Tinder has also targeted the demographic from whom they are most likely to see frequent usage. Between the ages of 16–34, where users have more years to make decisions, it is rational to be relatively selective in your dating preferences. As you age, your preferences would evolve into something like this:

And the higher a user’s selectivity, the more they are likely to continue using Tinder!

How Tinder Monetizes (and a simplified model)

Tinder has two main streams of revenue: advertisements and subscription-based Tinder Plus memberships.

Though Plus’s age-based price discrimination was initially released to backlash, it has thus far been a success, with analyst estimates of approximately 2.2M users and total revenues of $306M (including advertising).²

So how does Tinder’s freemium model work?

Plus memberships provide more benefits than just ad-free consumption. The utility (or benefit) here is gained from features such as unlimited likes, Tinder “Boosts” (where you become the top profile in your area), user filters (to get specific types of users), and swipe rewinds (where you can undo swipes). This means that users are paying for extra features — rather than the opportunity for ad-free consumption.

In a simplified world, where there are only three types of users³:

Users would consume where (keep in mind that marginal utility is the benefit gained from consuming one additional unit):

Freemium products where users primarily pay to remove ads simply remove the disutility experienced from advertisements — meaning that the only subscribers would be the ones who would “spend” equal or more (via their ad views) than the cost of subscription. In our example, if we assume a $5 subscription, this would only include Heavy Users.

https://frontofficesports.com/nike-adidas-under-armour-shoes-earnings-money-52d89c50a9bf

Since Tinder provides additional features, there is additional utility experienced by users, on top of the removal of disutility from advertisements. Assuming a $5 subscription and, from additional features, an additional utility of 50 percent⁴ of willingness to pay:

In short, for $5 subscription, Medium Users would also be willing to become Plus members (at no additional cost to Tinder).

Tinder’s bet is that their current split, where paid subscriptions comprise of most of their revenue, will maximize their earnings — meaning more Medium Users than Light or Heavy Users. This also suggests high marginal costs for an ad-supported model.

The Man U Partnership

So how does this tie into Tinder’s proposed Man U partnership?

A Tinder sponsorship of Man U accomplishes two goals: improving brand awareness/affinity and growing Plus memberships. Note that none of this would have anything to do with targeting a specific demographic — but would have everything to do with reaching as many potential and current users as possible. This is, in my opinion, the correct path for Tinder’s growth.

On a surface level, this is a play for more users. Wider and denser coverage (a high users/capita in more areas) could create a near-infinite supply of users, creating leverage for Tinder in negotiations with advertisers. Manchester United, still the most popular sports team in the world, offers the unique ability to reach all corners of the globe, with one of the most diverse and intense set of fans in the world.

But sponsorship also creates repeated interactions, leading to brand awareness and affinity, which should create desired purchasing habits. And that is why, when you look at the top sponsorship spenders, it has always comprised of companies in industries where either a) there are frequent purchases, or b) there are highly undifferentiated goods.

Creating a habit, for Tinder, is not about regular purchases. Rather, it is about becoming a default app in your iPhone. To create more habitual users is to nurture the development of high-volume users. If the subscription model is indeed a more profitable business than the ad-supported model, the ideal situation is to convert as many ad-supported Medium Users as possible.

The other place where repeated interactions may be helpful to Tinder is in improving brand equity to both users and advertisers. Although Tinder is in wide usage, it has yet to become completely socially viable. Call it spillover from the last generation, where internet dating was thought of as a last-resort move. Associating themselves with a brand as powerful as Man U could be highly effective: meaning that you might see more people swiping in the subway or in line at Starbucks.

What This Means for Sponsorship

If completed, Tinder’s sponsorship of Manchester United may indicate a subtle shift in the way the medium is used. Sponsorship does not accomplish the same goals for internet companies as they do for the traditional brands — you won’t see Tinder soap at the supermarket!

Rather, for internet companies who are aware of the declining value of a television advertisement, sponsorship may serve as a useful tool to spread their branding. This especially holds true for consumer apps — where habitual purchases have shifted to habitual usage.

As competition in this industry increases, and more niche players emerge, look for more investments from consumer-focused internet companies.

Note: the simplified examples used in this piece are in no way meant to be a completely accurate portrayal of the real world. They are used to create a better understanding of the way Tinder has executed their strategy.

¹ Which was not always the case, but is true now. Like all social apps, network effects are extremely valuable for dating apps: where an increase of users leads to an improvement in product quality! ^

² There are a TON of reasons why age-based price discrimination makes sense for a dating app, but this piece isn’t about that. ^

³ This example uses arbitrary numbers to illustrate a point. ^

⁴ The additional utility experienced from features should depend on your current willingness to pay. ^

Front Office Sports is a leading multi-platform publication and industry resource that covers the intersection of business and sports.

Want to learn more, or have a story featured about you or your organization? Contact us today.