The Utah Jazz’s work toward a new local distribution setup began well before the regional sports network model imploded.

“We’ve watched what’s happened with the RSN business over the last five, six, and even seven years,” Jazz President Jim Olson told Front Office Sports. “That’s when you started hearing rumblings of where this was going.”

The Jazz and the Phoenix Suns begin the regular season with an RSN-free setup, a mix of over-the-air and streaming coverage for in-market fans that could be the future for other teams.

This setup could also be implemented during the season, depending on the outcome of Diamond Sports Group’s bankruptcy.

Fifteen NBA teams remain with DSG’s Bally Sports RSNs as the 2023-24 season commences.

The Jazz weren’t caught up in the proceedings that have seen three teams in other professional sports — the San Diego Padres, Arizona Diamondbacks, and Arizona Coyotes — dropped by DSG with a bankruptcy judge’s approval. Utah’s contract with AT&T SportsNet expired after last season, and the RSN’s parent company, Warner Brothers Discovery, made it known earlier this year that it plans to abandon the RSN category.

Under the old model, Olson said the Jazz’s local broadcast setup with AT&T SportsNet reached only about 40% of the local market.

“We wanted to put it on our shoulders and make sure we’re getting great distribution,” Olson said. “And then, by getting that distribution, how do we maximize it? How do we grow our fan base? How do we engage more with our fans? How do we provide more content? We’re betting on ourselves. We are very anxious and excited about what lies ahead with it.”

The Jazz announced their over-the-air deal in June with KJZZ, an independent Salt Lake station owned, coincidentally, by the Sinclair Broadcast Group — the parent company of DSG. The station will broadcast a minimum of 72 of the 82 regular-season games, and Utah announced a streaming offering, Jazz+, that costs $125.50 annually.

The Suns — which had been with now-shuttered Bally Sports Arizona — have a similar setup with Gray Television’s 3TV or Arizona’s Family Sports. The team conducted a promotion in which approximately 10,000 antennas were distributed to fans. Furthermore, games will be accessible to local fans through the Suns Live streaming service, priced at $109.99 for the season.

This season, the Houston Rockets will be on the rebranded Space City Home Network, a former AT&T SportsNet RSN acquired by the Astros and Rockets. Monumental Sports and Entertainment — the parent company of the Washington Wizards, Capitals, and Mystics — recently rebranded its RSN, acquired last year from Comcast, to Monumental Sports Network, showing an RSN in a top 10 media market still has its benefits.

“We have a critical mass of programming,” Zach Leonsis, President of Media & New Enterprises at MSE, told FOS, “If you’re a single team in a small market, it’s going to be challenging to do what we’ve done in our case.”

NBA executive Jeff Geels told FOS that the league has been reassessing how the league distributes its content — including locally — since 2018.

“We were looking towards the future, and there were a lot of different trends that we were looking at,” said Geels, an NBA senior VP and the head of the league’s direct-to-consumer business. “That’s not only the shift to streaming, but also the shift to how our fans were engaging with content.

“That was the impetus for starting to invest and create our own technology consumer platform. It wasn’t specifically for Diamond, but it was just knowing our teams may need a vehicle to deliver, to deliver their games to local fans.”

The tech backbone of NBA App that powers NBA League Pass — the league’s national out-of-market streaming service — can be leaned on if the DSG bankruptcy leads to in-season distribution interruptions, much like MLB did for the Padres and Diamondbacks.

“That’s part of the thinking behind investing and building this platform is how do we have turnkey consumer streaming propositions ready for our teams?” Geels said. “So, we’re prepared to do that to the extent that it’s valuable for them. We are prepared to do that if the teams need that support.”

The Jazz and Suns are among a handful of NBA teams that have produced their broadcasts for years, making a shift from an RSN more manageable. But while this new model results in a broader reach than RSNs, it won’t be nearly as profitable at the outset.

Whether shedding the RSN model or restructuring current deals, some teams will come to grips that their local broadcast deals may not be as lucrative as they once were. But NBA teams don’t have to fret much as the next national rights deal is on the horizon.

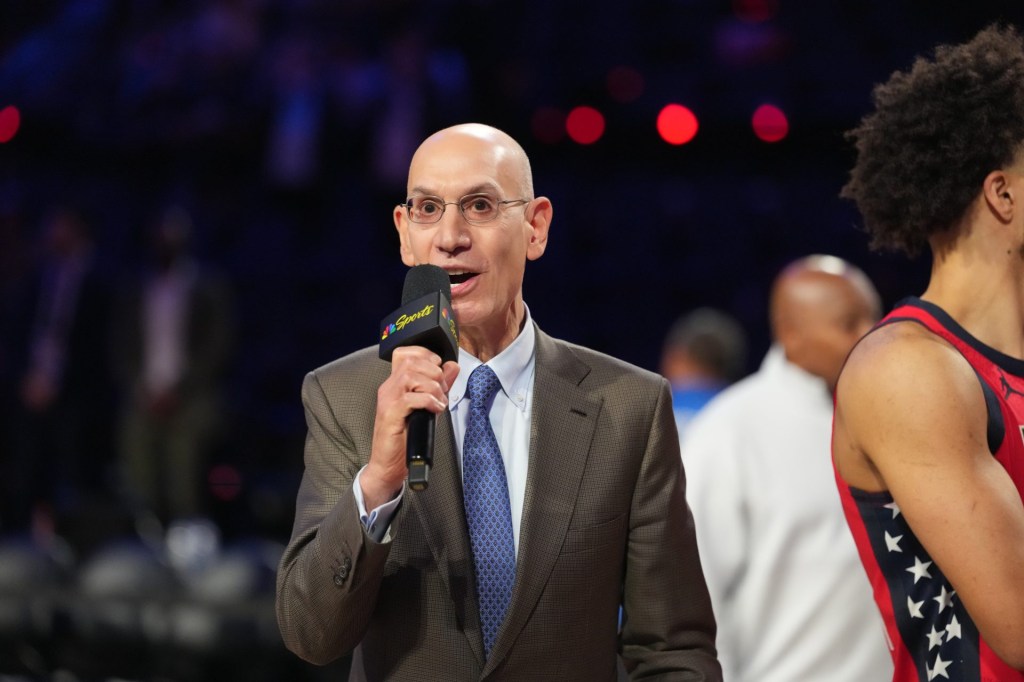

The NBA is reportedly seeking between $50 billion to $75 billion total for its next cycle of U.S. media rights, which could extend into the 2030s. The NBA’s nine-year deal with ESPN and TNT pays out about $24 billion, or $2.6 billion annually, through the 2024-25 season. But they will look to lock in their next long-term deal in 2024. Silver wants to double the overall contract or more. But the market is weakening. And so is the pay cable business model for ESPN and TNT.

While the media companies are within their exclusive negotiating window with the NBA, those rights have drawn interest from Amazon, Apple, Google, and NBC.

The likely windfall makes teams less stressed about their local TV deals in the short term.

“We’re going backwards financially, in the short to middle term,” said Olson, whose team reportedly received $20 million per year under its last RSN deal. “We knew going into it that we would take a step backwards, but the way we build out the model by increasing our viewership to 100 percent of the state of Utah, that’s going to allow us to increase rates for advertising by opening up our streaming, and controlling our streaming. We are going to get back to where we were.”