Sports SPACs are back, but with more of a whimper than a boom.

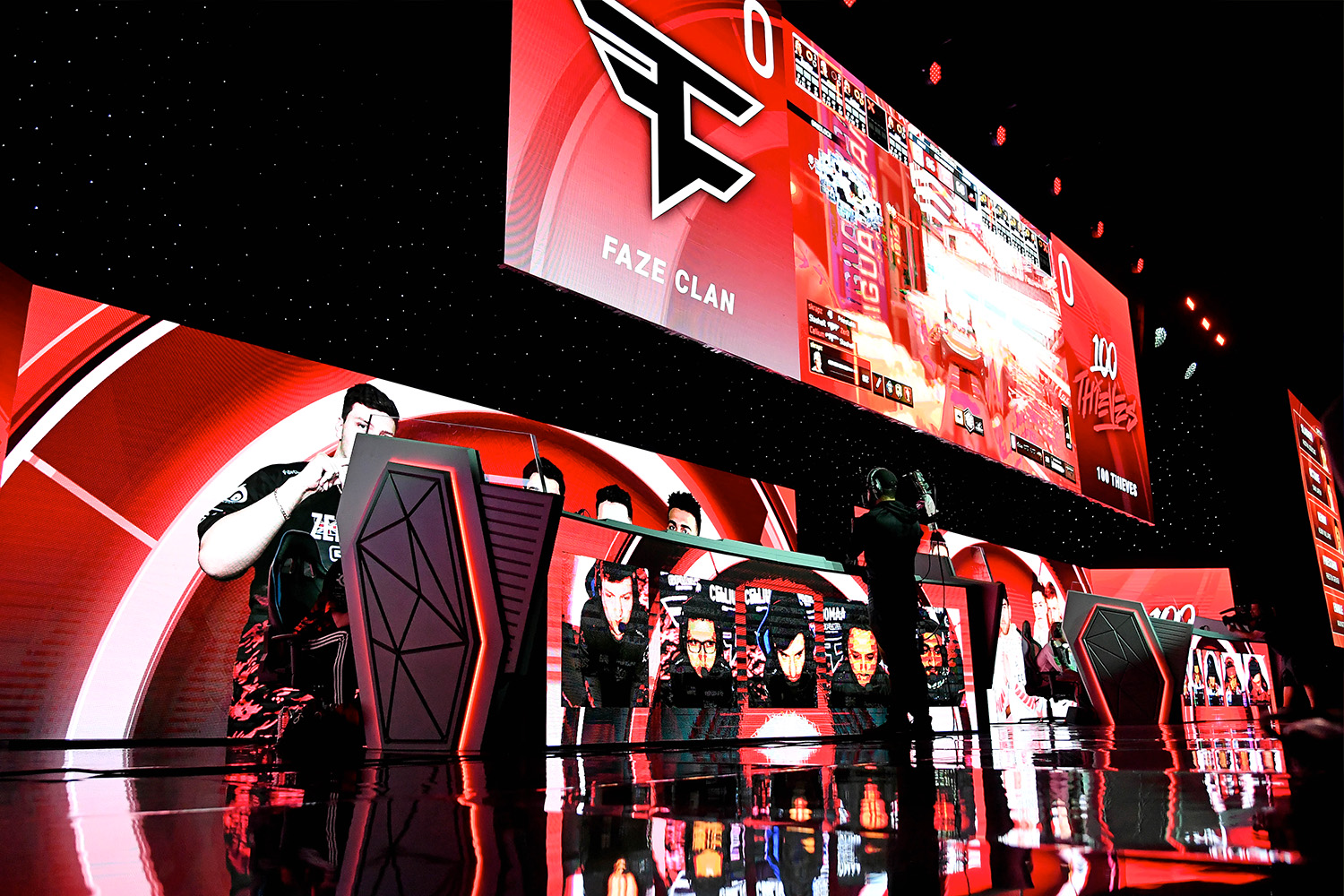

Digital entertainment and esports brand FaZe Clan began trading on the public markets Wednesday after completing a SPAC merger in a deal valued at $725 million, down from the anticipated $1 billion public markets debut in September 2021.

The company’s shares sank from its debut on Wednesday, finishing the first day of trading down 26%.

FaZe Clan’s journey to the public markets speaks to a broader trend in the overall SPAC market. Right now, the asset class is struggling — and sports SPACs are no exception.

Starting in mid-2020, SPACs (Special Purpose Acquisition Companies) were all the rage with athletes and celebrity investors riding the wave. Shaquille O’Neal, Serena Williams, Jay-Z, and many others attached themselves to these vehicles in the hopes of seeing greater-than-market returns.

According to a report by Forbes, 21 of 33 SPACs tied to famous public figures posted negative returns for 2021 — and in 2022 alone, 30 SPAC mergers have been called off.

Breaking Down the Numbers

Of the 375 firms that went public by merging with a SPAC in the last five years (e.g. DraftKings, Allied Esports, Vivid Seats), just 34, or less than 10%, have outperformed the S&P 500 Index over the past 12 months, according to data compiled and analyzed by Bloomberg.

According to Sportico, through May 2022, 11 sports-related SPACs have pulled their proposed IPOs for the year altogether. For context:

- 2021 SPAC IPOs: 369

- 2022 SPAC IPOs: 70

- 2022 SPACs Without Merger Target: 610

Currently, around 30 sports-related SPACs are still trying to hold their IPOs, with a double-digit number that are currently registered with the SEC but have yet to file any IPO paperwork, including Alex Rodriguez’s $500 million “Slam” SPAC.

But why did SPACs become so popular in the first place?

SPAC Mechanics Revisited

In traditional markets, a company goes public through an IPO — a relatively straightforward process.

- A private company reaches maturity and decides that it’s time to go public.

- It reaches out to investment banks to help underwrite the IPO and lead the process of finding institutional investors to participate.

- After gauging market interest and liaising with the client, the investment bank will provide guidance on how much money to raise by indicating the number of shares to issue and the price level.

- The company then goes to market with those recommendations from the bank and issues the shares, which then start trading on the secondary market.

A SPAC is formed when financial sponsors raise a sum of money from public investors and then go hunting for a private company to take public.

The money initially raised by the SPAC gets deposited in a trust. When the SPAC finds a private company to take public, instead of raising money from outside investors as with a traditional IPO, the private company takes money from the SPAC in exchange for an agreed-upon ownership percentage.

The private company then becomes public through what is known as a de-SPACing — meaning that the SPAC formally merges with the private company.

SPACs have a 24-month period horizon to close their deals. If a deal isn’t closed during that window, SPAC investors are paid back their initial investment plus interest, and sponsors are left holding the bag.

One final component worth noting is the difference in regulatory scrutiny.

IPOs take a lot of diligence and have strict rules around what a company can or cannot project into the future. IPOs are strictly regulated by the SEC and do not allow companies to make future-looking projections for revenues.

SPACs are not held to the same standard. They allow companies to come to market faster, with less regulatory burdens and a direct source of capital.

From DraftKings to SeatGeek

Prior to the SPAC boom of 2020, DraftKings used the vehicle to go public in 2019.

DraftKings combined with Diamond Eagle Acquisition Corp., a SPAC with a market cap of roughly $500 million, and SBTech, a betting and gaming technology company. By early 2021, DraftKings was one of the best-performing SPACs with shares trading at over 600% higher than its initial IPO price ($10). Now, the stock trades at $11.30, a modest 13% increase.

DraftKings is a company that should be public. It has a path to profitability and operates in a highly regulated industry where it has a competitive advantage — scale.

But a 600%-plus valuation above IPO price? Within 14 months? That does seem somewhat rich.

- DraftKings was one of the tech-centric companies that got caught up in the bull-market cycle.

- Investors transitioned from caring about the potential for growth to the active generation of cash flows.

- In its last earnings report, DraftKings announced that it expected losses for the year to amount to between $825 and $925 million.

Companies looking to navigate the current market, like SeatGeek and black-check firm RedBall Acquisition Corp, decided to terminate their $1.35 billion take-public deal amid the roller-coaster market. The announcement came just one month after SeatGeek reported record revenue and said that the deal was set to close by the end of June.

It turns out that speculative stocks with little earnings fall further out of favor in the face of rising rates. Sports-related companies tend to fall within this bucket.

Reason for Optimism

SPAC issuance and performance is definitely down from those astronomical all-time highs that we will perhaps never see again.

The economic environment that allowed for many of these SPACs to be raised in the first place allowed for some “bad behavior.”

Bringing unprofitable, highly speculative companies to the public markets too soon was a bug, not a feature, of the capital markets system. Now, with a higher interest rate and in a risk-averse environment, investors are looking for something novel — profitability.

Revenue generation and expectations for further growth will be the critical ingredients for successful SPAC mergers. SPAC sponsors dedicated to building out their businesses are showing they can drive successful outcomes.

There are still SPACs that have targets to find, and time to find them.

- January 2022: Mario and Michael Andretti had a $200 million IPO in their eponymous SPAC.

- January 2022: Broadcast media veteran Bob Prather closed a $175 million IPO to seek a sports or media entity.

- February 2022: Soccer and baseball executives including Paul Conway and Randy Frankel raised $75 million to purchase a European soccer team.

If SPAC investors can shift their sights onto companies that fit the “new” mold, they should still have something to look forward to — we’ll see.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)