Agency executives and industry consultants offered predictions about how brands would seek to maintain and innovate after their advertising strategies were upended by the coronavirus pandemic.

The first reaction of many was to pull back or rely on digital and social media channels to communicate brand messages without having them be associated with the virus.

But a select number of companies have undergone a more aggressive approach, shifting dollars to new campaigns that urge consumers to stay indoors and practice social distancing while advertising messages of unity. Others have pledged to manufacture equipment for healthcare professionals or donate goods to affected families.

“When you look at the creative coming out or how marketing dollars are being repurposed, it’s noticeable that you have a very small percentage of brands out there that can adapt to the speed of culture,” John Rowady, CEO and founder of Chicago-based marketing firm rEvolution, said.

In lieu of live events, rEvolution has begun shifting clients to other modes of communication with consumers – primarily digital activations.

The company says there will be plenty of time for marketers to craft new live strategies once return dates are announced by sports leagues. Long-time sponsors will additionally remain committed to coming back and working with properties in the future, even if that means taking financial hits in the short term.

“I do think that when you look at major categories like the airline industry, sponsorship deals with Premier League clubs may come at risk,” Rowady said. “This would give emerging brands an opportunity to partner with a high profile team.”

Melbourne, Australia-based Sports Geek helps sports franchises around the world build up online fan bases on social media and connect them to brands. The firm’s U.S. clients include the Washington Redskins and Minnesota Timberwolves, according to founder Sean Callanan.

Normally, Sports Geek works with teams to lay out and execute digital campaigns. These days, the company finds itself approaching sponsors about how they want to pivot on planned activations.

“We have a lot of teams with sponsorship contacts they can’t fulfill because they normally would be producing content like ‘dunk of the week’ or “home run of the game,’ but those aren’t happening,” Callanan said. “So there is actually work there to refit those contracts and still provide deliverables.”

This workflow will be the reality for Sports Geek for at least the next six months, Callanan said. The company has traditionally done lots of ticketing and membership campaigns on social media for teams while helping commercial partners become more digital and move away from in-stadium advertising.

READ MORE: Brands Pivot On Marketing Efforts Amid Coronavirus Cancellations

“This is a time to plan for a compressed number of games when sports do return, whether it’s the NBA or the National Rugby League in this side of the world,” he said. “If you can do some things to keep everyone happy from a sponsor and fan point of view in this period, then you can come out of it.”

While most brands declined to comment on their marketing strategies, others like Chevy and Anheuser Busch said they had reallocated sports marketing budgets to impromptu strategies due to the coronavirus.

But with a majority of brands in retail, travel, and restaurants expected to pull back, ad spending in the U.S. will decline nearly 3% this year to $217 billion, according to Magna Global. eMarketer has also downgraded global projected marketing spend in 2020 to $692 billion due to the coronavirus.

“Brands that would have spent money at the Kentucky Derby, Indianapolis 500 or the NBA can’t do that anymore,” Joe Favorito, sports marketing and media consultant and professor at Columbia University, said. “They might have scaled back some on brand activations, but in reality, they have a pool of money that they need to communicate and engage with consumers.”

Chevrolet said in an email that the company is repurposing all existing media buys to reinforce messages about its “Chevy Cares” campaign to customers. National and local messaging will be distributed using broadcast partnerships, social and digital channels, and Chevy’s website.

“We are continuing to be flexible and evolve our in-market efforts accordingly,” Chevy said. “Regarding Chevrolet sponsorships, we are working with our partners as they evaluate immediate and long-term solutions.”

Anheuser Busch announced on March 25 a new initiative with the American Red Cross – offering up its U.S. tour facilities to serve as blood donation centers during the coronavirus pandemic. Empty arenas of AB-partnered sports franchises will also be utilized.

A.B. InBev’s gesture includes a $5 million donation redirected from planned sports marketing spend for the year. The brewing company – through its portfolio brands – is the official beer sponsor of the NFL, MLB, NBA, and NHL.

“The company is pledging to redirect funds in order to provide the immediate resources needed to support national and local response for COVID-19,” it said.

Sports drink provider Ready Nutrition is an exception in that the brand has not deviated too far from marketing plans this year, citing that most of its planned announcements will not happen until the latter half of 2020.

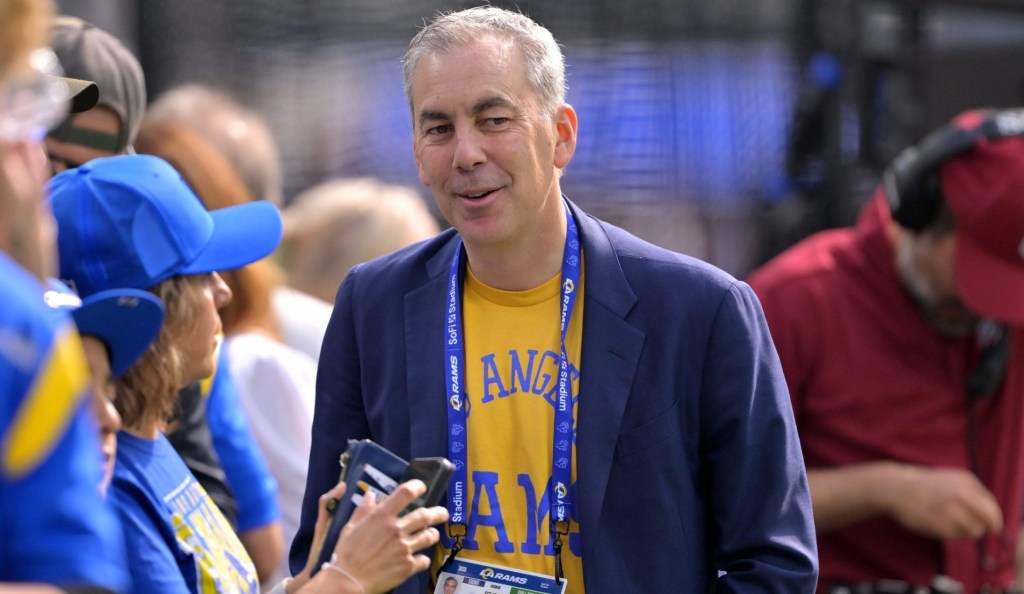

The company, whose investors include Los Angeles Rams star Aaron Donald, witnessed peaks and valleys in sales in March, as consumers stocked up on energy products at wholesale stores early on before beginning to place more online orders in recent weeks.

“Our online sales have been up triple digits pretty much from day one,” Pat Cavanaugh, president and CEO of Ready Nutrition, said.

READ MORE: Aaron Donald Emerges As One Of NFL’s Most Marketable Players

The brand, founded in 2012, began catering to athletes before expanding its consumer distribution strategy through deals with national wholesalers and retail chains. The company also touts a partnership with the Amateur Athletic Union as the organization’s official sports drink provider.

However, Ready Nutrition’s college business remains in flux, Cavanaugh said. Ready nutrition is currently in partnership with about 200 Division I schools that remain closed to student-athletes in light of the ongoing pandemic.

“Our collegiate business is still up in the air because colleges are still trying to figure out how to really provide nutrition for their athletes when they’re not on campus,” he said. “That’s been at a standstill as they wait to find out what they are allowed to do from an NCAA perspective.”

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)