From angry teens to frustrated lawmakers, social media users are bracing for a potential TikTok ban in the U.S. The implications could have serious implications for the sports world, from the NIL industry to how fans interact with their favorite teams.

TikTok has certainly helped big sports entities get bigger, like the unhinged Buffalo Bills account. But it’s also helped turn lower-profile athletes and teams into household names, like rugby player Ilona Maher, track power couple Hunter Woodhall and Tara Davis-Woodhall, and baseball’s viral Savannah Bananas.

“Over the past five years we were able to reach millions of fans through TikTok and utilize the platform as one of many ways to grow our tremendous fan base,” a spokesperson for the Savannah Bananas tells FOS. “We will always look for new ways to meet fans where they are, and we’ll continue to go wherever the attention goes.”

Some of those most impacted by a potential ban are content creators, a niche where college athletes dominate since the emergence of name, image, and likeness deals were widely legalized in 2021. Yes, the vast majority of money flowing through the NIL world right now goes through NIL collectives as pseudo-salaries for college football and men’s basketball players. But for all other sports, commercial brand deals can be a huge moneymaker, and college athletes are some of the best-performing creators for marketing departments.

At the center of it all is TikTok, a platform teetering on extinction yet again. In April, President Joe Biden signed a bipartisan bill saying the app’s Chinese parent company, ByteDance, had to divest from TikTok for the platform to continue operations in the U.S. The deadline for that sale to happen—or be in progress—is Jan. 19. Last week the Supreme Court heard TikTok’s arguments that the ban would violate the First Amendment, after President-elect Donald Trump asked the court to delay the deadline until after he takes office.

“In the history of advertising, forget just like sponsorships or sports or athletes, I can’t think of a bigger platform that could potentially disappear or completely change since major TV mergers,” Bob Lynch, the CEO of the endorsement tracking platform SponsorUnited, tells Front Office Sports. “When you think about it through the lens of college athletics, that’s where it has the biggest impact because most college athletes don’t have massive followings, but yet they’re able to get real, tangible exposure, which is obviously valuable to the brand community. And so if you take that away, that algorithm, it’s not as good on other platforms.”

“I think it really hampers their ability to monetize their IP to the degree that they can now in some cases,” Lynch added.

According to the NIL marketplace Opendorse, top-earning women’s volleyball players can do close to 90 commercial NIL deals per year, followed by women’s basketball at almost 40. Those sports see very few collective deals compared to football and men’s basketball, but partnering with the women is more attractive to brands. Top-earning women gymnasts make more than $20,000 per year, and the top-earning female athletes in swimming and diving, soccer, and volleyball make more than double what the male athletes in their sports do, according to Opendorse. Bigger deals can range in the six or seven figures.

About 40% of social media engagement for high school and college athletes comes from TikTok, which is a 73% increase from last year, according to SponsorUnited. Lynch says he anticipates that number will only grow if TikTok isn’t shut down.

“If you took half of my exposure away, is that half the dollars that I could potentially receive?” Lynch says.

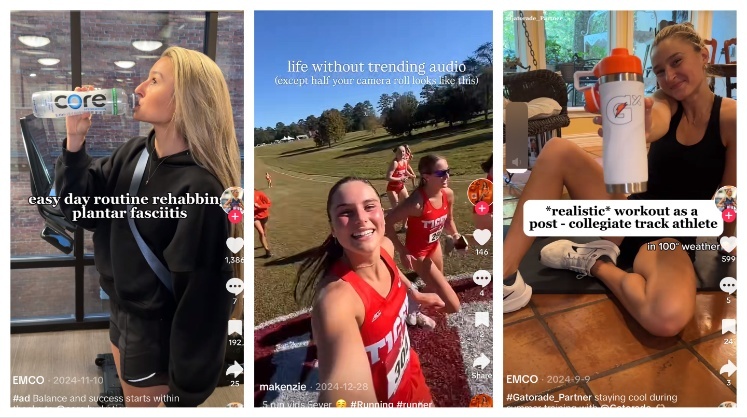

Duke track alum Emily Cole, who has more than 325,000 TikTok followers, tells FOS she doesn’t think the ban would be detrimental to NIL, but says the idea is “not fun.”

“The amount of hours and time me and my creator friends and these small businesses have put into growing their business and having the majority of your followers be coming from that platform, the idea of it just disappearing in a day is really daunting,” Cole says.

Clemson track athlete Makenzie Steele, who has more than 20,000 TikTok followers, tells FOS she has mixed emotions about the ban: sad about potentially losing years’ worth of videos, confused about whether it’s going to happen, and a bit excited to have one less platform to worry about. The 21-year-old posts running and cooking content, and she has worked with companies including Lululemon, Under Armour, and Graza Olive Oil. Instagram Reels seems the most natural fit for scooping up TikTok’s audience, but YouTube Shorts and even Snapchat Spotlight are also luring creators, Steele says.

“I think for maybe the new athletes, like incoming freshmen in the next few years,” Steele says, “it just might be a little harder to develop that audience with how fast things can go viral on TikTok versus how fast they can go viral on Instagram.”

Cole, who has done NIL deals with companies including Gatorade, Dick’s Sporting Goods, and Invesco QQQ, says she had already been moving away from TikTok before the January deadline approached. While TikTok’s algorithm gives her a much wider reach, the 24-year-old says she’s always felt more connected to her audience on Instagram, where she has just under 200,000 followers.

“For these athletes that are in college sports, I know a lot of them like to keep their Instagram a lot more professional and not share as intimately on it as they do on TikTok,” Cole says. “I think that a lot of athletes are going to have to be willing to make that shift. And the ones that do are going to see really, really big returns on it.”

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)