New York’s mobile sports betting laws have forced gambling operators to cautiously watch spending on marketing and promotional offers to combat ongoing financial losses.

New York got off to a hot start with an official handle that totaled more than $1.62 billion in January — topping the single-month record for any state despite only six mobile operators.

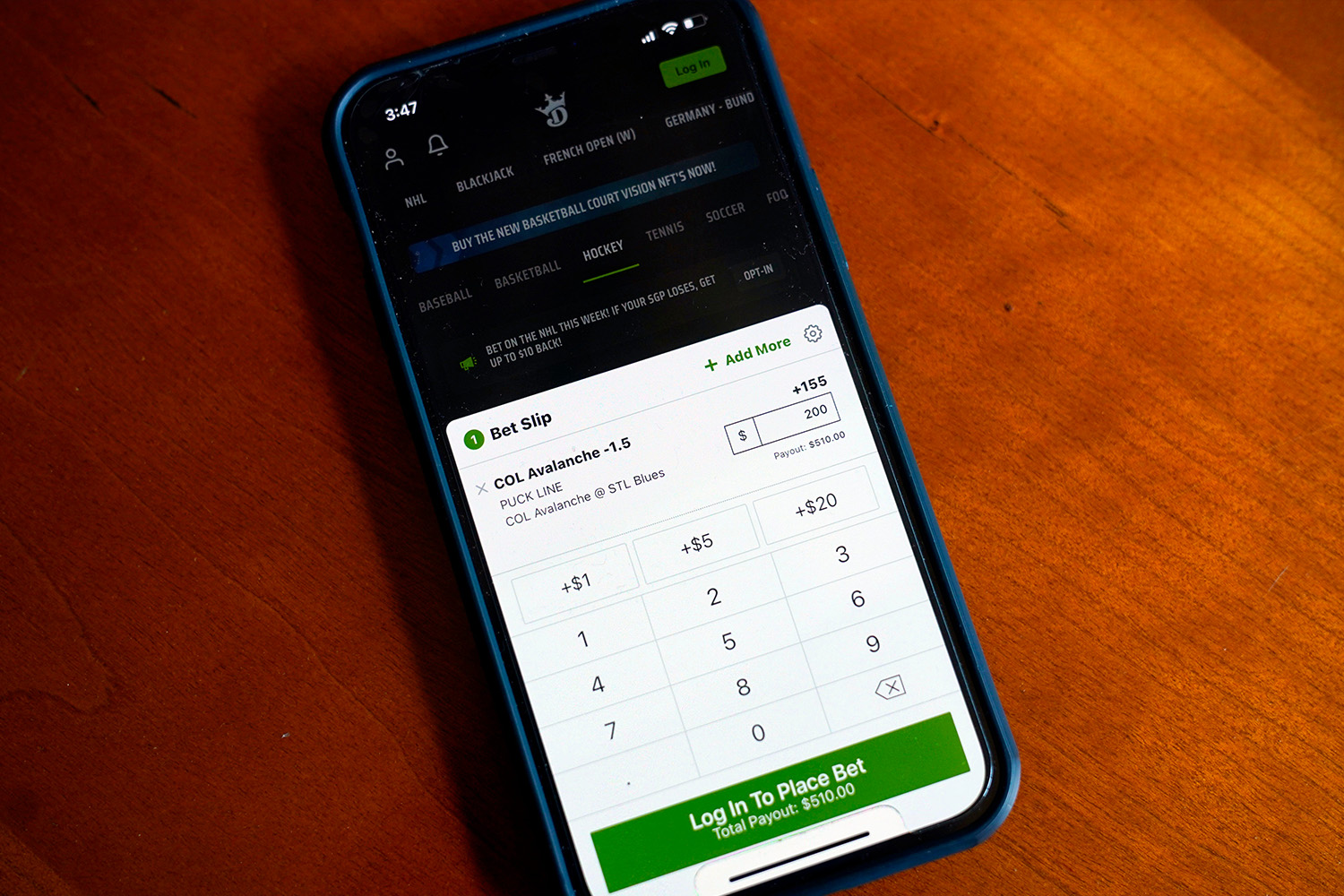

A few of those operators, including DraftKings and Flutter Entertainment’s FanDuel, have requested New York legislators to change laws regarding current sports-betting tax rates.

- Each operator is required to pay a 51% tax rate to the state for 10 years.

- The average sports-betting tax rate in the U.S. is 19%, per Morgan Stanley.

New York’s current tax rate for mobile sportsbooks has led to huge profits thanks to more than 20 million residents in the state, making it the largest online sports betting market in the U.S.

Gov. Kathy Hochul’s budget plan reportedly expects $357 million in sports betting tax revenue in FY2023.

Double Tax

Operators in New York are also taking a step back due to promotion revenue that is taxed by the state, which has made it “untenable to run a business,” according to the Tax Foundation.

As a Bloomberg report notes, if bettors receive and lose a free, promotional bet, it’s still counted as gross revenue for the sportsbook — even though no money changed hands.

The tax rate as a percentage of revenue could be more than 77%, including federal tax.