On Tuesday of last week, Swiss data and content service company Sportradar withdrew from negotiations with SPAC sponsor Horizon Acquisition Corporation II (“Horizon”) amid concerns over the ability to complete the potential transaction. The breakup is indicative of a slowing market that has seen less than SPAC-tacular (come on, it was right there) results in Q2.

Sportradar will opt instead to enter the public markets through a more traditional IPO.

It appears as though the “failed” SPAC process might have stemmed from the Horizon’s inability to navigate myriad difficult factors including a slowing SPAC market, less access to private investment capital (“PIPEs”), meeting the overall capital requirements of a $10 billion valuation, and a tightening regulatory environment.

Given these circumstances, it was difficult even for the Swiss to stay neutral on the deal prospectus.

While a failed SPAC merger may sound daunting, Sportradar is well positioned to enter the public markets on its own merit. The company’s existing contracts, history of positive cash flow, and opportunity to capitalize on the burgeoning sports gambling market are all reasons for optimism. An injection of liquidity will likely propel what was — in 2020 — considered to be the hottest sports-related acquisition target on its growth trajectory.

Whatever the mechanism, Sportradar is ready to be a public company. The unsuccessful SPAC merger is indicative only of a SPAC capital markets environment that was unable to support the transaction at this particular snapshot in time. Horizon, on the other hand, may have a tougher road ahead.

How Did We Get Here?

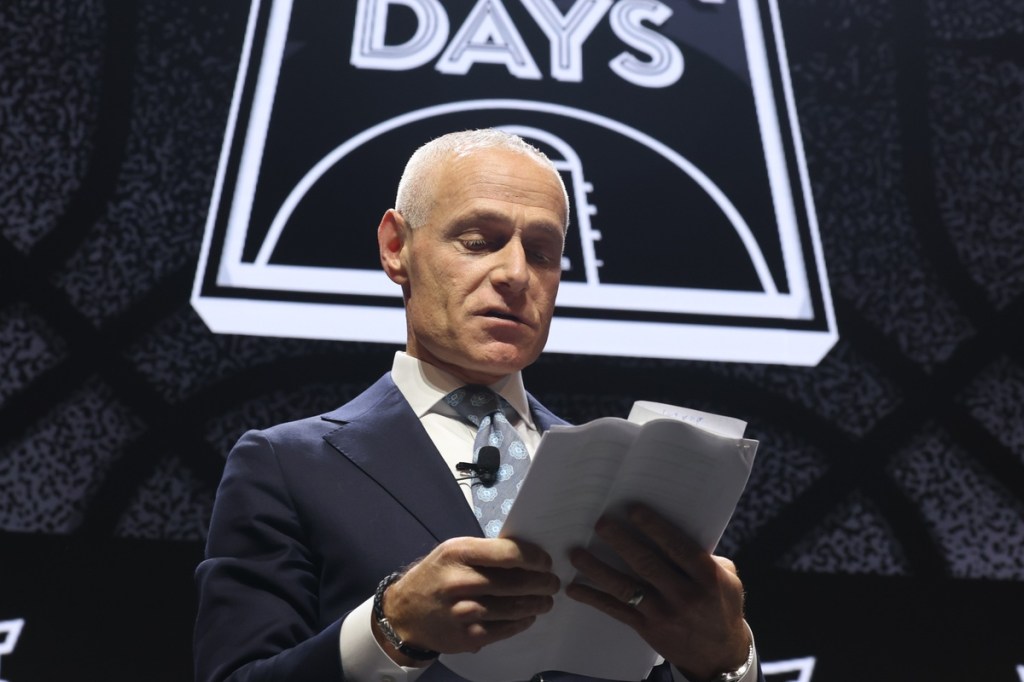

The deal for a potential merger between Horizon (led by Los Angeles Dodgers co-owner Todd Bohley) and Sportradar was initiated in March of this year when the two sides inked a letter of intent to bring Sportradar to the public markets.

The sides had agreed in principle to bring the company to market at a $10 billion (yes that’s billion with a B) valuation which would make it the largest-ever sports related company to go public via a SPAC. To put this in perspective, SoFi — the consumer finance firm taken public by Golden State Warriors minority owner and SPAC-man himself Chamath Palihapitya — was only valued at $8.65 billion. Sportradar 1 Chamath 0.

In order to get a deal done in the capital markets in March, Horizon would have needed to raise approximately $2.5-$3.0 billion to facilitate the transaction. When the merger was announced, Horizon’s stock price reached an all-time high of $11.48 relative to its $10 IPO price, meaning that the company had around $750 million in overall market cap.

While this would not be enough to cover the $2.5-$3.0 billion figure quoted above, it would include a PIPE transaction of roughly $2 billion — a.k.a. institutional investors footing the bill. Given Horizon’s share price and a relatively strong market for both PIPEs and SPACs at the time, the deal looked promising.

Note, the key phrase being “looked” past tense.

Overall SPAC Market & Regulatory Concerns

By May, the overall SPAC market had crashed and burned slowed significantly compared to Q1.

In the first quarter of 2021 the market saw 278 blank-check IPO transactions — more than 23 times the amount from the same period in 2020. Q2 of this year, however, has seen issuance at a much more tepid pace.

According to data from SPACinsider, the number of SPAC IPOs so far this quarter has been limited to 32, a figure much more in line with early 2020 numbers. Furthermore, overall performance of IPO’d SPACs has declined since the beginning of the year.

SPAK, SPCX, and SPXZ are three proxy ETFs to track the overall performance of the SPAC market and these funds have been — as Jay Sean so aptly put it — down, down, down since their Q1 highs of -23%, -13%, and -20%, respectively.

The backlog of SPACs waiting to IPO is also growing, with 293 SPACs eagerly waiting to be launched into the market like a loaded slingshot. The current imbalance between supply and demand paints an interesting picture for the market, namely: Will we be able to reach an equilibrium?

While the amount of “dry power” (capital available to potential acquisition targets) is continuing to increase, the overall demand has not followed suit.

But why the lack of demand? There appears to be two main factors:

- Regulation: The Securities and Exchange Commission (“SEC”) has indicated that it will introduce new guidance in the way it treats warrants for SPACs along with the potential for more stringent guidance on financial projections. Warrants — a financial instrument by which a shareholder has the right but not the obligation to buy shares in a company at a given price — were previously treated as a form of equity. These warrants acted like a proverbial carrot to SPAC investors who received additional incentives when buying into the merger. When treated as equity, the warrants are a tool for raising equity. If the SEC were to treat the warrants as liabilities on the balance sheet, they would be about as useful as a screen door on a submarine. Here’s what we know so far:

- In an April statement made by John Coates, Acting Director of Corporate Finance at the SEC, it was insinuated that warrants could be considered liabilities as opposed to equity. (*collective gulp from SPAC investors*) The distinction would not only reduce the amount of capital SPACs could raise but also would put a dent into the companies’ respective balance sheets.

- The SEC cited a “fact pattern” observed with the issuance of SPAC warrants that would suggest the instruments would not meet the commission’s indexation rules — a test which indicates that a derivative security is linked to the underlying stock.

- A change in the accounting treatment of warrants would not only impact new SPACs trying to raise capital but also existing SPACs would be required to correct any material errors in their previous accounting. This would significantly muddy what had previously been considered a “clean process” for SPACs and their accountants.

- Lower Demand from PIPE Investors: Another common trait of this most recent SPAC boom is the use of additional capital providers in the form of PIPEs. PIPE investors — think large institutional investor money like Fidelity or BlackRock — tend to seek outsized returns relative to what they would receive in the broader public markets (like Gamestop, just less memes). With the news from the SEC coming out and the large preponderance of public SPACs trading below their $10/share issuance price, institutions have opted for lower valuations and altogether forgone some of the opportunities in the current market.

While these factors do not mean that the SPAC market is altogether closed for companies like Sportradar, the news from the SEC has certainly spooked market participants.

Additionally, the largest hurdle for SPACs has yet to be cleared: forward-looking guidance — the ability for companies to make forward projections with little to no threat of litigation under the Private Securities Litigation Reform Act of 1995. Regulators and investors alike have been wary of the lack of transparency required for acquisition targets. In many cases, these pre-revenue or pre-product companies lean heavily on the ability to paint a rosy picture of the future in order to garner their high valuations.

Remember Nikola? The electric truck manufacturer went public via SPAC in mid 2020 and projected $32bn of revenue by 2024 without having an actual product. Fun fact, they currently have as many trucks on the road as I do.

Jokes aside, if the SEC were to materially change the guidance for SPAC mergers, the current “arbitrage opportunity” would fade as companies would be required to provide more robust disclosures. It appears as though the battle could be uphill going forward for any companies looking to break through the SPAC market.

Conclusion

While the issues raised by the SEC with regards to guidance are material, fortunately for Sportradar, they pose less of an issue. Having been founded in 2001 and with a history of revenue generation dating back to 2011, the company is still a strong candidate for the public markets through a more traditional IPO process.

In the meantime, Horizon will have to shift its focus, likely to a sports-related company with a lower valuation given current market dynamics.

The market should by no means be considered closed. With SPAC mergers in Q2 holding steady at 45 announced deals — compared to 94 in Q1 — there is still activity in the market. The days of blank-check companies funding pre-revenue companies at a double-digit billion dollar valuation, however, may be behind us.