Skechers has escaped a lawsuit challenging its blockbuster $9.4 billion sale to private-equity firm 3G Capital, with the suit being voluntarily dropped not long after the judge said the shareholder’s initial arguments were not up to snuff.

The suit from Key West Police Officers & Firefighters Retirement Plan, filed in May, has been voluntarily dropped without prejudice, meaning the plaintiff can refile these same claims again.

The lawsuit came in the wake of Skechers’ surprise decision to go private after 25 years as a public company. Under the terms of the transaction—which marks the largest footwear M&A deal ever—Skechers shareholders have the right to receive either $63 per share, or $57 in cash and one unlisted, non-transferable equity unit in a newly-formed entity that will be the parent of Skechers following the agreement’s completion.

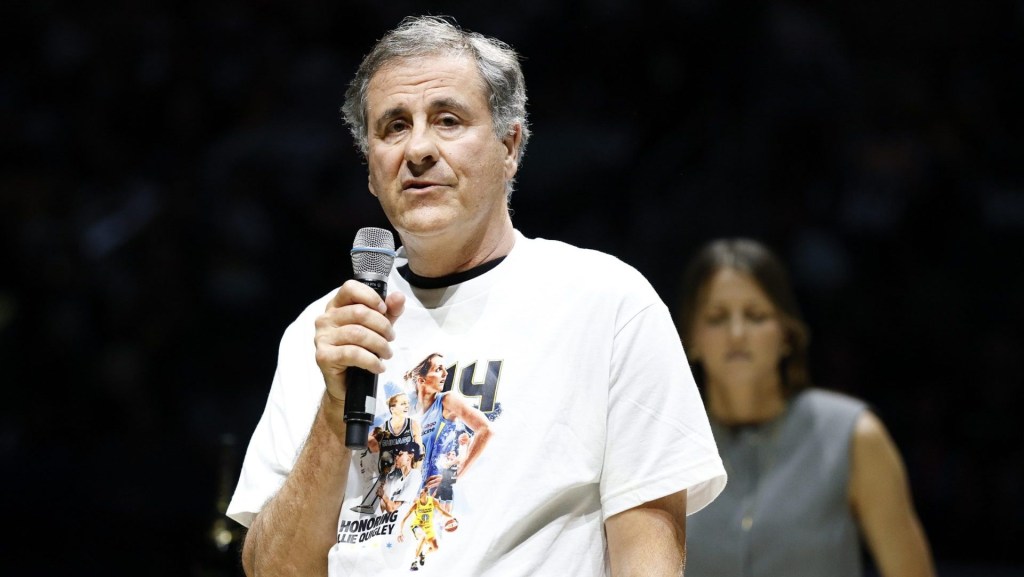

The lawsuit named as defendants Skechers and its two cofounders, chairman and CEO Robert Greenberg and his son, Michael Greenberg, who is president of Skechers. It sought “immediate action” to protect the plaintiff from being forced to choose which consideration without “full and accurate information concerning the Merger, the Company, and its financial condition and prospects.” The private-equity firm that is buying Skechers was not named as a defendant.

The decision to drop the suit comes only a few weeks after U.S. District Judge Percy Anderson ruled against Key West Police Officers & Firefighters Retirement Plan in a request for a preliminary injunction that would delay the deadline for shareholders to elect a consideration until the defendants made a thorough 13E-3 filing with the U.S. Securities and Exchange Commission. Such forms are meant to provide shareholders with all material information they need to decide how to vote on a transaction, including a general overview of terms of the deal, rationale behind the agreement, and more.

Judge Anderson made clear in a July 18 ruling that the shareholder had failed to show any immediate action was necessary, writing that other than identifying “broad categories of information,” Key West Police Officers & Firefighters Retirement Plan offered “no examples of information that it needs but has not already been provided.” The suit also failed to adequately address “how the unspecified additional information it seeks would affect its Consideration Election.”

“Absent any such details, Plaintiff has not alleged anything beyond a technical disclosure violation and thus fails to show that it is likely to suffer harm as a result of Defendants’ alleged disclosure violation,” the judge wrote.

The voluntary dismissal was made the same day Skechers issued its financial results for the second quarter, reporting sales of $2.44 billion, up 13.1% over the same period last year. International sales for the second quarter were just under $1.6 billion, also up about 13% over the same three-month period last year.

In the first quarter, Skechers reported sales of $2.41 billion, up 7% from last year, and it also pulled its full-year guidance because of uncertainty over tariff policies.

Representatives for Skechers and Key West Police Officers & Firefighters Retirement Plan did not immediately respond to requests for comment.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)