Blank check company Forest Road Acquisition raised $300 million in an IPO near the end of 2020, resulting in acquisition interest from 50 companies.

“When we raised our SPAC, we were determined to find a company with a strong, proven business model,” said Tom Staggs, Forest Road board member. “Beachbody is a perfect fit.” Beachbody and at-home connected cycling provider Myx Fitness will merge with Forest Road, with Myx becoming part of Beachbody.

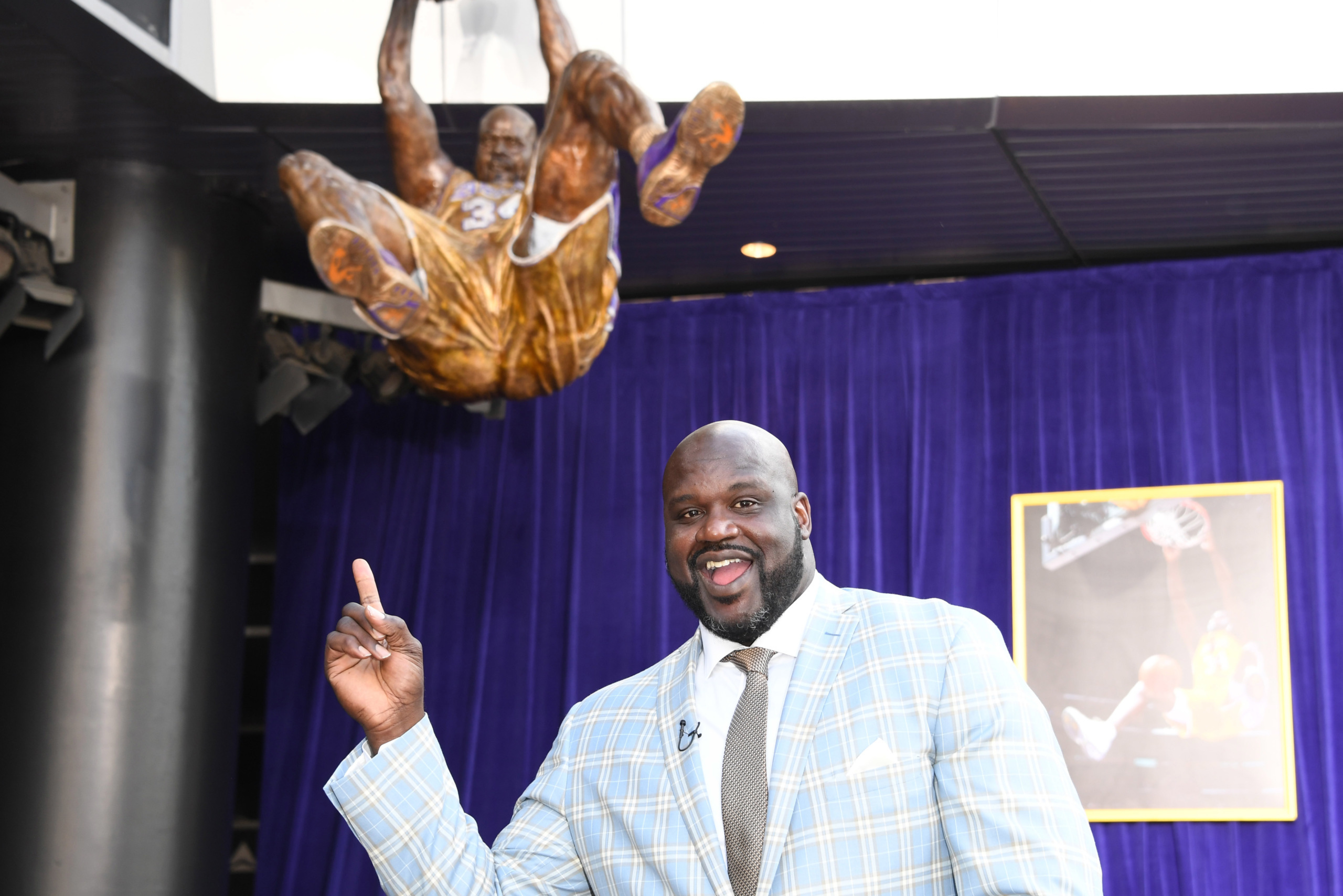

The merger gives the combined company a $3 billion valuation. Forest Road is led by three former Disney executives, and lists Shaquille O’Neal and Martin Luther King III among strategic advisors.

Beachbody expects to generate $1.1 billion in revenue this year, up from last year’s $880 million. In addition to Beachbody on Demand and Myx, the company owns digital streaming platform Openfit. In December, Openfit acquired Ladder, a nutrition company founded by LeBron James and Arnold Schwarzenegger, who remain minority shareholders.

The SPAC craze has been unavoidable in the sports industry.

- Houston Rockets owner Tilman Fertitta’s Fertitta Entertainment will go public after announcing a $6.6 billion merger with FAST Acquisition.

- DraftKings went public last year after a $2.7 billion merger with SBTech and Diamond Eagle Acquisition.

- Private investment firm RedBird Capital and famed Oakland A’s executive Billy Beane created RedBall Acquisition to acquire a professional sports franchise.

- Alex Rodriguez and Colin Kaepernick announced new SPACs earlier this month.

- Atlanta Braves and Formula One owner Liberty Media’s new SPAC raised $500 million in its January IPO.

SPACs have already raised $38 billion in 2021 — nearly half of the record $83 billion raised in 2020.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)