Roblox plans to sell $1 billion of junk bonds in what’s already been a popular year for high-yield borrowing.

The proceeds will be used to assist with “general corporate purposes,” including capital expenditures, production and development, potential acquisitions, and working capital.

The video game developer is the 85th first-time high-yield borrower in 2021, as more technology companies — especially those newly public — look to fund growth with debt, according to Bloomberg.

Roblox went public in March, reaching a $45 billion valuation on the day of its public market debut.

- Second-quarter revenue was $454.1 million, a 127% increase year-over-year.

- Daily active users hit 43.2 million in the quarter, a 29% increase from the same period in 2020.

- Roblox announced a partnership with Sony Music Entertainment in July, bringing Sony recording artists to the Roblox metaverse.

- In August, it acquired Discord competitor Guilded.

Goldman Sachs, Morgan Stanley, and JPMorgan Chase are leading the sale.

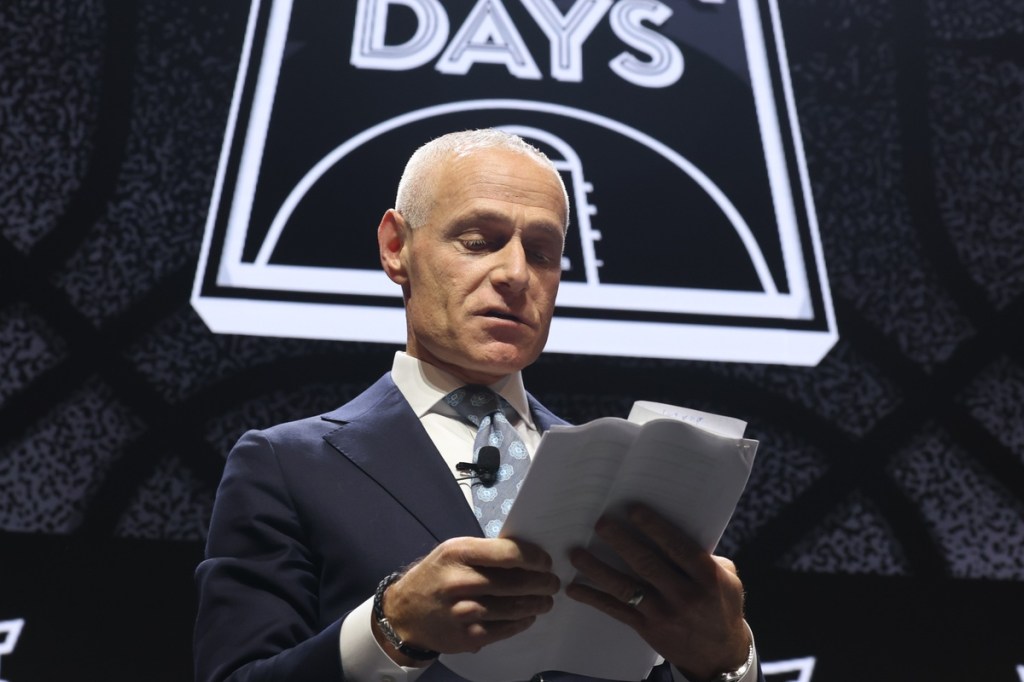

So far in 2021, Goldman Sachs has “done almost as much debut high-yield issuance for technology companies versus the last four years combined,” Anne Russ, head of technology, media, and telecom-leveraged finance at Goldman Sachs, told Bloomberg.