The commercialization of college sports has never been more evident than it was this past week.

On Thursday, the NCAA and power conferences (including the former Pac-12) agreed to broad terms of a settlement in the House v. NCAA case, which argues that players in the pre–name, image, and likeness era deserve back pay, and that athletes should get a cut of broadcast television revenue.

The settlement requires the NCAA and Power 5 to split $2.7 billion in damages, plaintiffs attorneys Jeffrey Kessler and Steve Berman said. It also creates a framework for power conference schools to begin sharing up to about $20 million per year with athletes (potentially in all sports) beginning as early as 2025. In total, players could earn $20 billion from revenue-sharing and other new benefits over a decade-long period, the attorneys estimated.

There was major pressure to settle, as the NCAA and conferences could have been on the hook for more than $5 billion in damages if they lost at trial.

“We have been marching down this long legal road seeking economic justice in college sports for more than a decade,” Kessler said. “The time to bring a fair compensation system to college athletes has finally arrived.”

The settlement isn’t completely final, and it doesn’t address other major questions about college sports’ business model (like whether athletes should be considered employees). But if it does go through, the cash has to come from somewhere, which is why this week, for the first time, private equity firms publicly expressed interest in funding athletic departments. On Wednesday, two firms, RedBird Capital Partners and Weatherford Capital, announced the creation of a new NCAA athletic department investment arm.

Here’s everything to know about the wild week in college sports.

Who filed the case and when?

In 2020, former Arizona State swimmer Grant House, and a few other plaintiffs including TCU basketball player Sedona Prince (known for filming a viral TikTok about NCAA gender inequity) filed the case. Kessler and Berman won a Supreme Court case over athlete educational benefits, NCAA v. Alston. The case was filed in the Northern District of California, the same venue as the other aforementioned antitrust suits against the NCAA.

The goal was to force the NCAA to agree to a revenue-sharing model. But the case itself asked schools to do so in a roundabout way, classifying broadcast revenue as a form of NIL, given that players’ faces and likenesses appear during games, instead of a salary or direct compensation.

Who will benefit?

Thousands of Division I athletes in all sports could be eligible for damages. Last fall, the case was certified as a class action with three different damage classes that extended to all D-I athletes who played between 2016 and ’21. The $2.7 billion lump sum will be split among them, based on the damage classes. All the athletes at power conference schools would, at some point in the future, also start earning a portion of the $20 million revenue-share agreement.

How will this work?

We don’t actually know yet. The exact distribution to all eligible players is yet to be determined by lawyers. But all power conference athletes could expect to start earning revenue shares starting as early as next year. It’s also unclear how that money will be distributed, however, given multiple factors like Title IX.

Sounds like a lot of money. Is everyone on board with this?

For the NCAA and power conferences, it is much cheaper than the alternative. Settling House allows a discounted settlement; they face $5 billion–plus if they go to trial. The settlement also consolidates two other cases: Hubbard v. NCAA and Carter v. NCAA, which brought similar antitrust claims and were brought by the same plaintiffs attorneys.

But the rest of D-I isn’t exactly thrilled.

The NCAA’s portion of the damages—a little over $1 billion—will come out of the revenue that would normally go to the rest of D-I schools. The non-power schools, which were not defendants in the lawsuit, have been voicing their displeasure in the media throughout the week. NCAA president Charlie Baker previously held a briefing with the rest of D-I, but barely explained any of the settlement’s actual terms, a source told FOS. The majority of non-power conference administrators learned most of the terms of the deal only after it was leaked to Yahoo! Sports. They then went on the offensive: the Big East’s Val Ackerman suggested an alternative payment model that she considered more fair to non-power conferences. Twenty-one other D-I commissioners signed the letter. Of course, they had no official recourse and will be stuck with hundreds of millions in lost revenue over the next decade.

How will the schools pay?

The power conferences and schools will likely use a combination of existing revenue and any other money they can raise. The top half of schools likely won’t need to move much money around to cover the $20 million per year in revenue sharing. But some of the less lucrative (or more in-debt) departments will be seeking creative income streams, from more booster donations to the potential for private equity capital.

Private equity?!

As if there wasn’t enough news this week, two private equity firms announced they’re wading into the college sports space. On Wednesday, RedBird Capital Partners and Weatherford Capital announced a new investment arm to inject capital into athletic departments. Collegiate Athletic Solutions, will offer between $50 million and $200 million to athletic departments that will have to pay the money back only if they earn revenue.

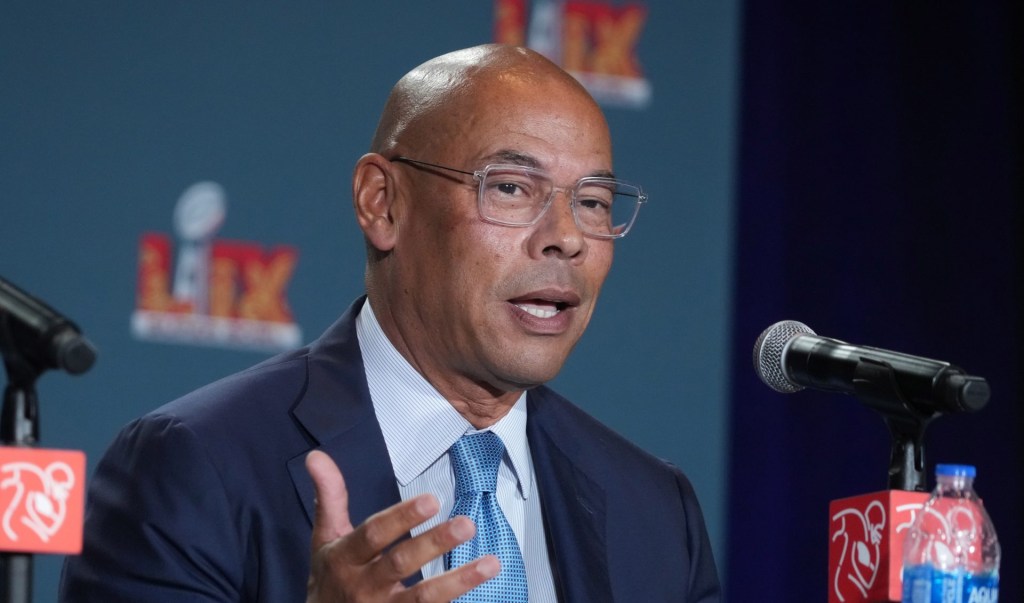

Why now? “The paradigm shift we are seeing in the collegiate athletics ecosystem is similar to the ones we’ve seen with media distribution models, collective bargaining rights, and premium hospitality,” RedBird founder and managing partner Gerry Cardinale said. “CAS addresses athletic departments’ need for near-term capital with additional operational expertise across strategies that can improve competitive positioning.”

The two firms are the first in the PE space to offer funds to athletic departments. But they’re not the first to consider some sort of marriage between PE and programs, whether that be through media rights or conferences, sources have told FOS. For some time, however, they have invested in companies that participate in the college sports industry, from NIL companies to hospitality.

Overall, is the House settlement a good deal for the athletes?

It seems like a win. After all, a slice of a $20 million pie is better than nothing. But that doesn’t mean it’s the best deal athletes could receive.

The settlement includes a revenue-sharing cap—and the only way to challenge it would be to get enough athletes to opt out of the deal during one of their annual review periods. If there was a true collective bargaining process, athletes could get more, says Jim Cavale, founder of Athletes.org, a company working toward organizing players. Cavale points out that the settlement is based on a revenue share of 22% of athletic department earnings and, that many pro leagues, including the NBA, get a much bigger share, often 50%.

Cavale does not believe that plaintiffs attorneys should assume a bargaining role through the settlement. “I don’t think that same attorney should be setting the terms for the future of college athletics,” he says. Instead, it should be an organization that looks more like a union.

But do athletes have any formal way to bargain for more?

Technically, yes. After the lawyers work out details of the settlement, they’ll present it to Northern District of California judge Claudia Wilken for initial approval. If Wilken signs off, athletes will be able to object to the terms. “I think you’re going to see a lot of athletes opt out of this and speak up,” Cavale says. “They’re not just going to take this like I think the leaders in college athletes are expecting.”

This is starting to sound a lot like employment.

According to the NCAA, it isn’t.

The settlement doesn’t address the biggest question looming over college sports: whether college athletes should be deemed employees. Two cases involving USC athletes and Dartmouth athletes, respectively, are going through the National Labor Relations Board. A third federal case, Johnson v. NCAA, has been in the 3rd Circuit since 2023. None of these cases will be impacted by a settlement in House.

There are other lingering cases, too.

The NCAA hoped that Fontenot v. NCAA, which argues that all of the governing body’s compensation limits on athletes are illegal, would be consolidated into the House settlement. But Thursday, a federal judge ruled against that … for now. And the governing body is still unable to enforce its NIL rules and restrictions, thanks to an interim ruling in an ongoing case brought by multiple state attorneys general—and that likely will not be affected by the House settlement.

Besides these cases, what’s next?

The NCAA also has a plan to use the settlement to its advantage politically. The governing body plans to take the settlement to Congress to show how many concessions it has made in favor of paying players. Then it will ask Congress to pass a law that would save the NCAA from any other legal challenges to its business model in the form of an antitrust exemption. The NCAA also wants Congress to deem athletes employees to end the other three lawsuits.

The NCAA confirmed as much in the joint statement it released with conferences Thursday night, saying: “This settlement is also a road map for college sports leaders and Congress to ensure this uniquely American institution can continue to provide unmatched opportunity for millions of students.” Lawmakers appear to have mixed feelings. Rep. Lori Trahan (D., Mass.) said she had no interest in codifying the settlement, while Sen. Ted Cruz (R., Texas) said congressional intervention is “urgent.”

The strategy is part of a yearslong, coordinated lobbying campaign for the NCAA and power conferences to convince Congress to end the athletes’ rights era. They may not be able to reinstate an era when players couldn’t partake in any revenue sharing and NIL—but they could win the ability to prevent any further concessions and strictly control the earnings players have fought for in court for more than a decade.

Editors’ note: RedBird IMI, of which RedBird Capital Partners is a joint venture partner, is an investor in Front Office Sports.