Nike’s latest quarterly earnings report describes the struggle of the apparel business in 2022.

Given that Nike virtually outsources all of its apparel manufacturing to third parties from multiple countries around the world — particularly China — various macroeconomic factors have been taking a toll on Nike’s core business.

The war in Eastern Europe, scarcity of key raw materials, and forced COVID lockdowns in China have challenged Nike’s supply chains since the last quarter of 2021, slowing overall growth and affecting its business operations.

Nevertheless, that hasn’t stopped the Swoosh from expanding its business and scoring alternative revenues from other places.

Nike has a longstanding reputation for innovation in adapting to advancements in technology, and its success and impact on consumer culture have been widely studied and discussed.

From diverse apps fueling direct-to-consumer sales growth to immersive stores and acquisitions in the tech space — Nike prides itself on setting the standard for innovation.

A good digital transformation strategy relies on the brand’s ability to predict future changes in consumer behavior based on emerging tech trends, then evolve quickly to keep up with the market.

Within the context of the hottest emerging tech trends of the moment — namely the metaverse, blockchain, and NFTs — Nike has been killing the competition.

Nike has been more successful than most other big brands in the transition to the metaverse because it committed to the trend early, leveraged its brand identity to tap into the multibillion-dollar market, and partnered with critical experts in the metaverse to deliver top-quality virtual experiences.

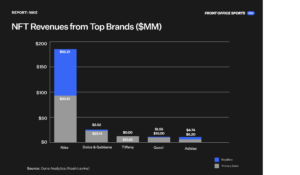

Here’s how it ranks in NFT revenues, compared to some of the biggest brands in sports and fashion:

| Brand | NFT Revenue |

| Nike | $185.3 million |

| Dolce & Gabbana | $25.6 million |

| Tiffany & Co. | $12.6 million |

| Gucci | $11.5 million |

| Adidas | $10.9 million |

Source: Dune Analytics

In today’s report, we’ll look at Nike’s initiatives in Web3 and how these tie to its core brand, as well as analyze its revenue streams, shares within existing business models, and its growth and potential.

Understanding the Metaverse

The interoperability of metaverse elements — gaming, shopping, social media, entertainment, digital currencies — creates new business opportunities in a market that’s growing extremely fast.

- Bloomberg estimated that the metaverse market was worth around $478 billion in 2020.

- With a massive estimated compounded annual growth rate (CAGR) of 44.1%, it may reach a market size of over $800 billion by 2024.

- Research from Newzoo found that the average age of metaverse users is 27, and North America is the biggest metaverse market, followed by Asia and Europe.

Companies active in the metaverse have become incredibly valuable, as well.

- Roblox went public at a valuation of $29.5 billion in 2021.

- Epic Games has raised a total of $6.4 billion at a valuation of $31.5 billion.

Facebook, which rebranded itself as Meta, hasn’t been subtle in its intentions to follow the trend. Nike, on the other hand, is moving a little more quietly, but no less aggressively.

Nike’s Approach

Since 2019, here’s how Nike’s game plan has unfolded:

- The company started filing various patents for “downloadable virtual goods, computer programs featuring footwear, clothing, headwear, eyewear, bags … for use online and in online virtual worlds.”

- It partnered with Roblox to create NIKELAND, a virtual world where people can play games, interact with each other, and try different Nike outfits.

- It acquired RTFKT, a company that creates and sells digital sneakers in the form of non-fungible tokens (NFTs).

- Nike has also launched and sold digital clothing collections like NFT sneakers known as ‘CryptoKicks’ and AR-powered hoodies.

Nike understands as well as any brand that people’s attention is shifting to digital. In 2018, it set a goal of generating 30% of revenues through Nike Digital by 2023 (currently 24%).

Nike has been discreet about disclosing revenues from the metaverse to the public. However, some of the reported numbers related to their Nike Digital and Global Brand segments provide some insight.

- According to Nike’s latest annual report, Nike Digital revenues — which include Nike’s D2C sales but may also contain revenues from metaverse operations — grew 18% in the 2022 fiscal year to $10.7 billion.

- Additionally, Nike’s Global Brand segment — the division that accounts for licensing and miscellaneous revenues not part of a geographic operating segment — grew 308% to $102 million from only $25 million in 2021. These could represent revenues derived from no particular geographical location — like the metaverse.

Since the launch of NIKELAND with Roblox, over 7 million players have spent time in it — generating millions of impressions that may have likely led to sales.

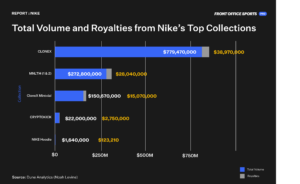

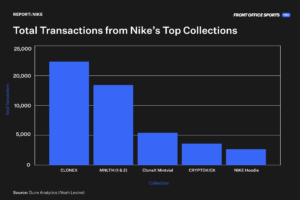

According to data from Dune Analytics, Nike has generated 67,400 secondary market transactions and $1.29 billion in volume, while Adidas has generated 51,500 comparable transactions and a significantly smaller $175.7 million volume.

Nike Is King

Nike nailed its transition to the metaverse wave through its ability to identify relevant consumer trends, find creative ways to align them with the brand without abandoning its core business, and take action with the right organizations.

Nike may be purposefully obscuring much of its metaverse returns to avoid revealing useful information to competitors — but if its involvement in the metaverse continues to grow, it may need to share more details in future reports.

Assuming that Nike accounts for the $185 million in revenues generated from the metaverse within the revenues generated from Nike Digital – it would still only represent 1.7% of the segment. There’s a ton of room to grow.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)