Last summer, the Big 12 was reportedly in talks with CVC Capital Partners to sell a 15% to 20% stake in the conference for $800 million to $1 billion. Other private-equity firms circled the rest of the nation’s top conferences.

“Having a capital resource as a partner makes a ton of sense,” Big 12 commissioner Brett Yormark said in July 2024 at his conference’s preseason football media days. “That’s really how you conduct good business, I really believe that. And if you see where private equity is kind of making a path into professional sports, at some point in time, it’s going to come here into college athletics.”

But more than a year later, no conference has made the leap, and top leaders continue to question the value of opening their doors to private equity. The only power conference still even pursuing private-equity deals currently is the Big Ten.

This summer, Front Office Sports asked each of the Power 4 commissioners about the status of PE talks.

- “We’re well informed,” Yormark said in late May. “We know what’s going on in that world … and we’re just not ready to jump in just yet.”

- In July, SEC commissioner Greg Sankey said, “We have been probably two and a half, three years into visits with banks, with private equity, with venture capital. … That’s not been the right direction for us. We’ve not seen the concept that works.”

- ACC commissioner Jim Phillips said his schools are “very educated about it, and there just hasn’t been anything that really has made sense.”

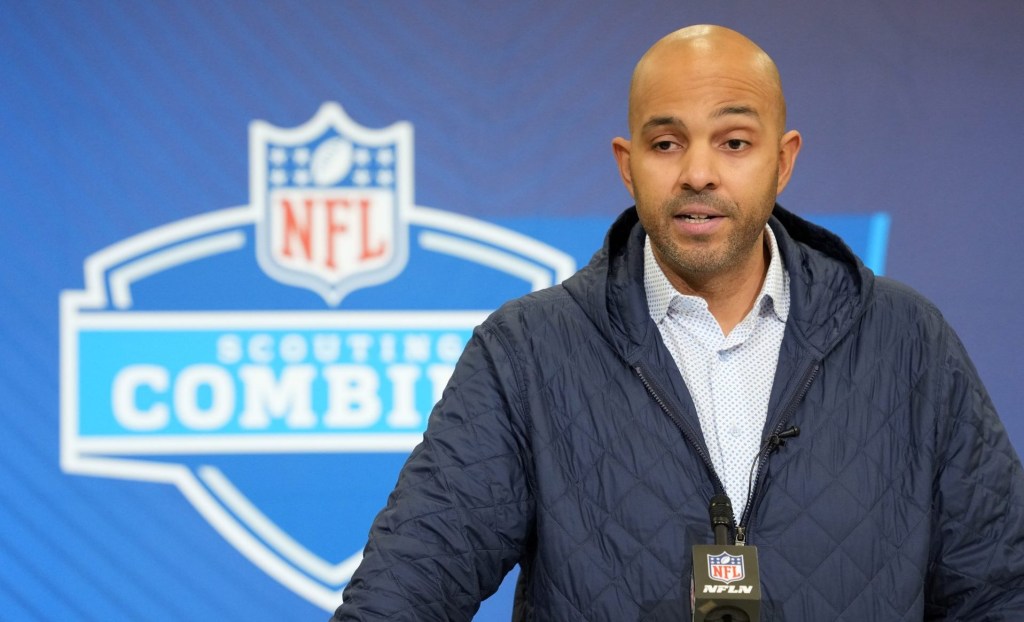

- Though the Big Ten’s Tony Petitti was the only commissioner to confirm he was still actively considering deals, he also said any deal is “a long way from crystallizing.”

The collective trepidation is a big shift from this time last year, when the floodgates appeared ready to open.

“There continues to be some uncertainty on both sides of the table,” says KPMG U.S. industry sports leader Shawn Quill, who helps advise PE firms and universities.

Quill cites several reasons for the slow movement around PE, such as concerns about the return on investment—both from firms about how much money they could make, and from conferences about the consequences of taking the up-front cash. There is also a need for more financially minded executives in athletic departments nationwide, Quill says, noting some departments are starting to hire their own chief commercial, operating, and financial officers.

Then there is the fact that schools have been faced with sharing revenue with athletes for the first time following the House v. NCAA settlement, as well as changes around NIL (name, image, and likeness) deals. “I think that there are potentially more pressing issues at the moment for these universities.”

Scott Purdy, media industry leader for KPMG U.S., says the temporary nature of private-equity investments—firms typically want to make a profit and exit within a certain time-frame—complicates investing in a conference or athletic department. “There’s not yet a proven mechanism to get money in and get money out,” Purdy says.

Overall, both Quill and Purdy are optimistic PE will eventually flood into college sports when the time is right, and the Power 4 conferences are keeping the doors open, too—if the price is right.

Phillips said the ACC still “occasionally” gets calls from PE firms, and Yormark called the Big 12’s PE search “a great exercise, and we’ll see what happens in the future.” Sankey said the SEC’s interest would be piqued “if there are opportunities for mutual benefit.”

“We’re still thinking about what that could mean in terms of how you would structure something,” Petitti said. “We’re doing work trying to figure out, if we were to build something, what’s the best way to build it?”

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)