Nike and Under Armour will each have new CEOs in 2020, but the sports apparel and footwear companies are expected to tread different paths en route to growing their digital businesses – and potentially adding new sponsorship deals with athletes.

Analysts estimate that both Nike and Under Armour’s annual revenue from direct-to-consumer sales is 20% and 35%, respectively, compared to their wholesale segments. Yet direct business is easily more profitable, with retailers taking home a larger percentage of revenue when wholesale partners like Foot Locker or Modell’s are cut out.

“Neither company will be 100% vertical, but it will be interesting to see how direct-to-consumer they are in five years,” said Matt Powell, sports industry advisor at the NPD Group, with expertise in retail and consumer trends across apparel, footwear, and equipment. “We’ve also seen outlets and shopping malls play themselves out, and are failing now”

Nike’s more recent active history on the mergers and acquisitions front suggests its CEO change will further accelerate company goals of selling shoes and apparel more on its own. In the last 18 months, the brand has bought predictive analytics startups Zodiac and Celect to support its ongoing digital transformation strategy. Adding former eBay CEO John Donahoe to the mix only supercharges its technological expertise.

“Donahoe has been supportive of Nike’s consumer direct offense strategy [while on its board] and joins as a highly accomplished technology & software executive at a time when the company is accelerating digital investments,” Rick Patel, senior analyst at Needham & Company, wrote in a research note last week.

Nike is currently on pace to surpass its goal of 30% revenue derived from direct-to-consumer sales by its 2023 fiscal year, according to Needham. Yet there will undoubtedly be a learning curve for Donahoe, whose background in technology has never required him to lead a consumer-facing brand.

In an interview with CNBC, Nike CEO Mark Parker said he and Donahoe are a “dream team,” with Parker focused on product development and Donahoe focused on technology.

“John comes in and adds horsepower to accelerate digital transformation and some of the steps we are taking to become even more competitive,” Parker told the network. “We feel he is the best choice to come and usher in the next wave of growth for Nike.”

SEE MORE: Nike Aims to Better Support Women’s Basketball with Apparel, Action

The consensus among industry experts is that the changeover at Nike will be a smoother transition compared to its long-time competitor, making Under Armour a less attractive opportunity for athletes seeking sponsorship deals.

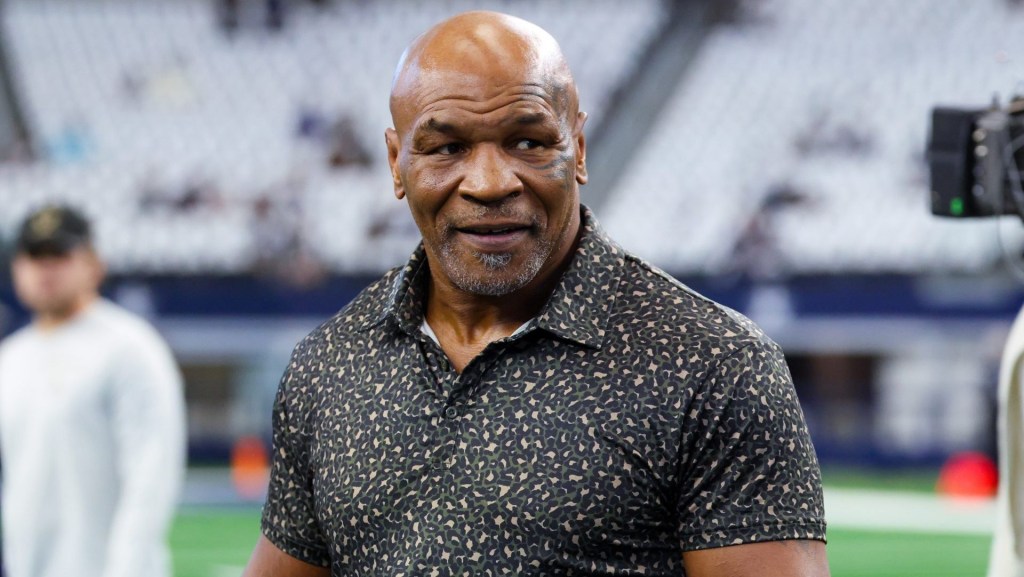

Under Armour’s existing sponsorship contracts with professional athletes, however, are nothing to scoff at. Partners to date include Tom Brady, Steph Curry, Michael Phelps, and Bryce Harper. But it’s Nike that holds the power in attracting new clients, based on revenue and cultural appeal, analysts said.

In its 2019 fiscal year, Nike spent $3.7 billion on creation spending – money used to sign athletes. That’s compared to $5.2 billion in total revenue for Under Armour last year. Nike’s revenue was $39 billion.

Both Nike and Under Armour’s outgoing CEOs will stay on at their respective companies under the role of executive chairman to help guide brand and product specifics. But while Under Armour continues to market itself as the go-to activewear brand for athletes, Nike appeals to all consumers, including Under Armour’s target audience.

SEE MORE: Bryce Harper On His Approach To Business Off The Field

Therein lies Under Armour’s problem, according to Sam Poser, footwear and apparel analyst at Susquehanna Financial Group. Five years ago, Under Armour sold its products directly to specialty retailers such as Dick’s Sporting Goods and Academy Sports + Outdoors. But when partners, including Sports Authority, Sports Chalet, and Gander Mountain filed for bankruptcy, the company lost a large percentage of its business.

“Under Armour is still going after the performance-oriented consumer and is marketing that way,” Poser said. Under Armour has since chosen to grow through “moderate retail channels,” by selling to Kohls and Famous Footwear, he said.

In a research note, Poser added, “We are unsure if Mr. Plank’s current track record makes him the best person to execute the roles he will undertake as Executive Chairman and Brand Chief. The hasty decision to open up distribution within the moderate retail channel to sustain the CEO’s mantra that Under Armour is a growth company resulted in erosion of the brand’s status and deterioration of revenue growth and margins.”

Nike and Under Armour did not immediately respond to multiple requests for comment on this story.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)