Micro betting is on the rise and appears primed to become more of a factor in the U.S. sports wagering market, which JPMorgan estimates will be worth $9.25 billion by 2025.

As the market grows, companies like Simplebet are gaining traction.

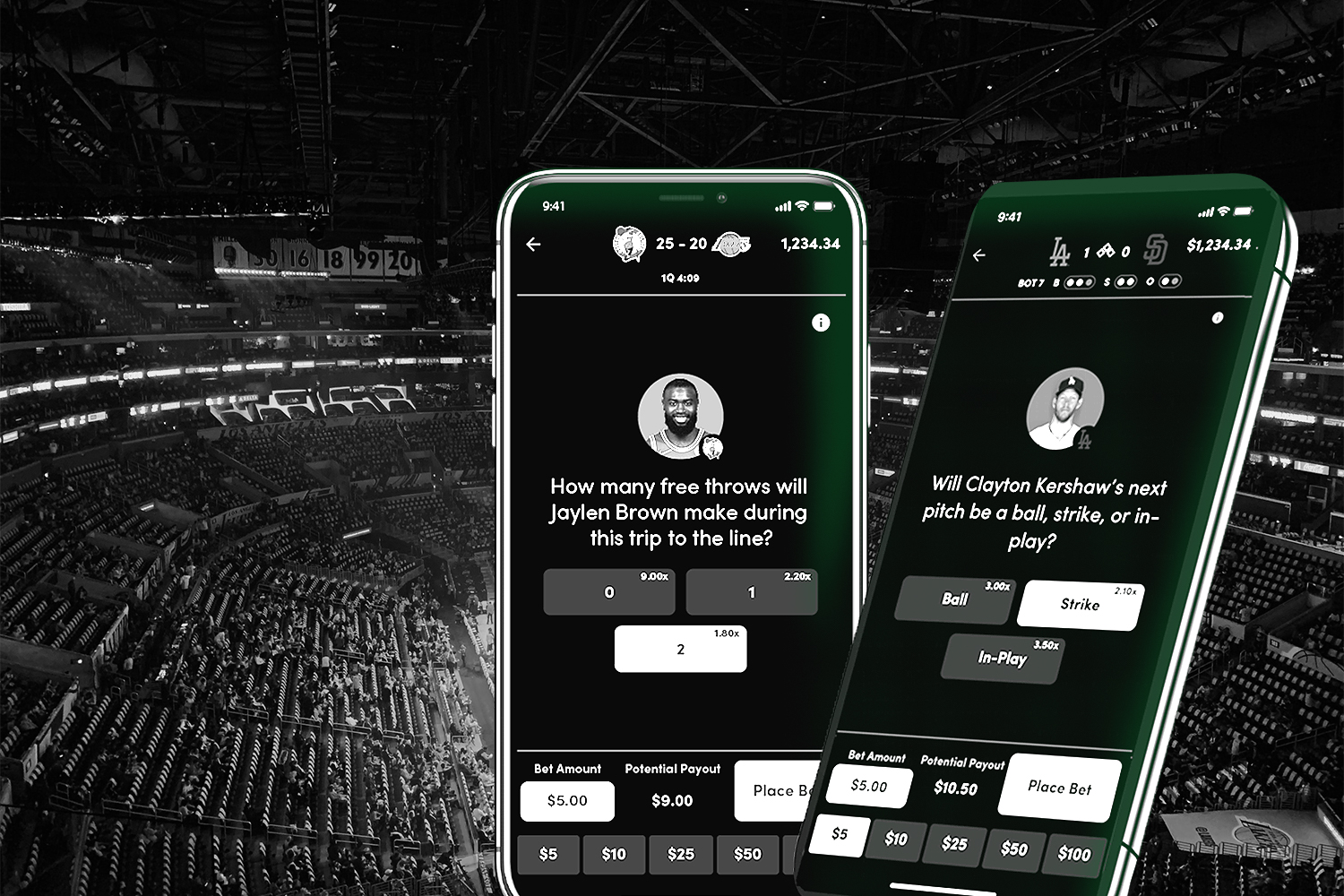

Founded in 2018, the same year sports betting was legalized in the U.S., the tech company was one of the first to capitalize on micro betting, focusing on details of a game — for instance, who scores next — rather than the overall outcome.

- After completing a $15 million financing round earlier this year, Simplebet is now furthering its goal of “reimagining the way fans engage with live sports” through a multiyear deal with DraftKings.

- Simplebet also currently has a yearlong deal with FanDuel.

PointsBet acquired B2B software company Banach for $43 million in March, spurred by an interest in adding in-play betting opportunities and algorithms to its platform.

“The trend in this industry, especially in the U.S., will be all around in-play betting,” PointsBet CEO Johnny Aitken told CNBC. “Within three years, our expectation is roughly 75% of bets will be in-play.”

Live wagering already accounts for 75% of all sports bets in the United Kingdom.

Editor’s note: DraftKings is an FOS partner.

![ESPN Bet broadcasts inside the PGA Tour Studios building in Ponte Vedra Beach, Florida, on March 14, 2025. [Clayton Freeman/Florida Times-Union]](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_25668497_168416386_lowres-1-scaled.jpg?quality=100&w=1024)