When Marc Spiegel decided he wanted to buy a soccer club, he spent years considering options from all over the world. Spiegel, the founder of Atlanta-based investment firm Innovatio Capital, looked at teams in 20 countries and came close to acquiring a lower-level club in England before he settled on Querétaro, a top-division club in the heart of Mexico.

When the deal went through in July, Spiegel became the first foreign majority owner of a club in Liga MX. He will not be the last.

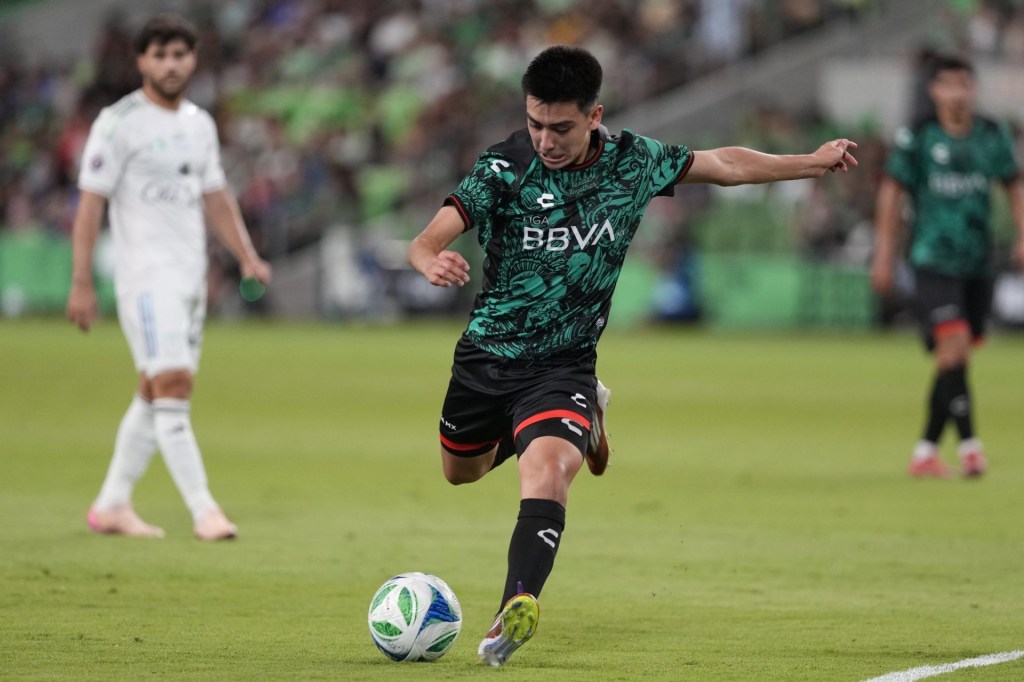

The 2026 FIFA men’s World Cup is part of this story. For the first time in 40 years, Mexico will be on the world stage as it hosts 13 of the tournament’s 104 games at stadiums across Mexico City, Monterrey, and Guadalajara. Figures within Mexican soccer who spoke with Front Office Sports believe the tournament will raise the global profile of the country’s existing soccer culture.

Yet they also feel Liga MX already has plenty of momentum.

Spiegel says that when he chose Querétaro, he decided a Mexican team offered the best combination of affordability and growth potential. “I think a lot of the leagues in Europe are more mature,” he tells FOS. “You can’t expect that you will be able to increase revenue quickly by 30 percent to 50 percent.”

That maturity also means that elite teams in Europe cost billions of dollars, putting them out of reach for most prospective investors. Buying teams further down the European pyramid has also gotten more complicated as deep-pocketed investors have poured money into second-division clubs in England, as well as Italy and France.

The foreign cash infusion has enhanced competition for promotion to top leagues, including the English Premier League and Serie A, where broadcast revenues are higher and commercial opportunities more lucrative. (A banker involved in soccer describes buying a club in the English second-tier as “playing in the most expensive casino on the planet.”)

And in the U.S., Major League Soccer teams have long been out of reach. MLS clubs are routinely valued at 9 or 10 times their revenue due to the widely held view that soccer will become more and more popular in the world’s largest consumer market. Both Los Angeles teams, plus Miami and New York, are all currently valued at more than $1 billion.

As a result, the price tags on Mexican clubs are just right for investors like Spiegel, who paid just north of $120 million for Querétaro, and says he “couldn’t be happier” with the deal. (Spiegel did not disclose the team’s revenue.) Before Spiegel’s purchase, Ryan Reynolds and Rob McElhenney bought a minority stake in another Liga MX club, Necaxa, for an undisclosed sum, joining investors including Eva Longoria, Justin Verlander, and Mesut Özil.

Mexican soccer can be a challenging space in which to operate. The past five years have seen violent rioting, a match-fixing scandal, and a lawsuit brought against Liga MX by the second-tier competition. But structural and regulatory changes are likely to improve governance. And the imminent arrival of more American capital has made investors bullish on the massive financial opportunities ahead.

At the end of 2024, Liga MX owners declined to unanimously approve an investment of around $1.25 billion from U.S. private-equity firm Apollo Global Management into a new entity that would have centralized the league’s commercial, sponsorship, and broadcast rights. A source close to the negotiations tells FOS that some club owners worried that the deal undervalued the league’s potential future revenue. Others wanted to make several structural changes to the league before the agreement was approved.

Among them is ending the ability for owners to have a controlling interest in more than one club. This practice is banned in Europe, given the potential for conflicts of interest. (It is also outlawed by FIFA, which prevented one of the Mexican qualifiers for the 2025 Club World Cup, Club León, from participating in the tournament.) Liga MX is adopting it as a matter of “good hygiene,” a source involved in league transactions tells FOS. All groups must divest secondary holdings by 2027.

It was this reform that resulted in Querétaro coming onto the market, as its previous owners also controlled Tijuana. Another major sale is imminent as domestic conglomerate Grupo Orlegi is looking to sell Guadalajara-based Atlas while holding on to Santos Laguna.

There are major upsides to these changes: Increasing the number of owners will grow the pool of capital available to the league as well as bring regulatory standards closer into line with international norms.

But the most easily lucrative change in the works is the pooling of media rights. Currently, each club in the league negotiates its own deal with its broadcast partners. This entrenches inequality, as the most popular clubs, such as Club América and Chivas, command much larger fees.

Other competitions, such as the English Premier League, distribute their centralized rights in a way that rewards performance and limits the gap in earnings between the most- and least-popular clubs. Broadcasters are generally willing to pay more when rights are sold collectively. One banker working with Liga MX tells FOS he expects centralization to at least double the average annual value of media rights to roughly $40 million per team.

Alejandro Irarragorri of Grupo Orlegi tells FOS that centralizing rights will also enable Liga MX to sell coverage of its matches overseas, which is an increasingly important revenue stream. (The English Premier League earned more money from its overseas rights than domestic ones for the first time in 2022.) Irarragorri says it is currently impossible for individual teams to sell their rights overseas anywhere except the U.S., as there are not enough fans of a single team to attract fees from broadcasters. But this will change if the league can sell access to every club.

Perhaps the biggest opportunity for Liga MX’s growth—and the one that will lure American dollars—is right on U.S. soil.

Liga MX is already one of the two most-watched soccer leagues in the U.S., alongside the English Premier League. Its matches routinely draw hundreds of thousands more viewers than MLS games—viewership that can swell into the millions for big contests. In July, MLS commissioner Don Garber said the league averaged 120,000 unique viewers per match on MLS Season Pass games on Apple TV for the first half of the season; the opening rounds of Liga MX’s 2025 Apertura, its first league tournament, drew viewership of more than 500,000 across TelevisaUnivision networks.

“There are 45 million Mexicans in America,” Irarragorri says. “We never think about this number. We just think, ‘Oh yeah, there are many Mexicans.’ But that’s the same number of people as in the whole of Spain.”

And when the Mexican league travels to play in the U.S., fans pack some of the country’s biggest venues. A 2022 doubleheader exhibition match in L.A. between MLS and Liga MX teams drew more than 70,000 fans. Average regular-season attendance in MLS is around 22,000. “There’s not an MLS team that can sell out the Dallas Cowboys stadium,” an analyst tells FOS. “But Club América can go to any NFL stadium in the U.S., sell it out, and 80 percent of the fans will be wearing yellow.”

Especially as the World Cup draws closer, Liga MX is becoming increasingly tempting to investors, and money is already beginning to flow in. Confidence is also still high that an agreement with Apollo will be reached under a new leader, Mikel Arriola.

Ultimately, owners believe the presence of billions of dollars of blue-chip capital—the majority of which is likely to be American—will help other potential investors to overcome the fear that Mexico is a risky market to enter. Irarragorri estimates half of the teams in the league will have overseas owners within five years.

If Liga MX booms, the result can be bigger than simply money for Mexican soccer. More cash in the sport and growing North American fandom may provide a boost to MLS, too—something both Spiegel and Irarragorri say is important for all North American soccer federations. The growth of both Mexican and U.S. soccer could help compensate for the lack of a prestigious—and lucrative—regional club competition like the Champions League in Europe or the Copa Libertadores in South America.

And in the long term, success stemming from the growth of Liga MX could even spell a North American Super League. “If the leagues got together,” says Spiegel, “you would have a competition that is instantly the second biggest in the world, behind the Premier League.”

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[US, Mexico & Canada customers only] April 13, 2025; Sakhir, BAHRAIN; Oscar Piastri leads George Russell into the first corner at the start of the race during the F1 Bahrain Grand Prix at the Bahrain International Circuit.](https://frontofficesports.com/wp-content/uploads/2026/03/USATSI_25925940_168416386_lowres-scaled.jpg?quality=100&w=1024)