Recent News

An NFT lab is vying to become the Disney of web3.0.

Yuga Labs, the developer of the world’s third-most-popular NFT project, Bored Ape Yacht Club, recently acquired the second-most-popular Crypto Punks for an undisclosed amount. The deal represents one of the largest M&A transactions in the NFT / Web3.0 space to date by project value.

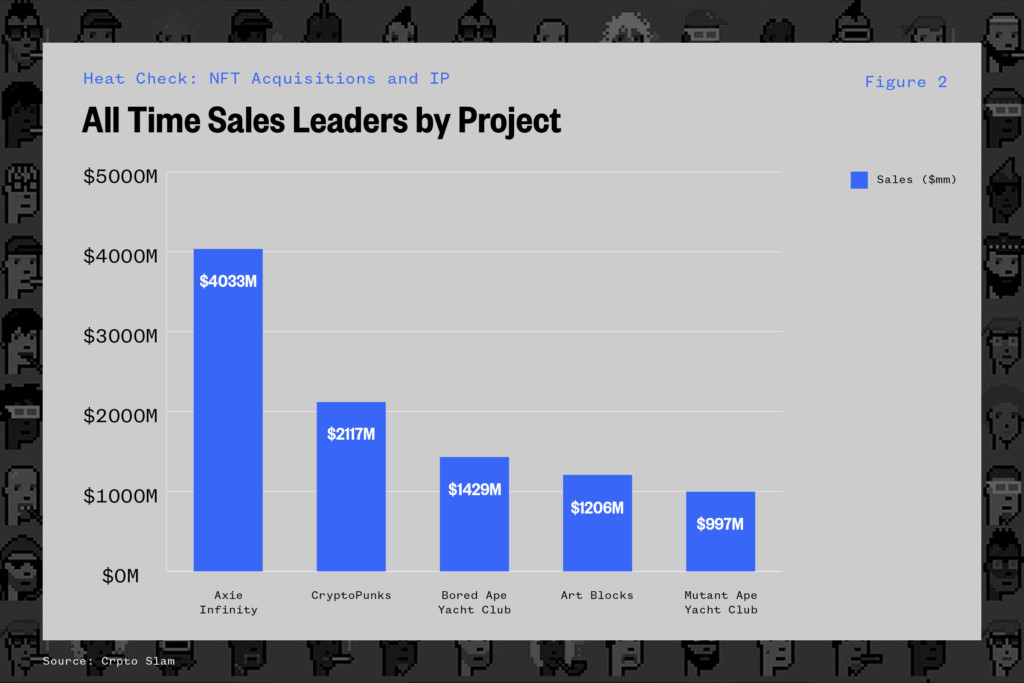

Combined, the projects have done approximately $3.6 billion of sales, according to data from cryptoslam.io. The deal will also include the Meetbits project, which touts sales of $431 million.

While there are many differences between the two projects, one of the main differentiating factors between the two are how they treat the intellectual property (“IP”) of their NFTs. From the outset, Yuga Labs has granted commercial license of the IP associated with its NFTs to the owners, while Larva Labs (original developers of Crypto Punks and Meetbits) was historically unwilling to share those same IP rights with CryptoPunks owners.

Post-transaction, the first step for Yuga Labs is to grant full commercial license to CryptoPunks and Meebits holders. According to a statement from the company,

“With this acquisition Yuga Labs will own the CryptoPunks and Meebit brands and logos, and as they’ve done with their own BAYC collection, Yuga Labs will transfer IP, commercial, and exclusive licensing rights to individual NFT holders.”

-Founders of CryptoPunks

While the market has been scorching hot over the past several months, February showed a little bit of a cooldown in transactions. After a rise in sales volume and value throughout much of last year and January, the market began to dip and has yet to pick back up. The sales tracker NonFungible pegs March 16’s NFT sales at around 17,000 transactions with a total value of $32 million.

What Does this Mean?

The purchase and decision to give IP rights back to owners of the NFTs resolves a longstanding conflict between the CryptoPunk community and Larva Labs.

The acquisition opens up possibilities for Punks- or Meebits-based spinoffs by community members, allowing them and the developers to begin using these NFTs in their associated Web3 projects.

Yuga Labs hopes the community involvement will drive further attention to these user-generated projects and NFTs in general, as more customers discover ways to monetize their super-popular digital objects.

Market Context

NFTs captured much of the crypto zeitgeist in 2021. Data from OpenSea — one of the world’s largest NFT marketplaces — reported that NFT volume on the platform for 2021 reached $14 billion in total transactions. The figure represents a 646-factor increase from 2020.

2022 has shown no slowdown in the pace of transactions. In January, OpenSea hit an all-time high of $5 billion USD in trading volume between Ethereum and its marketplace, Polygon. This topped its previous monthly record of $3.4 billion USD in August 2021.

One of the main projects driving this transaction volume is Bored Ape Yacht Club (“BAYC”) — a picture-for-proof (“PFP”) project with 10,000 unique ape-based avatars that has been one of the most successful projects on the platform. As of January, the BAYC project surpassed $1 billion in trading on the OpenSea platform.

Market Reaction

Since the news of the transaction, the market has seen some notable swings. According to blockchain data aggregator DappRadar (at time of writing), the Meetbits project has surged in price 995%, while CryptoPunks trading has seen a 1,000% increase in total trading volume.

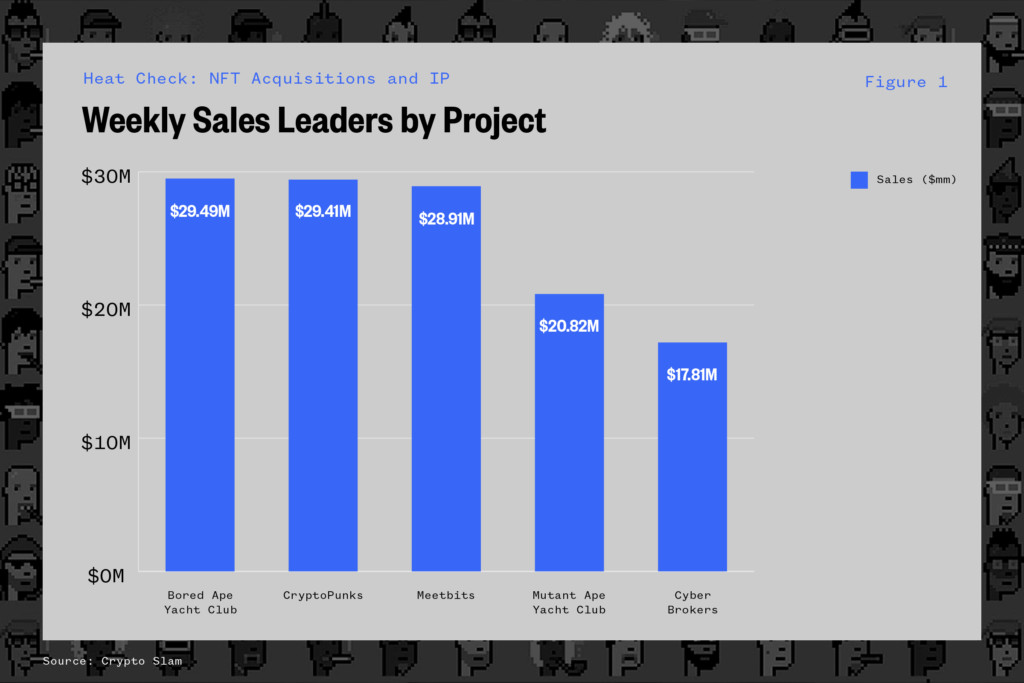

Over the past month, NFT projects tracked by CryptoSlam have seen the following distribution in terms of sales:

Yuga Labs currently owns four of the five highest-earning projects on the market. In terms of all-time sales figures, projects owned or created by Yuga Labs represent three of the top-five.

The adoption of NFTs remains on the rise, even if the trading volume might suggest otherwise. On-chain metrics that measure demand signal that the number of unique traders and the sales count have increased 8% and 2% across all protocols month-over-month (MoM), respectively. The total number of traders would indicate growth relative to 2021 with the growth rate decreasing in January.

According to DappRadar, another positive trend for the category is the impact of newer projects in the space. The PFP project Azuki was the most traded collection in February, surpassing even established projects like BAYC, CryptoPunks.

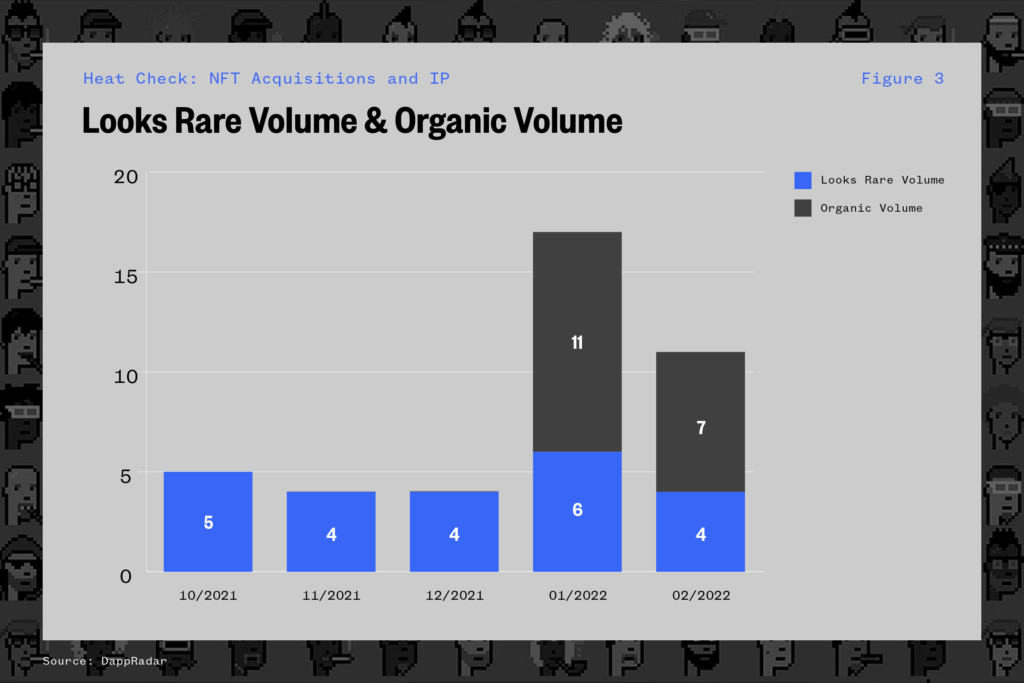

While the overall volume for trading is still up for OpenSea and LooksRare relative to 2021, there has been a decent amount of retracement in both price and total volume from earlier levels.

There could be room for more price appreciation on the Bored Apes, as well. After the announcement of the merger, it was reported on Tuesday that Yuga Labs would be selling metaverse land, a gaming metaverse, and BAYC tokens. The report from crypto blog The Block indicated that Yuga made a cool $127 million in net revenue last year — a figure it projects will reach $455 million in 2022 — chiefly through proceeds from the virtual land sales.

For more on the leaked presentation and the potential roadmap going forward, check out the links below:

- LuckyTrader

- The Block

- NFT Culture

Yuga is looking to raise fresh funds at a valuation of as much as $5 billion with an investment from Andreesen Horowitz, according to last month’s report by the Financial Times.

IP and Rules

BAYC has taken a unique approach to IP. Unlike NBA Top Shot, which licenses NBA content (highlights) to developer Dapper Labs, those NFTs represent ownership of the underlying license to the content, not the IP itself. Furthermore, owners of NBA Top Shot have restrictions, including one on the right to make copies for commercial exploitation.

Fordham University’s Mark Conrad published a study on the impact of IP and sports law on potential NFT projects encompassing real-world examples of the IP issues that can befall NFT projects, particularly as they apply to sports. Here are some of the key takeaways:

- Securities Laws: NFTs can be considered financial instruments if the NFT is created and sold, so if people can earn investment returns, then it is likely that this type of NFT is a security.

- Copyright Law: Unless there is a written contract with specific terms stating that the seller is assigning the copyright of the work to the buyer, the buyer does not have copyright ownership.

- Name, Image and Likeness: This means that the buyer cannot legally make copies of the NFT nor sell, license, or transfer the copyright.

The report by Conrad provides a case study on how the various concerns listed above could impact a particular project where IP for various stakeholders is concerned.

What to Look For

According to crypto newsletter The Milk Road, investors within the space are looking at the acquisition very favorably.

“This will go down as one of the most important acquisitions of the era.You don’t usually see the Nos.1 and 2 players in a market merge. This consolidates the largest and most culturally significant NFTs in the space into one company. Yuga now accounts for ~25% of daily NFT transaction volume on Ethereum. We may look back on this acquisition and wonder why it wasn’t subject to antitrust scrutiny. This will go down with Google buying YouTube and Facebook buying Instagram as one of the most important tech acquisitions of this era.”

A Prolific Crypto Investor with $100m+

While the markets look to stabilize, NFT consolidation is likely to continue with the likes of Yuga Labs leading the charge. We will continue to monitor the space for transactions.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)