Executive Summary

Alternative assets can most broadly be defined as assets that fall outside of the traditional definition of stocks, bonds, or currency investments. Over the past several years, there has been a democratization of access to investments in alternative assets, such as startups, investment funds, or real estate projects.

Various platforms have been created over the past decade to allow individual investors to participate in private markets that otherwise would not have been available to them. The most recent trend? Access to investments in culture – the unlocking of a new asset class.

Investment platforms such as Alt, SNKRS, Rally Rd, Otis, and GOAT not only allow individuals to purchase a new asset class in a curated manner, but also allows for fractionalized ownership of those very same assets.

While investing in culture has been a large trend, the boom in alternative asset investing covers many verticals ranging from NFTs, to real estate, to art, to crypto, to farmland. The movement towards the “financialization of everything” will enable individuals to create value and earn based on their interests and competencies. Investing in assets will move away from a “financial professionals” owned market and instead usher in a new class of investor.

In The News

On Wednesday, Jan. 12, it was announced that streetwear e-commerce platform StockX would reportedly be looking to go public during the first half of 2022.

The company was last valued at $3.8 billion after their April 2021 $60 million Series E capital raise. Furthermore, it was announced that StockX has tapped investment banks Goldman Sachs and Morgan Stanley to work on the transaction.

What is StockX? The company is an e-commerce platform that connects buyers and sellers of designer and streetwear accessories, shoes, electronics, luxury watches, and other collectibles. The company has recently expanded its offering to more and more consumer goods as a platform that captures various verticals within the “culture” space. Items like sought after gaming consoles, consumer electronics, and fad accessories are often listed as the platform is agnostic to product type (SKU) and instead focuses on capturing a cultural zeitgeist.

StockX is one of the first of the “culture” investing platforms that will grace the public markets. Ebay and Craigslist are successful examples of internet retail marketplaces that have existed and flourished in the past. The likes of StockX and other similar marketplaces represent an “unbundling” of an existing business model.

This unbundling can be seen in more than just the culture market. Earlier this month, Fanatics agreed in principle to purchase Topps trading cards for $500 million. Additionally, PSA/Collectors Universe was taken private for $850 million at the end of 2020 as the market for trading cards and sports nostalgia saw its initial spike during the pandemic.

Any way you slice it, alternative asset investing is going mainstream.

Current Market

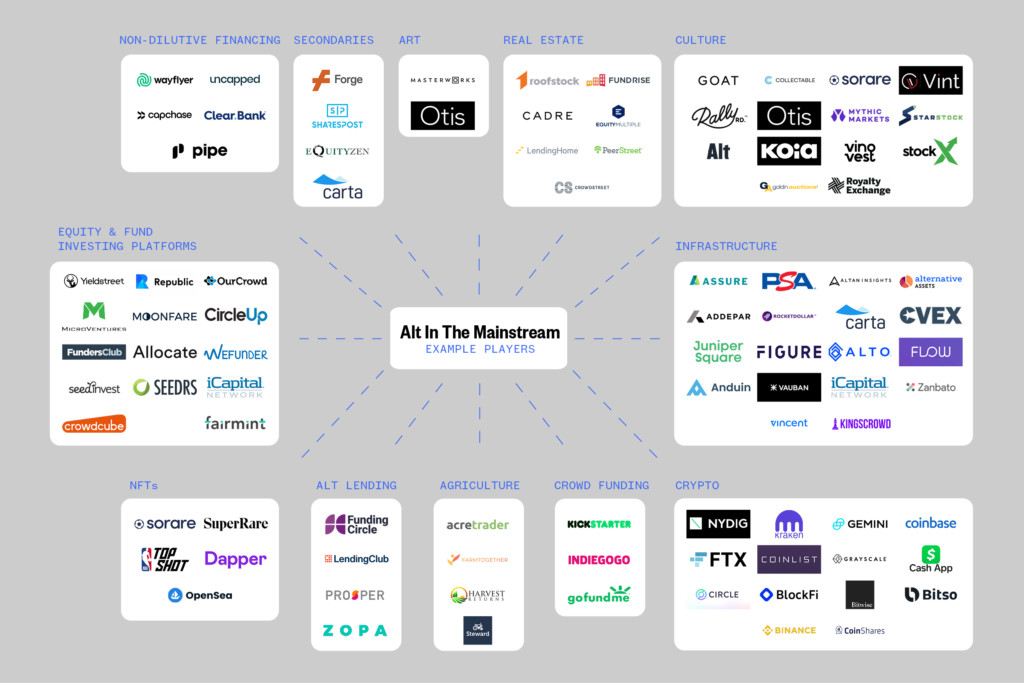

As we look at the current market for alternative asset investing, various verticals have formed as investor interest drives demand for new and innovative platforms to invest in. Below, we have outlined some of the main verticals which have seen new investment platforms. The map is inclusive of some of the largest players we have identified and believe provide a representation of the current market.

Our market map provides context for how capital has flowed into these various platforms over the last few years. According to funding data, the highest areas of concentration currently can be distilled into the following categories:

- Culture

- Infrastructure

- Crypto

- Equity Crowdfunding

What we can see from these various verticals forming is that there is an investing shift from public assets (stocks, bonds, ETFs) to private ones such as those in our market map above.

Previously, these private markets were not accessible to the broader public. But with the introduction of fractionalization and platform trading, we can anticipate a shift in capital. For context, JPMorgan and BlackRock released their Global Alternatives Outlook which covers how institutions spend on traditional alternative assets. Both investment firms highlighted increased volume in the investment into alternative assets and cited low interest rates as one of the driving factors. More specifically, in 2021 the institutional market for alternative assets saw the following:

- $1.1 trillion new assets under management in private debt, infrastructure, natural resources, private equity (“PE”), and real estate.

- Total alternative assets under management surpassed $9 trillion.

- PE investments reached $737 billion in new funding and total PE under management of $5.8 trillion.

Why is this important? Institutional investors (e.g. big banks, pension funds, insurance companies, etc.) have historically dominated all markets – both public and private – to the tune of 90%-plus according to NASDAQ. Retail investors, however, have seen increased volume in recent years with a large increase specifically during the pandemic era. The trend shows that retail investors (i.e. non-institutions) have been more active in markets writ large, a positive sign for newly formed alternative asset markets.

The overall macro trend of everyday individuals accessing markets, looking to actively earn yield or returns, and participating in investing activities, are positive tailwinds for further adoption of alternative assets – an asset class that opens the door to a larger population.

NFT Market vs. Collectibles

To look at the market for alternatives on a more granular level, we will examine NFTs and trading cards, two verticals which have seen incredible growth during the pandemic through today. In terms of trading cards, the pandemic saw a massive increase in adoption and value of these assets. According to data from eBay, domestic card sales saw a 142% increase in 2020 indicating that 4 million more cards changed hands over the past year. One additional note: According to a PWCC study, if you had invested in a basket of high-end trading cards (sports, Pokemon, etc.) in 2008 instead of a S&P 500, your returns would have been 175% versus 102%.

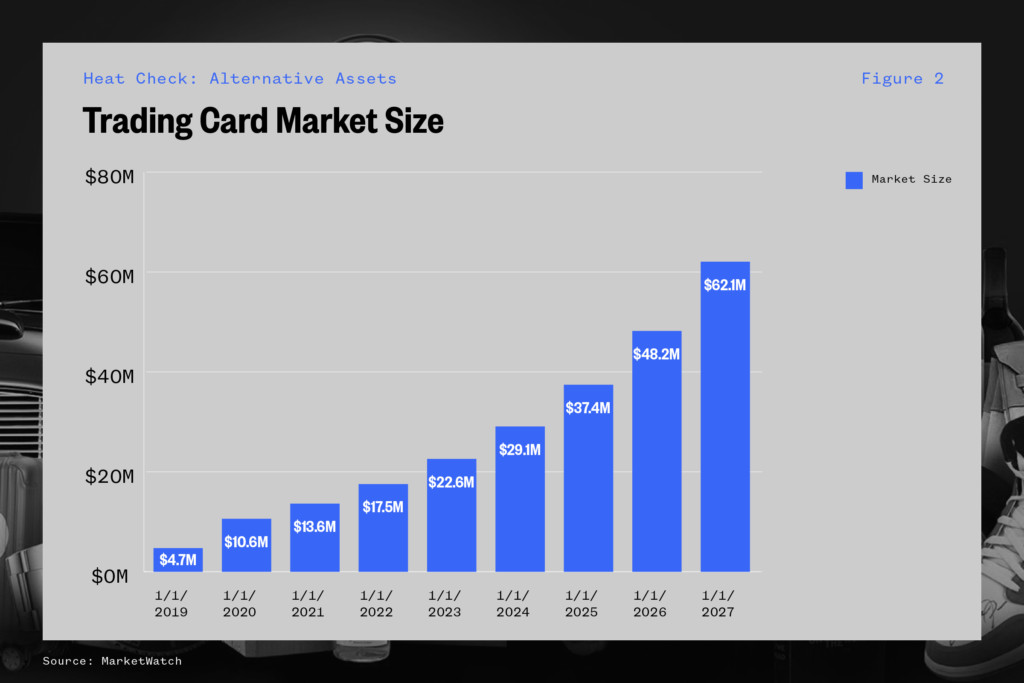

Looking to the future, the market size for trading cards domestically is anticipated to grow from $10.6 billion in 2020 (last recorded data) to $62.1 billion in 2027 according to a study from Research and Markets. The growth represents an annual growth rate of 28.8%.

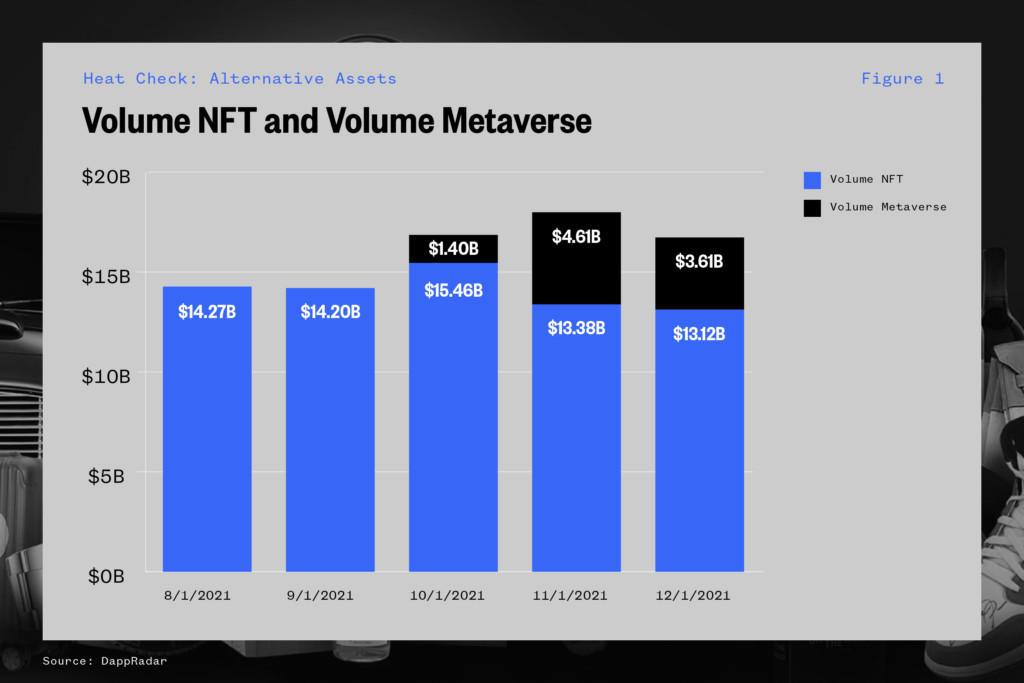

NFTs are quickly gaining traction as well. According to data from blockchain research company DappRadar, the total NFT volume traded in 2021 amounted to $16.7 billion when including Web3 assets and $13.1 billion when including only NFTs. The number represents a roughly 43,000% increase from 2020, when trading volume reached only $33 million.

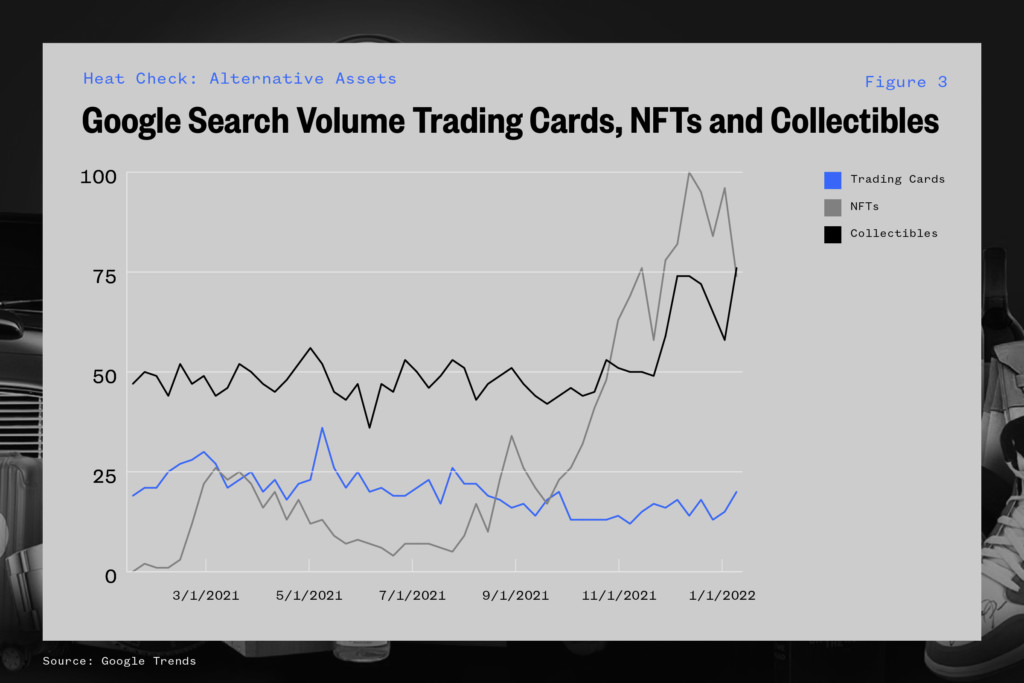

However, it is important to note that certain trends seem to be persisting at a rate higher than others. When looking at search volume traffic and Google trends data, it appears that NFTs have retained internet interest while trading cards have seen a steady decline or “leveling” since the height of the first wave of the pandemic. Collectibles as a whole are also showing increased interest. Supporting data included below:

Across platforms, we anticipate increased adoption regardless of vertical. The overarching trend of retail investors increasing their overall investment activity will drive the most change.

Why Does It Matter?

The big picture would indicate that transaction platforms (think anything from PayPal to Airbnb) have the ability to scale, generate revenues, and succeed in the current market. While there will be winners and losers, like any market, there are indications that these platforms could garner some mass adoption. In the future, there is potential for the likes of large investment managers like BlackRock, Nuveen, Invesco, VanGuard, etc. to partner with platforms like GOAT or StockX to form actual ETFs for people to invest in the stock market.

The possibilities are broad in the “financialization of everything” version of the world. From a culture investing standpoint, the sports industry sits squarely in the middle of the trend. We are anticipating continued growth both from a platform perspective and also from a market participation standpoint.

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)