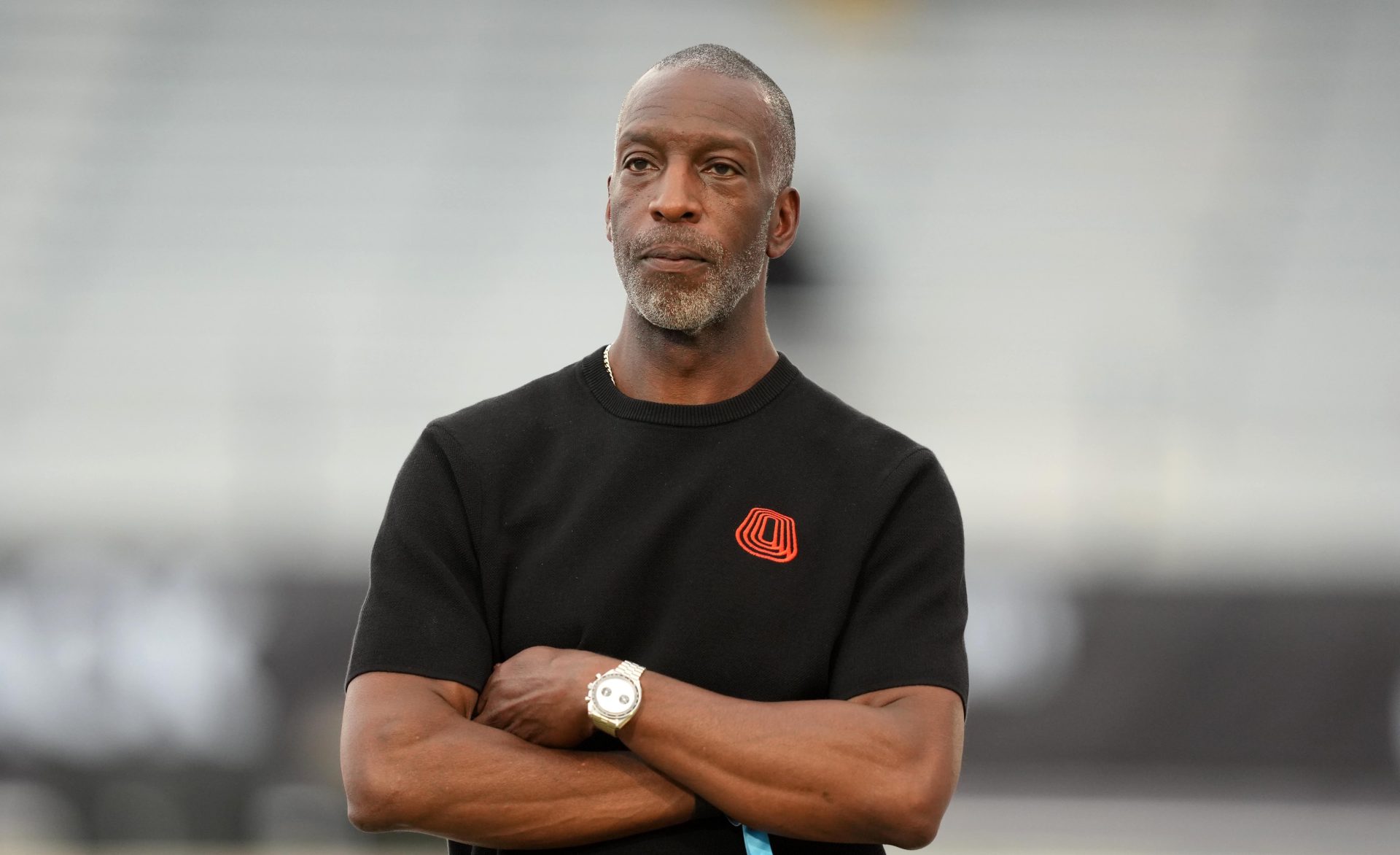

Grand Slam Track is in a multimillion-dollar hole because an investor backed out of their full commitment, founder Michael Johnson told Front Office Sports.

The beleaguered running startup owes athletes at least $13 million plus an untold sum to vendors, including one venue where the league has missed multiple deadlines to pay its bill.

Johnson launched the league last year with at least $30 million in promised funding, boasting that he would transform the sport with first-class treatment of athletes and big prize money—$100,000 for winning an event group at each “Slam,” dwarfing existing purses in the sport.

But he told FOS that a key investor pulled out; Johnson would not name which investor.

“That was a huge blow to us, caused a major, major cash flow issue for us, put us in a difficult position, put our athletes in a difficult position,” Johnson said. “But we’re very confident that we’ll pull ourselves out of it.”

A source familiar with the matter told FOS the investor reneged on their eight-figure term sheet days after attending Grand Slam’s April debut in Kingston, Jamaica, saying they planned to invest their money elsewhere after President Donald Trump’s tariff announcement.

When Grand Slam Track cancelled its fourth and final event in Los Angeles last month, the league told reporters it wasn’t having financial issues, instead blaming several issues including the venue contract. But Johnson admitted Thursday on Front Office Sports Today that the cancellation was due to money problems.

“We’ve had a very difficult situation this year financially,” Johnson said. “We had an investor that wasn’t able to honor their complete commitment to the league.”

Pressure has built on Grand Slam to pay its promised prize money and appearance fees to athletes. Sprinter Gabby Thomas commented “Pls pay me” on one of the league’s TikTok posts, while World Athletics chief Seb Coe said he was considering steps to compel the league to pay its athletes.

Grand Slam launched last year with $30 million “in commitments” led by Winners Alliance, the sports firm chaired by hedge fund billionaire Bill Ackman. Pitchbook lists a total of $39.5 million from investors including APL Ventures, a Silicon Valley investment firm led by Albert Lee.

Lee and a spokesperson for Ackman’s Pershing Square did not immediately reply to requests for comment. Winners Alliance told FOS it will continue backing Grand Slam.

“Winners Alliance has always been, and continues to be, a strong supporter of Grand Slam Track and its ongoing development for the benefit of athletes and fans worldwide,” a spokesperson told FOS. “We maintain regular communication with the Grand Slam Track team as they advance their important work and gear up for an even more successful 2026 season and beyond.”

Johnson said the league’s successes on linear television and social media had led to new investors approaching the league with funding, and that the league would be back for a second year after covering its debts. Vista Equity partner Robert Smith had already joined and was funding Grand Slam by May so it could have its third and ultimately final event in Philadelphia, FOS previously reported.

Johnson admitted that the league was in a hole with runners and vendors like venues and timers. Grand Slam had previously told runners that it would pay the athletes from its Kingston, Jamaica event by the end of July, and the athletes from its Philadelphia and Miami events by the end of September.

Asked if he was considering bankruptcy or otherwise winding down the venture, Johnson said he needed to make athletes whole first and that he planned to return next year. “We’ve got to get this right, we’ve got to get our athletes and vendors taken care of,” he said.

Johnson previously said after the Los Angeles cancellation that the league would return for a second season in 2026.

A source confirmed to FOS that the outstanding athlete payments have still not been made. The league rewrote its payment plan with the city of Miramar, Fla., for the more than $77,000 it owes for using its track, and still missed the July 18 deadline in the new payment plan.

“We’ve been working very hard over the last couple of months to make sure that we can get everyone taken care of and making sure that we can actually get to next season,” Johnson said. “It’s what I wake up in the middle of the night working on and thinking about and what I wake up every morning.”

Despite the league’s serious financial problems, Johnson said he was proud of the three events, which produced modest ratings on The CW that he said beat expectations.

Grand Slam recently laid off a handful of employees (out of dozens) and cut pay for the remaining staff by 15%.

“We probably went too fast,” Johnson said when asked what his biggest mistake was. “We probably need to be more cautious, and certainly will going forward.”

Johnson also said broader economic uncertainty, including the Trump administration’s tariff policy, was to blame for the investor pulling out.

“We’re in a very, very difficult economic situation right now that is pretty unprecedented and has affected a lot of folks, a lot of businesses, and affected one of our investors,” he said.

Johnson did not mention Trump by name. But he alluded to the president’s “Independence Day” tariffs announcement in the spring as a major problem for the investor who pulled back their money. “There’s a lot of volatility in markets,” Johnson said. “April, we saw a bit of a seismic shift in the economy due to tariffs.”

Grand Slam was only the largest of a number of new track startups that sought to capitalize on the ongoing running boom and post-Olympic interest in the sport. Other new founders have said that the rush of new events only worsened track’s long-running fragmentation problem, but Johnson disagreed. “People love this sport,” he said. “They just don’t have enough of it to enjoy.”

— Margaret Fleming and Daniel Roberts contributed reporting.

![[US, Mexico & Canada customers only] April 13, 2025; Sakhir, BAHRAIN; Oscar Piastri leads George Russell into the first corner at the start of the race during the F1 Bahrain Grand Prix at the Bahrain International Circuit.](https://frontofficesports.com/wp-content/uploads/2026/03/USATSI_25925940_168416386_lowres-scaled.jpg?quality=100&w=1024)