The Walt Disney Co. broke out quarterly financial results for ESPN for the first time last week, and to the surprise of doomsayers on Wall Street, it is still a powerful and profitable entity.

But there’s another audience frustrated, even angered, by the revelation ESPN generated nearly $1 billion in profits during the fourth quarter—namely, ESPNers whose jobs were sacrificed on the altar of cost-cutting by Disney.

ESPN has long portrayed financial struggles to its 5,000 employees. The last decade has seen multiple rounds of layoffs, including the departure of big-name talents such as Jeff Van Gundy, Keyshawn Johnson, Suzy Kolber, and Max Kellerman this summer.

Remaining on-air talents had to accept smaller raises — or even salary cuts. Staffers behind the scenes were told to cover games remotely and limit or eliminate travel.

But Disney could fetch $25 billion or more by selling ESPN. For the second time in recent weeks, the Mouse House gave possible investors a peek under the hood at ESPN’s financials.

For decades, it’s been an open secret that ESPN was Disney’s cash cow. But Disney hid ESPN’s real numbers because they didn’t want leagues and distributors to know just how rich the media giant really was. Even reduced as they are after a decade of cord-cutting, ESPN’s financials came as a stunner to former staffers.

During the fourth quarter, Disney reported ESPN’s operating income surged 16% to $987 million off $3.5 billion in revenue. In a previous SEC filing, Disney revealed Bristol delivered $2.9 billion in profits off $16 billion in revenue to Burbank’s coffers in fiscal 2022. The network’s profits have grown for two straight fiscal years.

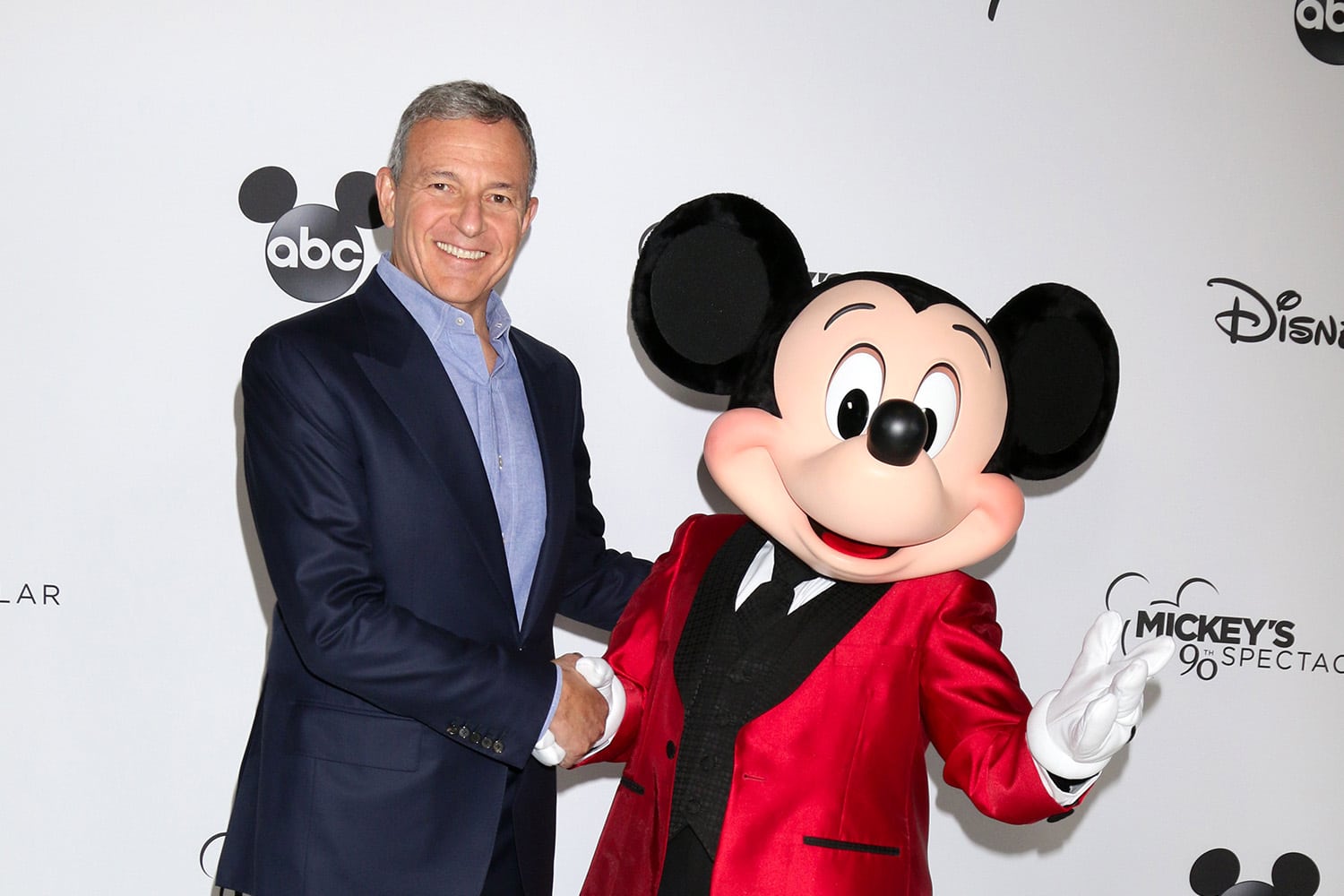

Some former ESPNers resent the billions in profits siphoned out of Bristol over the years. Others believe they paid with their jobs for mistakes made by Disney 3,000 miles away. This year, returning Disney chairman Bob Iger announced his plan to slash 7,000 jobs with the goal of $5.5 billion in cost savings.

“A lot of employees are asking, ‘What the f—-?’” complained one ex-ESPNer. “We were told internally, don’t travel, no Christmas parties, and layoff, layoff, layoff. Then you see the numbers…and you learn we earned $3 billion?”

There are good reasons why Iger would rather sell a minority stake in ESPN to the NFL or NBA than spin it off as a distressed asset. It’s not because he sentimentally recalls cutting his teeth in sports under the late Roone Arledge at ABC Sports.

Yes, cord-cutting has shrunk ESPN’s footprint to 71 million homes from a peak of 100 million. Yes, the cable bundle that nourished ESPN’s dual-revenue stream is crumbling. Yes, ESPN’s strategy to transition to a direct-to-consumer future by 2025 is not guaranteed to succeed.

But a close read of the numbers indicates that ESPN is still the Disney empire’s crown jewel.

ESPN generated more profits in fiscal 2022 than Disney’s entire entertainment business ($2.1 billion), noted The Hollywood Reporter. Meanwhile, the company’s ESPN+ streaming platform is already profiting, while Disney and Hulu’s platforms are still losing money.

In April, author James Andrew Miller tweeted ESPN generated an astonishing $22 billion in profits for Disney from 2018-2022. He would know. Miller wrote the book on the Worldwide Leader in Sports with his best-selling, “Those Guys Have All The Fun: Inside The World Of ESPN.”

At the height of the cable subscription market in the 2010s, ESPN “was a bigger, more profitable company than the studio and the parks put together,” former president John Skipper said on the “Pablo Torre Finds Out” podcast.

That enabled ESPN — with its dual revenue streams of cable subscriptions plus advertising — to simply outbid linear TV competitors, whether it was for expensive sports media rights or top on-air talents.

Meanwhile, Iger shrewdly used the billions generated by ESPN to bankroll his acquisitions of 21st Century Fox, Marvel, Pixar and Lucasfilm.

As former ESPNer Bill Simmons told Jimmy Traina of Sports Illustrated: “They were the ATM for Disney.”

On the other hand, plenty of current and former ESPNers can’t complain about their careers under Disney’s stewardship.

They found fame and fortune on Disney’s dime for years. They were the beneficiaries of long-term, million-dollar contracts from generous ESPN executives like Skipper and Jamie Horowitz.

Like other media entities, ESPN must accept the good and the bad of being part of a giant conglomerate. Being part of Disney has given ESPN huge marketing and cross-promotional clout over the decades.

And subsidiaries paying the price for the sins of corporate headquarters is as old as capitalism itself. Just ask any local Gannett newspaper how they felt about subsidizing money-losing “USA Today” for years.

Now, it’s a new era for ESPN under former top Disney executive Jimmy Pitaro.

The ESPN chairman has brought fiscal discipline and rigor to everything from media rights negotiations to talent hires, which has led some observers to wonder if Pitaro’s ESPN will pay what it takes to retain media rights to the NBA.

Under Pitaro’s watch, ESPN has passed on media deals with the Big Ten and the Pac-12 Conferences and Major League Soccer, noted Wall Street analyst Michael Nathanson.

ESPN also took a pass on the NFL’s expensive Sunday Ticket package, which was eventually scooped up by Google’s YouTube TV at $2 billion a year. When ESPN didn’t like the numbers, it walked away from Big Ten talks despite 40 years as a rights partner.

Disney noted ESPN’s newfound discipline on Wednesday, attributing decreased programming/production costs to the “non-renewal of certain contracts.”

But Pitaro (cited as Iger’s possible successor at Disney) is no penny-pincher. He’s willing to spend big for beachfront properties like the NFL ($2.7 billion a year) and the SEC Conference ($300 million a year). And get creative via his deals with Peyton Manning’s Omaha Productions and “The Pat McAfee Show.” But he won’t bid on everything. And he won’t overpay.

The NBA’s exclusive negotiating period with ESPN and Warner Bros. Discovery Sports’ TNT runs through April. After that, it’s anybody’s ball game. Waiting in the wings for a shot at the NBA are former rights partner NBC Sports and streaming giant Amazon Prime Video, which wants to create the NBA version of “Thursday Night Football.”

ESPN’s NBA rights talks have already tipped off. Pitaro is optimistic the Association and the NBA Finals will remain with the four letters.

“It’s an incredibly important property for us,” he told The Athletic.

Pitaro’s ESPN predecessor, John Skipper believes ESPN has no choice but to go to the limit for the NBA.

“These are existential rights for ESPN — they have to have the NBA,” Skipper told Torre. “And it’s pretty close to existential for TNT. I don’t know if they have to have the NBA. But I think they do.”.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)