Earlier this year, global lifestyle marketing agency MKTG and sister agency, marketing analytics company, SRi, released The Receptivity Story, as part of Decoding 2.0.

Earlier this year, global lifestyle marketing agency MKTG and sister agency, marketing analytics company, SRi, released The Receptivity Story, as part of Decoding 2.0.

Decoding 2.0 is a unique study, as it acts as one of the few sponsorship-specific studies in the industry. To date, it is also one of the most intensive ones as well.

There’s a ton of great stuff here, but I’ll focus on a couple of my favourite findings, and one thought:

- Receptivity Theory

- Niche Sports

- Firm-Level Differences

Receptivity Theory

Initially unearthed in the original Decoding study in 2012, Receptivity Theory is the idea that, more than the passion associated with a property, the receptivity of fans towards branding is more predictive of sponsorship success.

While this seems like an intuitive finding, the industry, without the necessary data, could only use passion or exposure as a proxy for predicted success.

Really — what we are doing here is shifting the inflection point. Rather than having brands place a premium on number of passionate fans, we can now shift to a brand-specific view, where meaningful attention to branding is being measured.

Niche Sports

Through this study, SRi discovered that there are three types of fans: Receptives, Selectives, and Non-Receptives. Niche sports, which suffer from a lower total number of fans, benefit from a greater percentage of Receptive fans.

From a sponsor’s perspective, the math here has always been simple: would you prefer to reach many, but impact a lower percentage? Or, alternatively, would you prefer to reach few, but impact a greater percentage?

What’s easy to determine is relative exposure at the extremes — i.e.: the NFL is clearly more popular than swimming. The middle is more difficult to measure, and even tougher, the relative willingness to pay of fans.

For instance, assume the following, for average brand X:

- Sponsorship for Sport A will reach 1,000 fans per game, with fans, on average, valuing branded sponsorship at 1

- Sponsorship for Sport B will reach 500 fans per game, with fans, on average, valuing branded sponsorship at 2

Under this scenario, if return is value, X would be indifferent between the two options at the same price.

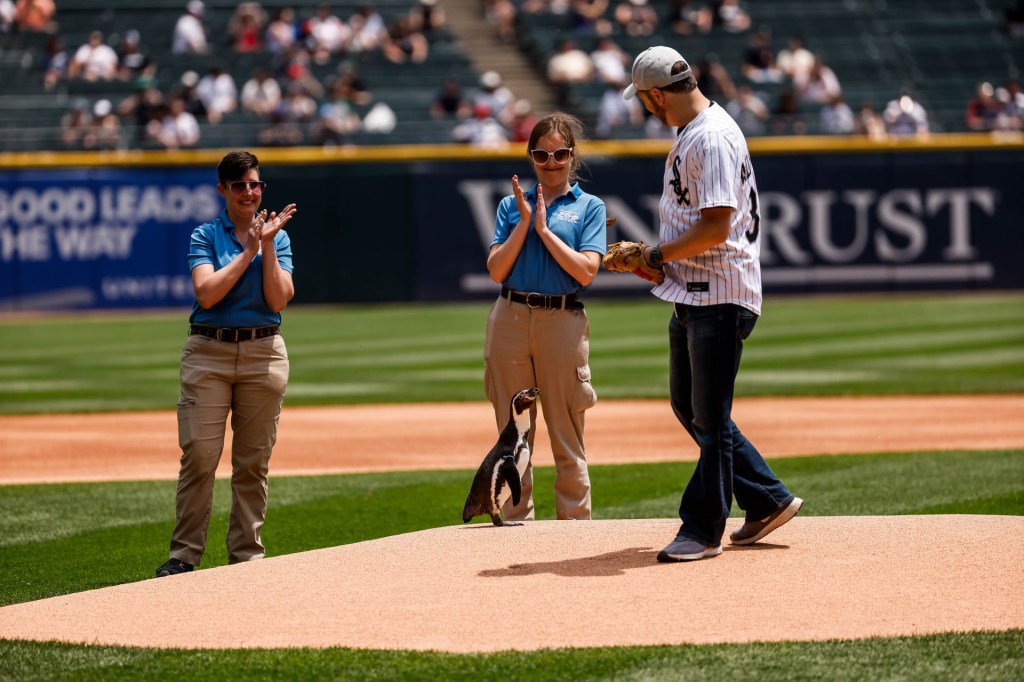

Scenarios like these are where receptivity is powerful. It provides perhaps one of the best estimations of reach — just because your branding is at a baseball game, does not mean that everyone will see it!

In addition, it lays the groundwork for potentially being able to measure predicted value of sponsorship, or “willingness to pay” — which would vary, whether you are a Receptive or Non-Receptive fan.

Borrowed from economics, willingness to pay is the idea that each consumer has a maximum price that they are willing to pay for a good. For this application, I will treat attention as price — the scarce resource.

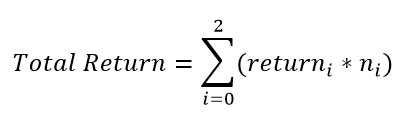

Thus, the equation becomes closer to this:

Where i would act as categorical variable for category of fan. n would represent number of fans falling within the given category. Return would represent willingness to pay.

Because fans are heterogeneous, the brand will experience a different return for each “unit view” — meaning that even if one person’s receptivity differs from another, there will be subgroups within categories of fans, separated by willingness to pay. While we can assume that the return from a Receptive fan will be greater, meaning that variable return exists, we would still be uncertain as to the degree that this exists.

Importantly — this study clearly shows a greater percentage of surfing fans falling under the “Receptive” category than the NBA, but does the willingness to pay for Receptives, Selectives, and Non-Receptives differ between the two sports? It’s still early, and there will be ongoing studies, but these are questions that immediately come to mind.

One interesting note: if receptivity proves as powerful as this study suggests, it may become an arbitrage opportunity for the first brands who successfully adopt it. And, while the long-run equilibrium should theoretically be one in which all brands adopt this strategy, it may take some more time for sponsorship to get there — meaning that the early adopters could reap massive gains.

In speaking with Julie Zdziarski, VP of SRi:

“Brands do recognize that the scope is much smaller. But the key piece here is that the smaller sports are more lifestyle focused… they’re a more intimate environment”

Firm-Level Differences

Plenty of this is dependent on the firm, as well. In my earlier example, I assumed that a fan’s assigned value for branding (or willingness to pay) being greater was always a good thing.

For some firms, this isn’t necessarily true — and in fact, many firms pursue strategies in which they are unconcerned about reaching high-value customers. This leads to an advantage in number of customers, rather than one in revenue per customer. Think Google, or the telcos.

For these firms, receptivity still matters. Even if you want to be everywhere, you want to be sure that people are noticing you. But what matters less is the degree to which fans are willing to pay, whether they are Receptive or not.

Good Data Is Always Good

In an industry that suffers from a dearth of public data and dispersed data sets, this study acts as one of the true landmark pieces of research.

But here’s the thing: marketing data is tough, and it will never be as easy as it is in industries like finance to find information. And that’s why stuff like this is important.

To be sure, firms like MKTG enable people like me, who study the industry, to make better and more informed analyses, but it also benefits companies and other stakeholders. And understanding the consumer does more than just help brands make money — it provides consumers with an opportunity to gain more as well: leading to (hopefully) an optimal outcome.

It’s still early days, but MKTG has promised to release more stories in the future. When it comes to research and available data, sponsorship looks more promising than ever.