Barstool Sports founder Dave Portnoy has repeatedly claimed on Twitter that he owns a “ton of” Penn National Gaming stock, the company that acquired a chunk of Barstool earlier this year.

There’s nothing improper about Portnoy’s ownership of Penn National stock, although his use of social media and other platforms to tout the stock is potentially troublesome, investment lawyers and a prominent former financial regulator tell Front Office Sports.

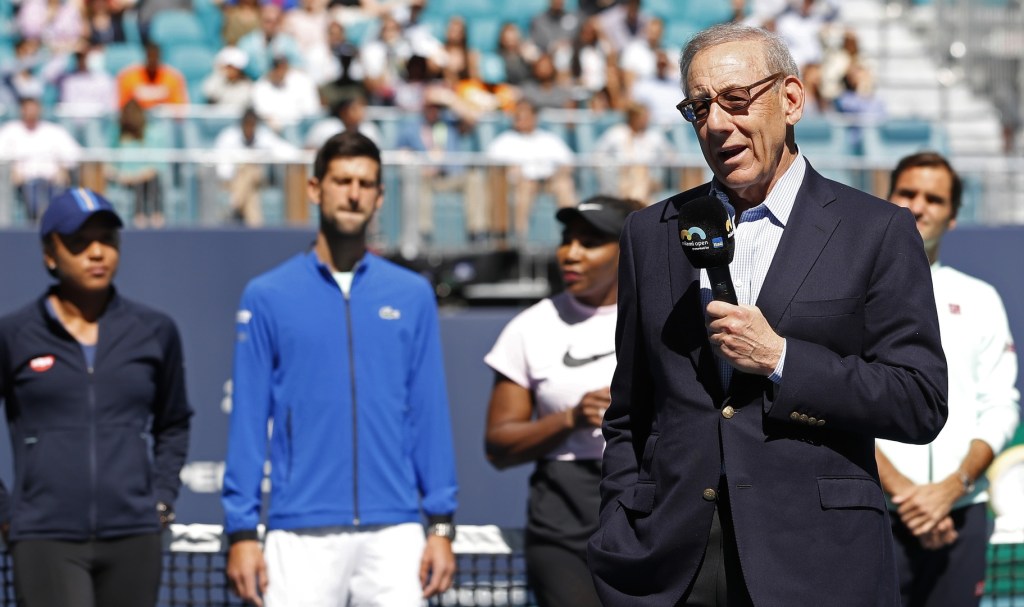

“His conduct is certainly aggressive,” said Harvey Pitt, who served as chairman of the U.S. Securities and Exchange Commission under George W. Bush’s administration. “If he is engaged in touting a stock in an effort to enhance his own personal wealth in order to move the markets, this could be a potential case of manipulation.”

Penn National purchased 36% of Barstool in January — valuing the media company at $450 million — for $163 million, a sum that included $135 million in cash and $28 million in non-voting stock. Penn National can further increase its stake in the media company to nearly 50% in three years for another $62 million. Both sides also have options to further increase the casino company’s stake, even to full ownership.

None of the company’s financial disclosures mention Portnoy’s level of ownership, which requires publicly traded companies to report individuals or organizations who have purchased more than 5% of stock.

The exact amount of stock Portnoy received as part of the Penn National purchase was not specifically stated in financial disclosures, but key employees at Barstool were awarded thousands of shares that won’t mature until 2023. Portnoy has said on Twitter he’s purchased additional shares of Penn stock after the sale.

“The difficulty is that in order to prove manipulation — one of the hardest things for the government to do — you have to show that there was a specific intent to artificially move the price of the stock,” Pitt said.

Penn National stock is up more than 50% since the Barstool deal was announced. The average volume of the stock traded has increased more than 600% since the acquisition compared to the 12 months before the Penn National acquisition was announced on Jan. 29.

Front Office Sports examined several tweets where Portnoy, one of the more polarizing figures in sports media, mentioned Penn National stock and focused on days where he referenced Penn National multiple times: Feb. 28, June 22, July 29, Aug. 7 and Aug. 13.

Penn’s stock saw average gains of 6.4% those days with an average volume 40% higher than the average trading days since the Barstool acquisition. The June 22 tweets came after markets closed and coincided with appearances of Portnoy and Nardini on CNBC’s “Mad Money with Jim Cramer.” On the following trading day — June 23 — Penn National’s stock price increased 10% and saw more than three times normal trading volume.

“My favorite part of owning $penn stock is not watching all my millions stack up,” Portnoy wrote in an Aug. 7 tweet. “It’s destroying the fools dumb enough to bet against us. AND watching my millions stack up.”

On July 29, Portnoy said in a video he was “up millions” with Penn National stock up 12%. It closed at $37.42, a 9% increase over the previous day’s close.

Michael F. Perlis, a former assistant director and attorney at the SEC’s Division of Enforcement, told Front Office Sports that if he “saw facts like this” during his time with the SEC, he would have pursued them.

“If I was still sitting at the SEC and somebody gave me that information, I would pick up the phone and make a call,” said Perlis, a partner at the firm Partner, Locke Lord LLP. “I’d call Penn National’s general council and start asking questions about the transactions. I’d want to know what he knew at the time? Were they aware in the trading of the securities? Do they have an explanation about the volume increases?”

Trading patterns could be factors if the SEC decides to look at it, and Portnoy has admitted to shorting — where investors speculate a stock will decline in value — Penn shares.

Portnoy first mentioned he was shorting Penn National stock during a broadcast of “The Rundown” on March 31 with Kevin Clancy and Dan Katz, both of whom wondered if such activity was permissible.

The next day, Portnoy said he “got [expletive] yelled at a little bit by Penn.”

During the “Davey Day Trader” livestream on April 9, a producer put Portnoy’s stock holdings on screen — and it revealed he was shorting 50,000 shares of Penn National stock. The podcast is still online, but the video was scrubbed from Periscope and Barstool’s own platforms.

“We had that little to-do, which I’m never going to touch Penn again because people try to twist what I’m doing,” Portnoy said during the April 13 livestream. “It’s like ‘Oh, he’s shorting Penn.’ Yeah, for my day-trading I have five stocks that I follow religiously, based on price: Boeing, Lulu[lemon], Nike, Shake Shack, and Penn. I buy them in bulk. I buy, I sell, I short, together.

“But if you guys want to take it and run, which is what you did, then [expletive] you. And you shouldn’t be on this stream … and you should really have your throat slashed and thrown in a gulag.”

Tesla CEO Elon Musk was the most notable target of an SEC investigation that resulted in the agency filing a federal complaint related to social media posts.

Musk, who had 22 million followers at the time, tweeted his intention to take Tesla private at $420 a share in August 2018. The tweet sent Tesla’s stock up more than 6% and volume increased nearly 11%, according to the SEC complaint. Tesla was also charged by the SEC for “failing to have required disclosure controls and procedures relating to Musk’s tweets.”

Musk and Tesla settled with the SEC in September 2018. As part of the settlement, Musk agreed to step down as chairman, Tesla had to establish a committee to place controls on Musk’s public disclosures about the company, and both Musk and Tesla paid a total of $40 million in penalties.

“[Musk] is a bigger-than-life celebrity,” said Thomas O. Gorman, one of the nation’s top security fraud defense lawyers. “When he speaks, he has a super megaphone. Everybody listens. When he says he buys a certain candy bar, it would move the price of that stock. That’s one of the liabilities of being Elon Musk. Anything you say can move the stock price. When he muses to people that he’s thinking about taking the company private, all of a sudden everybody goes ballistic.”

Portnoy pushes out his “Davey Day Trader” videos regularly to 1.8 million followers on Twitter, around 38 million fewer followers than Musk currently has on the social media site. The disparity in reach alone could make the SEC less likely to seek security charges against Portnoy, Gorman said.

“There are First Amendment rights here,” said Gorman, partner at the law firm Dorsey & Whitney. “You can say what you want to say. You don’t have a First Amendment right to lie. You don’t have a First Amendment right to mislead people. … If [Portnoy] can move the market and he lies, he should get sued and the SEC should investigate him. He should be careful. If he’s telling people, ‘Yeah. The company is going up and up. We are going to great.’ He does have insider information or at least people think he does.”

The start of Portnoy’s “Davey Day Trader” videos include a lengthy disclaimer in tiny type that warns viewers his recommendations “are made available solely for educational and informational purposes.” But, reading through Portnoy’s many replies, it appears his followers are buying in whether it be through traditional stock brokers or increasingly popular fintech services like Robinhood.

“Who would have thought being a @barstoolsports fan would make you money?” one follower wrote in a reply to a Portnoy tweet. “If I didn’t follow Barstool, I would have never known what $penn was then I would have never bought it.”

The number of Robinhood users who hold Penn National stock jumped 7,770% from the time the acquisition was announced through Aug. 13 when Robinhood stopped making such data public, according to investment research firm Quiver Quantitative.

Venture capital firm The Chernin Group purchased a majority stake in Barstool for an undisclosed sum in 2016 in a deal that valued the company between $10 million and $15 million.

In a June 17 tweet, Portnoy said he “took more than half equity in $PENN instead of cash and asked for more because when I bet big I bet on myself and I always win.”

Beyond his stake in Penn National, USC professor Lawrence Harris said Portnoy’s potential access to inside information could interest regulators.

“As somebody in possession of material insider information, [Portnoy] cannot act on it in the stock market and he can’t give that to people except for an appropriate business purpose that is subject to confidentiality agreements,” said Harris, chair of finance at USC’s Marshall School of Business.

A spokesperson for the SEC declined comment, a standard response from federal agencies when it comes to current or potential investigations.

Barstool, The Chernin Group and Penn National did not return multiple requests for comment.

Portnoy has had to deal with one federal agency after tweets on Aug. 13, 2019, where he threatened to fire and sue employers who attempted to start a union at Barstool, something several other sports-focused websites have done in recent years. Portnoy deleted the tweets and agreed to remove any anti-union literature at Barstool Sports as part of a settlement with the National Labor Relations Board in December 2019.

His personality and drive helped turn Barstool Sports from a newspaper he personally handed out to commuters in Boston in 2003 into a force online.

But while his brash, often misogynistic persona has helped him create an outsized following, it has also opened him to heavy scrutiny.

After Portnoy’s harassment of an ESPN reporter resurfaced in 2017, pushback from those within ESPN led the network to cancel its collaboration around the “Barstool Van Talk” late-night show. Portnoy later said he would “slowly suffocate” the reporter “in an online war” after the deal was called off by ESPN.

Portnoy announced on Twitter on June 25 that E-Trade “officially” kicked him off the platform for criticizing the Morgan Stanley-owned trading platform. That came days after Portnoy said in one of his videos he used E-Trade to make $100,000 on a $400,000 investment in a little-known Isreali-based company, InspireMD, The Financial Times reported.

Penn National, however, is literally betting on the company Portnoy created to gain an edge as more states legalize sports betting.

CEO Jay Snowden credited the success of the Barstool Sportsbook app for part of the reason the casino company had its first profitable quarter in its fiscal year as the pandemic led to a broad industry downturn.

Four Barstool-branded sportsbooks are scheduled to open inside Penn National casinos in the coming months. Snowden also said on an Oct. 29 earning call that the company is working on Barstool sports bars with virtual sportsbooks “in large metropolitan areas.”

The SEC has sent requests to Penn National from 2016-2019 asking the company to clarify how it accounts for expenses listed in quarterly and annual filings, which is not unusual. The SEC hasn’t listed an investigation of Penn National over the last four years.

“The current crew is pretty dogged,” Pitt said of the SEC. “I think they would [investigate Portnoy] if they thought there was a rationale behind at least figuring it out, this group would go after. I am not saying they are those most aggressive folks in the world, but they are pretty active. Just look what they did with Elon Musk.”

Robert Silverman provided additional reporting related to Portnoy’s livestreams in March and April 2020.