Budweiser’s launch of Budweiser Zero, its first-ever new zero alcohol, zero-sugar brew, is expected to further lift and bring legitimacy to a growing non-alcoholic beer category already being filled by Heineken and Athletic Brewing.

While non-alcoholic beer still makes up less than 2% of the overall beer segment, it’s one of the few bright spots in an otherwise flat and shrinking market. The segment has grown 44% this year, adding to a similar trend in breweries releasing low-calorie beers, beers with electrolytes, and hard seltzers.

“Five, three years ago, the U.S. wasn’t ready, but now there’s a wide swath of millennials and younger who are, for a variety of reasons, driving this trend,” Quinn Kilbury, head of partnerships and consumer experiences for Heineken USA said. “These are real things that are happening with or without us and we should be pushing and embracing it.”

For Heineken, its non-alcoholic brand Heineken 0.0 has been its global innovation focus for more than a year, Kilbury said, adding that it will continue to be a focus, and a complementary piece to Heineken, for the foreseeable future.

Heineken has staked much of its U.S. sports partnerships in soccer, and with its official beer status with the MLS and 14 of the league’s teams, Kilbury said Heineken 0.0 has taken a front-seat role.

“Where Heineken is, 0.0 is,” he said. “They are complementary and incremental and the ridiculously strong growth hasn’t come at the expense of Heineken.”

Athletic Brewing is tracking 500% growth year-over-year, passing its 2019 revenue last month, according to CEO Bill Shufelt. By the end of 2020, Shufelt expects the brand to be in retailers in 30 states – but it’s also available nationwide via e-commerce.

Shufelt feels the Budweiser Zero debut will be a net positive to the non-alcoholic beer category, offering an additional big beer brand, along with Heineken, to Athletic’s craft beer approach to the segment.

“Most people would probably view it as threatening,” Shufelt said. “But we can’t build it alone and we’ve loved having Heineken there. If every shelf is green for Heineken, blue and yellow for us and silver for Bud Zero, that would be a shelf I’d love to see.”

As the non-alcoholic beer segment has taken off, Budweiser Vice President of Marketing Monica Rustgi said the company saw an opportunity to bring “familiarity and brewing heritage” to the category.

“Budweiser Zero will help redefine pre-existing expectations and associations with non-alcoholic options,” Rustgi said. “Our goal is to de-stigmatize the association with non-alcoholic beer by showcasing the new and exciting opportunities it provides for people to continue celebrating across occasions big and small.”

Athletic Brewing’s Shufelt said Budweiser’s entry into the space is only going to raise the profile of the movement toward a broader non-alcoholic consumer base.

“Our goal is to be the national non-alcoholic brand and they’re validating that in how they’re going about this,” he said. “They’ve had the same talking points for decades with [N/A brand] O’Douls. We’re honored they’re using similar talking points to ours and helping build the category.”

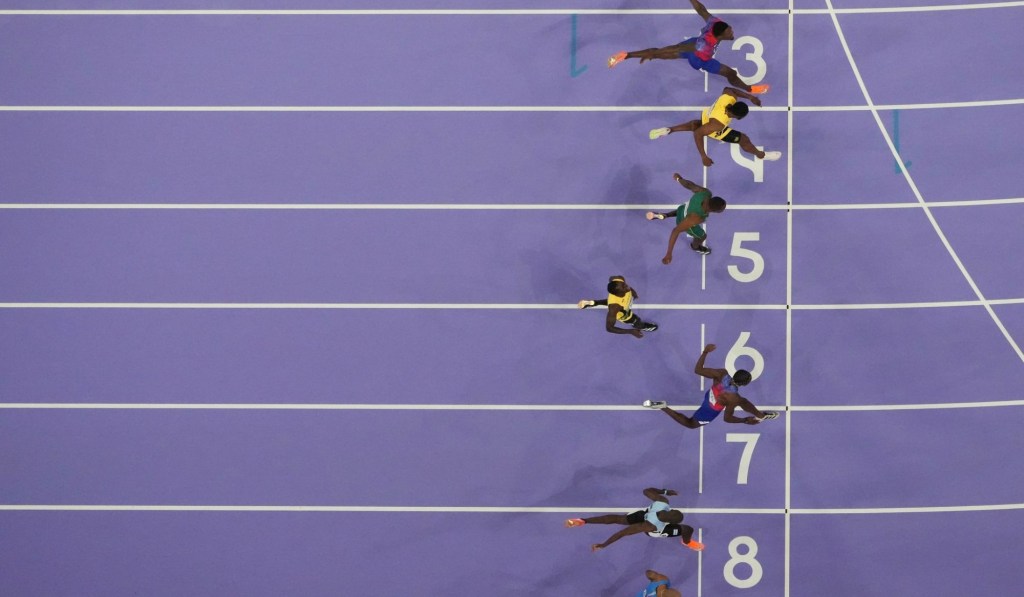

All three of the brands are approaching the market suggesting the products are good for times full alcoholic offerings might have adverse effects on life, like a Tuesday afternoon soccer match or for athletes in training, but when a consumer might want the experience of drinking a beer.

To launch, Budweiser teamed up with former Miami Heat guard Dwyane Wade – who the company has worked with since “This Bud’s For 3” campaign a year ago – to develop the beer. Wade has been designated a “co-founder” of the brand and helped “design the core attributes of the product, including the sleek packaging.”

Clean packaging and a super star athlete will help land some drinkers, but there’s a healthy dose of skepticism around non-alcoholic beer. But statistics suggest the trend is here to stay with Gen Z and Millennials drinking less alcoholic beverages. Aside from the trends, however, Kilbury said the full-flavor non-alcoholic options also will provide new revenue opportunities for teams and beverage producers alike.

Kilbury said Heineken sold a million cases of 0.0 in year one and is on pace to more than double that this year.

“It’s not the hardest sell in the world; in MLS after the 75th minute they’re not getting money in the beer category — now they are,” he said. “It’s getting it right from responsibility and clarity and in the end everyone wins in this.”

Like Heineken’s mission, Rustgi said Budweiser Zero will become the beer of the fourth quarter and ninth inning, as well as those looking to avoid alcohol but still get the “full sports experience.”

Athletic Brewing is hoping to disrupt the industry by creating a new sponsorship category – and has signed several deals as an “official non-alcoholic beer” partner. The major producers will likely continue to play the complementary card.

“An N/A beer is part of the beer category, it’s unlikely to be broken out, but I”m not sure it should be today,” Kilbury said. “That’s the way we’re looking at it. It’s the same beer without alcohol, side by side.”

“The category will stay the same, but investment level will go up, but it won’t be a break out category,” he said.

Newer to the industry than Heineken and Athletic, Budweiser Zero does have the mass marketing experience and budget of AB InBev. Budweiser is already one of the most recognized brands in the world with a massive sports budget, which should propel the new product quickly.

Budweiser Zero ads will air on ESPN and appear on NBA.com and MLB.com. Rustgi said the brand will also partner with athletes across the NBA, NWSL, MLB and PGA.

“We have a non-traditional marketing campaign in place that will both bring forward familiar methods of marketing to drive awareness of the product, but also disruptive methods that we hope will shake up the non-alcoholic beer industry as we know it,” Rustgi said. “With the return of sports, our goal is to continue driving awareness of Budweiser Zero as a trustworthy option for consumers who are looking for zero-alcohol, zero-sugar options without compromising on taste or experience.

“We will be using our long standing ties to sports, partnership with Dwyane Wade, and our collective scale, to familiarize Budweiser drinkers and new drinkers with this product,” she said.