Investment house Blackstone is gambling that the hospitality and entertainment industries will bounce back — and that Crown Resorts won’t be dragged down by money laundering allegations.

New York-based Blackstone, which already owns 10% of the gaming operator, offered $6.2 billion for Crown Resorts, or $9.15 per share.

That would be a discount, even on the pandemic low from a year ago, but Crown has its hands full right now and may be eager to pass on its issues to a new owner.

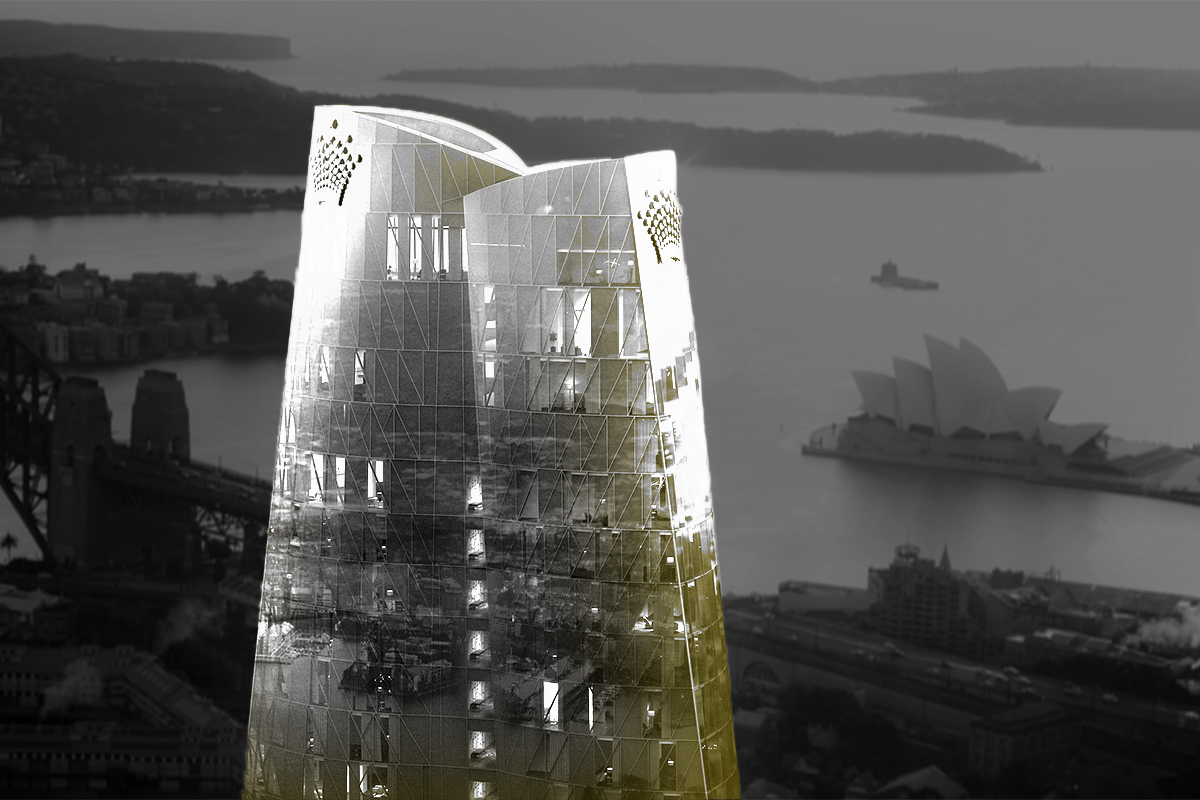

In February, a judge ruled that Crown was ineligible to operate the Sydney casino it opened in December amid allegations of money laundering and organized crime activity that Crown is accused of facilitating, or at minimum willfully ignoring.

Blackstone’s bid is conditional on Australian regulators allowing Blackstone to own and operate Crown’s casinos in Sydney, Melbourne, and Perth. Separate investigations over whether Crown is fit to run its other two casinos are in early stages.

- Blackstone, with $619 billion in assets under management, has targeted large, pandemic-damaged companies. It acquired Extended Stay America with Starwood Capital for $6 billion last week.

- Blackstone agreed to buy Las Vegas’ Bellagio casino and resort in 2019 for $4.25 billion.

If the offer is accepted, Blackstone will have a potential steal on its hands, but like any big gamble, the potential reward is balanced by major risk.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)