The BIG3 unveiled its plans to open its 12 franchises up to sale through NFTs, a concept that seemed like a natural evolution for the 3-on-3 pro league that began play in 2017.

Within weeks of the April 4 announcement, the BIG3 had sold eight of the franchises for between $550,000 to $625,000. The BIG3 became the first pro league in the U.S. to have one of its franchise purchased by an NFT fund as Wave Financial and other Web3 proponents — including entrepreneur Gary Vaynerchuk, angel investor Kevin Rose, and a group led by rapper Snoop Dogg and co-founder of PayPal Ken Howery — became team owners.

Then the crypto asset market crashed.

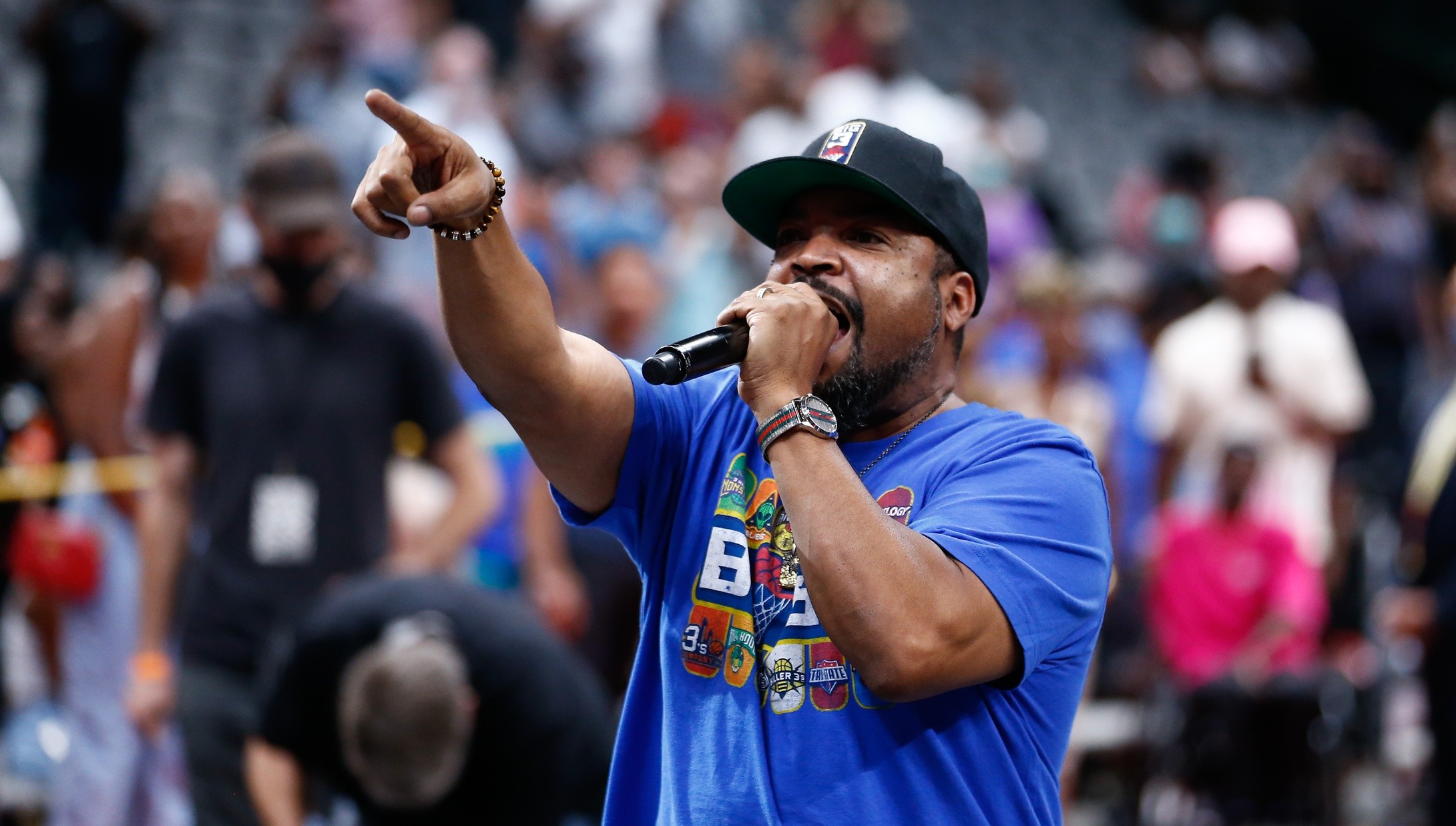

“Even though the market took a hit, we still connected with some great communities, like some of the biggest names in the space,” BIG3 co-founder Ice Cube told Front Office Sports.

The league had maneuvered around the pandemic that forced the cancellation of the 2020 season. But it was time to move beyond the single-entity structure where the BIG3 owned each franchise, much like MLS did for years after it launched.

“The NFT craze was hitting at the same time [the new franchise model was being worked out],” Cube said. “We were looking at these [crypto asset] communities and asked, ‘How can we be a part of these communities? How can we get these communities in our league? With their enthusiasm and their talent, they could really push the league over the top.’”

The league took in more than $4 million of Ethereium and Dogecoin from the eight new owners. Ether is down more than 30% and Doge is down nearly 40% from the time of the transactions. The league converted about half the cryptocurrencies into dollars shortly after each transaction.

Instead of tying each team to a city like other pro leagues, BIG3 execs saw the NFT as the best route to sell their franchises — and the league isn’t abandoning that aim.

The NFT market has seen daily transactions and the average sale price crater about 95% from highs on May 1, according to CryptoSlam. A big reason for that — beyond the dips in major cryptocurrencies typically used to purchase NFTs — is that new NFT projects were put on hold.

It takes 25 BIG3 “Fire” NFTs — priced at $25,000 each — to purchase one of the teams, although the price was lower for some teams due to marketing considerations. Most of that tier have been sold, but the BIG3 delayed the launch of its 975 “Gold” NFTs priced at $5,000 each.

Even before digital assets took a hit as of late, there has long been talk about the utility of NFTs, something beyond owning just a piece of digital artwork. BIG3 already promised NFT purchasers preferred seating, press conference access, and other benefits, but when the marketplace reopens, token owners will see more perks.

Being the majority owner of a BIG3 franchise isn’t quite the same as other sports, but what do you want for a franchise for around $600,000?

The league’s new owners don’t have a lot of sway in the day-to-day operations of the league and — subject to SEC approval — they would only receive 40% of the net proceeds of a future sale of the team.

It was an opportunity that Wave Financial co-founder Les Borsai wasn’t about to pass up. His fund purchased the Enemies, a team headlined by Nick Young and coached by Gilbert Arenas.

Borsai followed his company’s purchase of the Enemies by buying arguably the hottest NFT to serve as the team’s mascot: a Bored Ape Yacht Club token. The ape cost 169 ETH, worth about $377,000 at the time of the purchase. The average floor price of BAYC NFTs fell about 20% over the last month.

“The Apes may [have lost value], but that’s not what this is for me.” Borsai said. “The disruption that I saw is that if we are innovative enough, we can monetize. In grabbing the Apes, we are grabbing crypto culture.

“We bought a basketball team and a mascot and created an entity in all about four hours. When does that ever happen? … Everything about it just really lends itself to a new way of thinking.”

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)