The Securities and Exchange Commission issued an alert about the influx of SPACs involved with celebrities, “from movie stars to professional athletes.”

“It is never a good idea to invest in a SPAC just because someone famous sponsors or invests in it or says it is a good investment,” the agency wrote.

SPACs, also called “blank check companies,” raise money from investors with the purpose of acquiring a private company in a specific sector and taking it public. SPACs have exploded in popularity over the last year and become quite trendy among athlete investors, along with many other sports figures and entities.

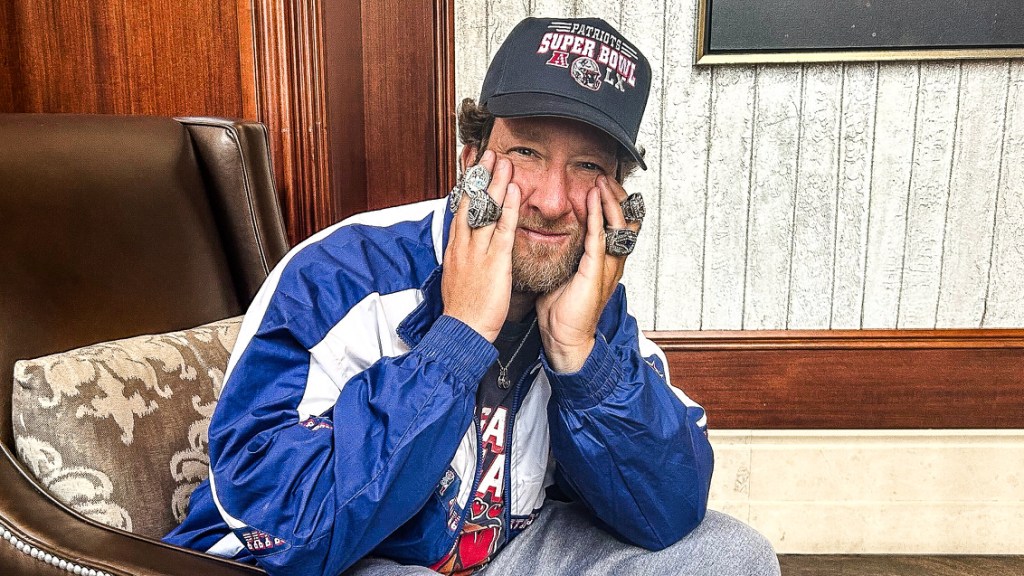

- A-Rod, Colin Kaepernick, Serena Williams, and Steph Curry have all recently gotten into the SPAC game.

- Fitness company Beachbody agreed to go public in February through a merger with a SPAC advised by Shaq.

- Houston Rockets owner Tilman Fertitta will take Fertitta Entertainment public through a $6.6 billion merger with FAST Acquisition.

- RedBird Capital and famed Oakland A’s executive Billy Beane created RedBall Acquisition to acquire a professional sports franchise.

- Atlanta Braves and Formula One owner Liberty Media’s new SPAC raised $500 million in its January IPO.

With the popularity of blank check companies comes increased scrutiny. An analysis by the Harvard Law School of Corporate Governance concluded that, “When commentators say SPACs are a cheap way to go public, they are right, but only because SPAC investors are bearing the cost, which is an unsustainable situation.”

The first two months of 2021 were the largest ever for SPACs, with $24.4 billion and $33.4 billion in issuances in January and February respectively, according to Bloomberg.

![[Subscription Customers Only] Jun 15, 2025; Seattle, Washington, USA; Botafogo owner John Textor inside the stadium before the match during a group stage match of the 2025 FIFA Club World Cup at Lumen Field.](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26465842_168416386_lowres-scaled.jpg?quality=100&w=1024)

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)