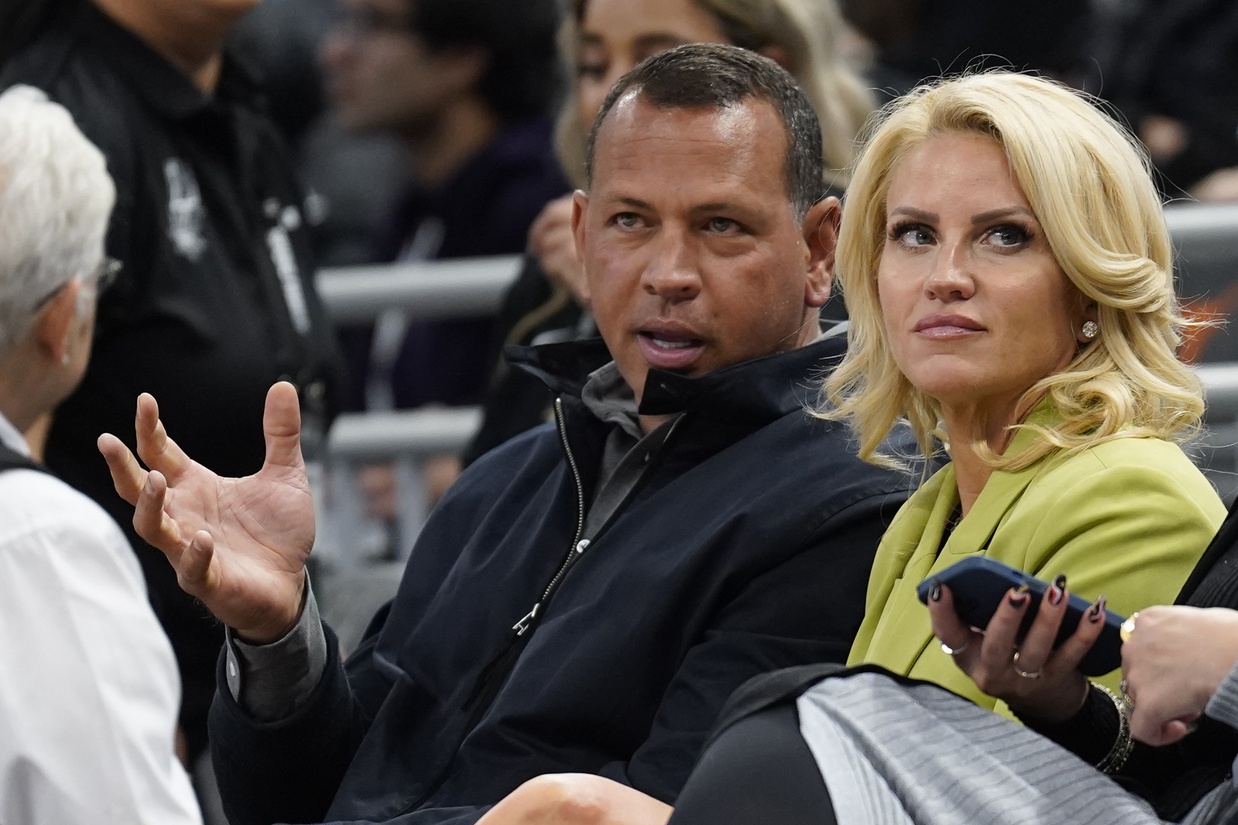

The Timberwolves ownership saga starring Alex Rodriguez, Marc Lore, and longtime owner Glen Taylor could have an end in sight.

The parties will enter mediation May 1 in Minneapolis, according to ESPN. Last month, Taylor aborted a three-year succession plan for the former baseball star and his business partner to take over the franchise and the WNBA’s Lynx.

Rodriguez and Lore currently own 36% of the T-Wolves and were prepared to purchase another 40% for $600 million in late March when Taylor called off the arrangement and said the duo had missed a financing deadline. Rodriguez and Lore dispute Taylor’s claim and said they had the money, but had yet to receive NBA approval and added that Taylor had seller’s remorse with the sale amid the team’s success. Their original agreement allowed for an automatic 90-day extension to obtain NBA approval and majority ownership. In late March, Taylor said the team is no longer for sale.

When the parties originally agreed to the deal in 2021, the three-year agreement valued the franchise at $1.5 billion. Since then, the value of sports franchises has significantly increased as the Suns ($4 billion), Hornets ($3 billion), and Mavericks ($3.5 billion) have all since sold for at least double Taylor’s original valuation.

“It’s not so much seller’s remorse as just wanting to taste a little bit more of the explosion in franchise values,” Jodi Balsam, a professor at Brooklyn Law School and former lawyer for the NFL, tells Front Office Sports. “The deal price back in 2021 valued the team at $1.5 billion. The latest Forbes and Sportico valuations are close to $3 billion. I’m sure Taylor is sitting on the sidelines crossing his fingers every time the next purchase option comes live that they’re going to fail to meet deadlines and give him an out. I think that writing was on the wall as soon as they exercised the second option. I know it was a four-stage deal and by stage two it was clear he had seriously undervalued the team.

“One possible outcome here is this is Taylor positioning to renegotiate the purchase price.”

The dispute comes during one of the franchise’s best seasons. The Timberwolves are currently the No. 3 seed in the Western Conference playoffs and lead their first-round series against the Suns 1–0 while 22-year-old Anthony Edwards has emerged as one of the young faces of the NBA. Game 2 is Tuesday night in Minnesota.

ESPN previously reported that Rodriguez and Lore submitted financial projections that would take the Timberwolves out of the luxury tax next season, which Taylor was purportedly concerned would impact the team’s ability to contend. It’s an interesting accusation, given Taylor has paid just $25 million in luxury taxes in his 30 years of ownership. Minnesota is projected to have a payroll of more than $180 million next season, well above the $172 million tax line. Barring a salary-saving move, the team would have a luxury tax bill of $25 million, matching Taylor’s career tax payments in just one season. Lore and Rodriguez’s plan would have lowered the Wolves’ salary to around $171 million, just below the tax line, according to ESPN.

“The question to me is do they have a leg to stand on to challenge Taylor’s decision to withdraw the team from the market?” Balsam says. “Because from what I understand in the purchase agreement there were interim deadlines and checkpoints that would obviate the purchaser’s right to continue. And those are usually considered reasonable. There’s a whole host of reasons why somebody who’s selling a business wants to control the timeline and if they agree to a timeline in the purchase agreement and the timeline wasn’t met and the purchase agreement gives the seller the right to withdraw, I’m not sure what there is to litigate.”

Speaking at the league’s annual governors meetings April 10, league commissioner Adam Silver said that the mediation was an issue between Taylor and the Lore-Rodriguez group. “There is no role for the league in that process,” he said. Silver added that the layaway plan the parties chose is “certainly not ideal” and may have the league change the way it handles future transactions.

“It met our rules from that standpoint, and it’s what Glen Taylor wanted and it’s what they were willing to agree to at the time,” Silver said. “But I think once the dust clears on this deal, it may cause us to reassess what sort of transactions we should allow.”

Balsam said the slow-moving deal would never fly in the NFL, based on her experience working on operations and litigation cases for the league.

“The NBA is rare among the major sports leagues to even permit the layaway plan,” Balsam says. “The NFL is very strict and demanding in transfers of majority ownership interest. The deal has to sort of final at the outset. It has to include all the required components that meet the NFL’s ownership transaction standards. It’s a single transaction. None of this layaway plan stuff. And so I think a layaway plan deal for a sports team is just rife in vulnerability to all sorts of later disputes and unexpected consequences. And this is sort of Exhibit A in the risks of a layaway plan for a sale of a majority ownership interest.”

The May 1 mediation session will likely be the first of several, Balsam said, with resolution possible by the beginning of the next NBA season.

“In a high stakes commercial dispute like this one depending on the availability of the parties it could take place over two, three, four months,” Balsam says. “I’d be surprised if it goes on longer than that. Typically you’ll know if a mediation is going to succeed or fail even in a high-stakes commercial dispute within that time frame. And if it fails the next step would be private commercial arbitration or they might try to go to public court.”

![[Subscription Customers Only] Jul 13, 2025; East Rutherford, New Jersey, USA; Chelsea FC midfielder Cole Palmer (10) celebrates winning the final of the 2025 FIFA Club World Cup at MetLife Stadium](https://frontofficesports.com/wp-content/uploads/2026/02/USATSI_26636703-scaled-e1770932227605.jpg?quality=100&w=1024)